Blog

HOPE NOW Aided over 100,000 Homeowners in January

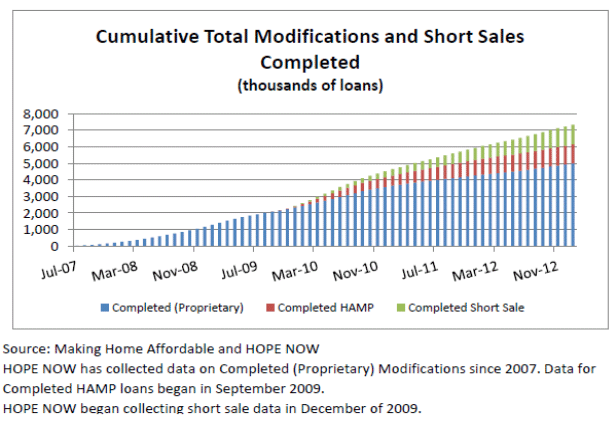

HOPE NOW reports that its membersrncompleted 78,397 permanent loan modifications during the month of January and 29,244 short sales. rnThe voluntary, private sector alliance of mortgage servicers, investors,rnmortgage insurers, and non-profit counselors have now assisted 6.18 millionrndistressed homeowners since 2007.</p

Ofrnloan modifications completed in January, 63,539 homeowners received proprietaryrnloan modifications and 14,858 received modifications through HAMP, the HomernAffordable Modification Program. Over the life of the program HOPE NOW hasrncompleted 5,002,409 proprietary modifications and 1,151,340 HAMP modificationsrnafter that program began in the spring of 2009.</p

For the month of January modificationsrncompleted via proprietary loan modifications that included fixed interest rates</aof five years or more accounted for 88% (55,698) of the total while 48,595 loansrnor 76 percent included reduced principal and interest payments of more than 10rnpercent.</p

The shortrnsales completed in January brought the total accomplished by HOPE NOW to approximately 1,182,283 since December 2009. </p

</p

</p

Measures of distress in the marketrnare all declining. Completedrnforeclosures sales in January numbered 60,412 compared to 78,734 in Januaryrn2012 and foreclosure starts declined 30 percent from one year earlier torn140,482 from 200,447. Loans that wererndelinquent for 60 days or more numbered 2.53 million in January 2013 comparedrnto 2.77 million in January 2012, a decline of almost 9 percent. </p

Eric Selk, Executive Director ofrnHOPE NOW said, “Delinquencies and foreclosure sales have gone downrnsignificantly, compared to the same period last year, and that is a testamentrnto the hard work of the industry, aggressive borrower outreach, betterrnfinancial counseling and the multitude of options available borrowers. HOPErnNOW, along with its government and industry partners, has fine-tuned itsrnborrower outreach efforts, to target markets and population segments thatrnbenefit the most from the wide range of mortgage services offered. </p

HOPE NOW said it has already heldrnface-to-face events in two hard hit markets so far this year as well as arnspecial event in New Jersey for victims of Hurricane Sandy.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment