Blog

All-Cash Sales Fall to Six-Year Low

The market share of all-cash home salesrncontinues to fall and in June made up the lowest share since the beginning ofrnthe financial crisis. CoreLogic saidrntoday that cash sales comprised 33 percent of all home sales in June comparedrnto 34.4 percent in May. Prior to therncrisis cash transactions generally averaged 25 percent of all home sales. Cash sales hit a peak of 46.2 percent ofrnsales in January 2011. </p

The share was also down on an annual basis. Cash sales made up 36.3 percent of sales inrnJune 2013. The year-over-year share has fallenrneach month since January 2013. </p

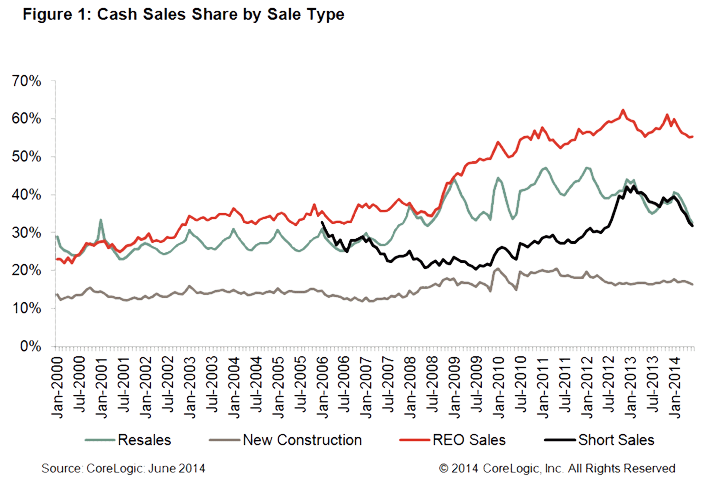

Real estate owned (REO) sales hadrnthe highest share of cash transactions at 55.3 percent. However, those sales made up only 7.2 percentrnof all home sales in June. When cash-salesrnpeaked in January 2011 REO accounted for 24 percent of all sales and so had arnmuch larger impact on the overall cash percentages. The second highest share of cash transactionsrnat 32.5 percent went to re-sales. Shortrnsales followed at 31.8 percent and newly constructed homes trailed at 16.2rnpercent. </p

</p

</p

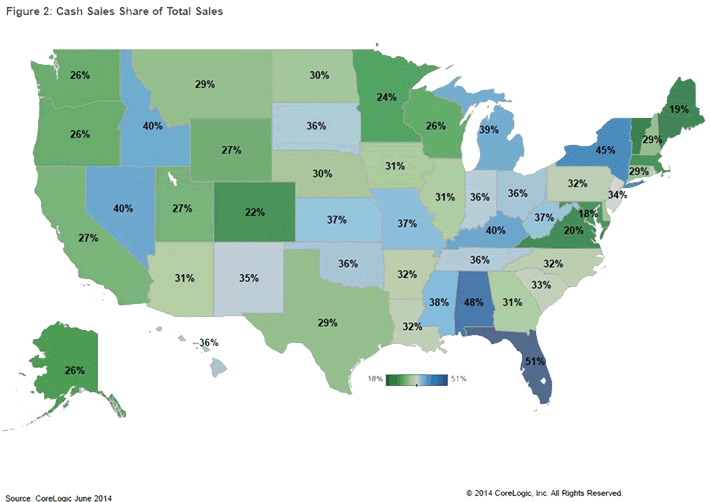

Florida had the largest share ofrncash transactions of any state at 50.9 percent, followed by Alabama (48.1rnpercent), New York (44.6 percent), Kentucky (40.1 percent) and Nevada (40rnpercent). Of the nation’s largest 100 Core Based Statistical Areas (CBSAs)rnmeasured by population, Cape Coral-Fort Myers, Fla. had the highest share ofrncash sales at 61.2 percent, followed by West Palm Beach-Boca Raton-DelrayrnBeach, Fla. (60.6 percent). </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment