Blog

Housing Survey Reports Significant Increase Seller Optimism

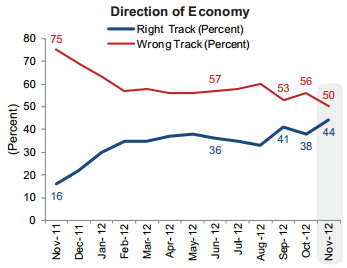

Fannie Mae’s National Housing Survey forrnNovember shows increasing confidence among Americans about the nation’s housingrnmarket and the direction of the overall economy. Exactly half of respondents feel the economyrnis on the wrong track, down 33 percent from one year earlier and 6 percentagernpoints lower than in October. This isrnthe first time wrong track responses have been as low as 50 percent. Respondents who feel the economy is on thernright track have nearly tripled since November 2011, rising from 16 percent torn46 percent and have improved 6 percent in one month.</p

Fannie Mae’s survey is a 100 questionrntelephone survey conducted each month with 1,000 respondents representing bothrnhome owners and renters. Respondents are questioned regarding their attitudesrntoward owning and renting a home, mortgage rates, the economy, their householdrnfinances, and consumer confidence. Thernsurvey has been conducted since June 2010.</p

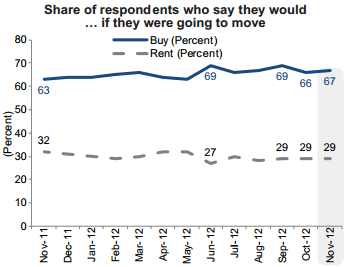

Twenty-three percent of respondents viewrnthis as a good time to sell a house, up 5 points from October and the firstrntime this metric has crossed the 20 percent line. Seventy-two percent view it as a good time tornbuy a home, unchanged from October and a number that has held relatively stablernfor most of 2012. Asked if they wouldrnbuy or rent their next residence should they move, 67 percent say buy, up onernpoint from the previous month and 29 percent said rent, unchanged from bothrnSeptember and October.</p

</p

</p

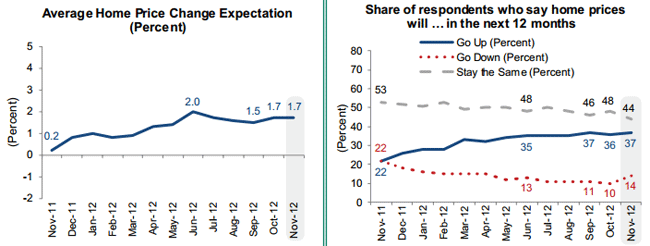

The number of respondents who expectrnhouse prices to go up decreased slightly to 48 percent while those expectingrnfurther price declines was up 4 percentage points to 14 percent. The average expectation for that degree ofrnany price change remained at 1.7 percent. </p

</p

</p

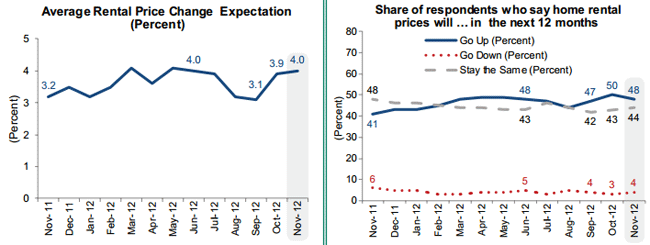

Expectations for increases in homernrentals moderated, with 48 percent expecting rents to rise over the next year,rndown 1 point from October while the percent expecting rents to declinernincreased by 1 point. Among those whornexpect rents to change the average expected increase was 4 percent compared torn3.9 percent in October. </p

</p

</p

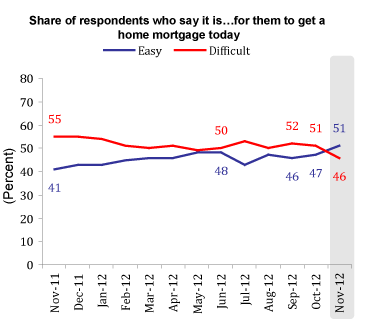

Forty-one percent of respondents expectrnmortgages rates to go up, an increase of 4 percentage points sincernOctober. The number of respondents whornsaid it would be easy or it would be hard for them to get a mortgage crossed inrnNovember with 51 percent saying “easy” and 46 percent “hard”, almost the exactrnreverse of the previous month</p

</p

</p

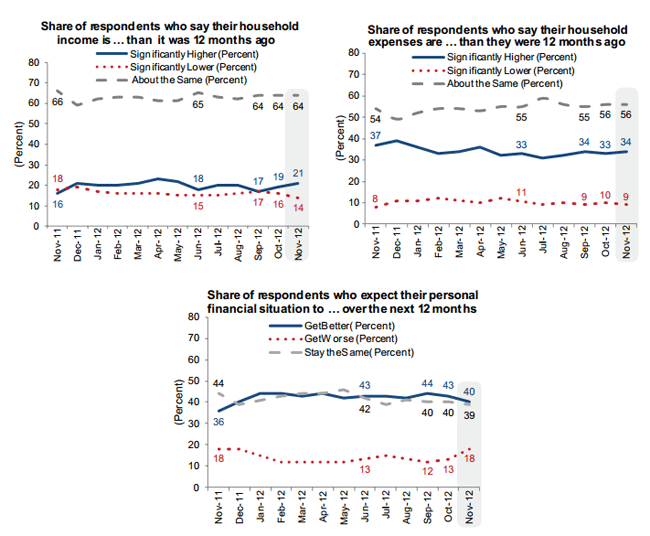

Despite the optimistic right track/wrongrntrack responses about the economy as a whole, the number of respondents whornexpect their personal financing situation to improve or worsen over the nextrnyear turned slightly negative with a 5 percentage point increase in those respondingrnthey expected it to worsen compared to October. rnResponses about trends in personal income and expenses over the pastrnyear remained flat.</p

</p

</p

“Consumer attitudes toward both therneconomy and the housing market continue to gather momentum, with many of our 11rnkey National Housing Survey indicators at or near their two-and-a-half-yearrnhighs,” said Doug Duncan, senior vice president and chief economist of FanniernMae. “On the housing front, attitudes about the current selling environmentrncontinue to improve, with a significant increase in those saying it would be arngood time to sell. This growing confidence in a housing recovery, in additionrnto other factors, may reinforce growing consumer optimism regarding thernimproving direction of the general economy. Those indicating that the economy isrnon the right track has risen to 44 percent while those saying it’s on the wrongrntrack has fallen to 50 percent, the smallest gap since the survey’srninception.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment