Blog

Higher Rates Should Lead to ARM Resurgence Freddie Mac Says

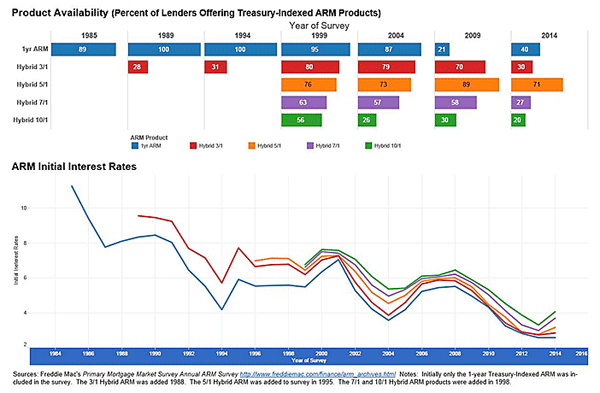

Adjustablernrate mortgages remain at historic lows Freddie Mac said today as the companyrnreleased results of its 30th AnnualrnAdjustable-Rate Mortgage (ARM) Survey of prime loan offerings. The 1-year ARM has remained essentiallyrnunchanged since last year’s survey while initial period rates on hybrid loanrnproducts rose. This, Freddie Mac said, largely reflects term structurernmovements in the rest of the capital markets and the Federal Reserve’srnmonetary policy, which has kept the federal funds rate and otherrnshort-term interest rates exceptionally low while allowing a rise inrnmedium- and longer-term interest rates from last year. </p

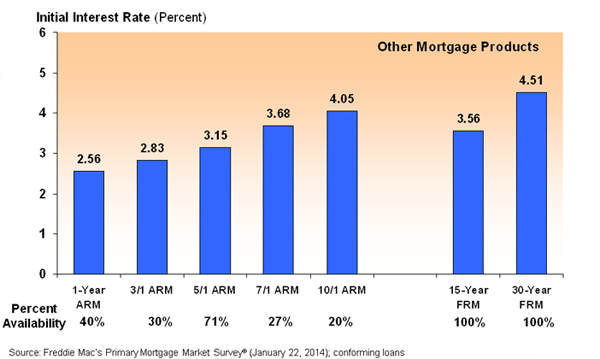

Hybrid ARMs have a fixed rate for anrninitial period ranging from three to 10 years and then adjust annualrnthereafter. Nearly all of the ARMrnlenders participating in the survey offered a hybrid with the 5/1 far andrnaway the most common of the products both in terms of availability and use, followedrnby the 3/1, the 7/1 and the 10/1. Lessrncommon are ARMs with longer repricing periods such as a 5/5 which features raternadjustments every five years for the life of the loan. </p

</p

</p

The survey, which was conductedrnJanuary 6 to January 10, showed that the largest rate increases were forrnhybrids with longer initial fixed-rate periods. rnThe 7/1 ARM rose by 0.71 basis points from last year and the 10/1 was up 0.76 basisrnpoints. </p

The savings in early January 2014rnfor a borrower taking a 30-year 5/1 hybrid ARM instead of a 30-year fixed raternmortgage (FRM) was about 1.36 percentage points. This would result in a monthly principal andrninterest payment during the first five years that is about $194 less than forrnthe fixed rate for a $250,000 loan. </p

Frank Nothaft, Freddie Mac vicernpresident and chief economist said, “Homebuyers have preferred fixed-raternmortgages the past few years because of the low interest rates and therncertainty of the monthly principal and interest payment. As longer-termrnrates rise, ARMs with their lower initial interest rates will become morernappealing to loan applicants. Hybrid ARMs are particularly attractive becausernthey have an initial extended fixed-rate period of 3 to 10 years.”</p

</p

</p

Freddie Mac surveyed 106 ARM lendersrnand found that 84 offered ARMS indexed to Treasury bills and 22 offered LondonrnInterbank Offered Rate (LIBOR)-indexed ARMs. The company said that generally largernnational lenders offered LIBOR based loans while community and regional lendersrnwere more likely to offer those based on Treasury indices. Thus, even though offered by fewerrnlenders, the LIBOR-based product accounted for more than one-half ofrnARM originations. LIBOR-indexed ARMs generally had a lower marginrn(about 0.5 percentage points lower) than Treasury-indexed ARMs, a similarrninitial interest rate, but a higher index rate (about 0.5 percentage pointsrnhigher).

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment