Blog

Early Stage Foreclosure Filings up Nationwide and in Most States

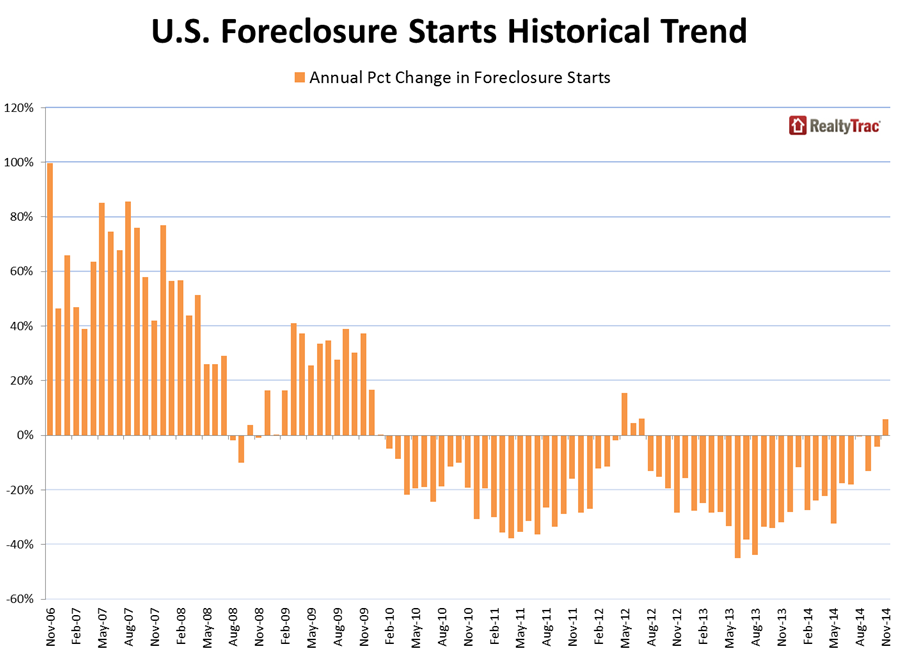

While overall foreclosure activity overallrncontinued its now years-long decline from housing crisis peaks there was arnsignificant year-over-year increase in foreclosure starts. RealtyTrac says in its November U.S. Foreclosure Market Report that 55,906 properties started the foreclosure process during thernmonth, a decrease of 1 percent from October but a 6 percent increase from arnyear ago. This was the first suchrnincrease after 27 consecutive months of year-over-year declines. rn</p

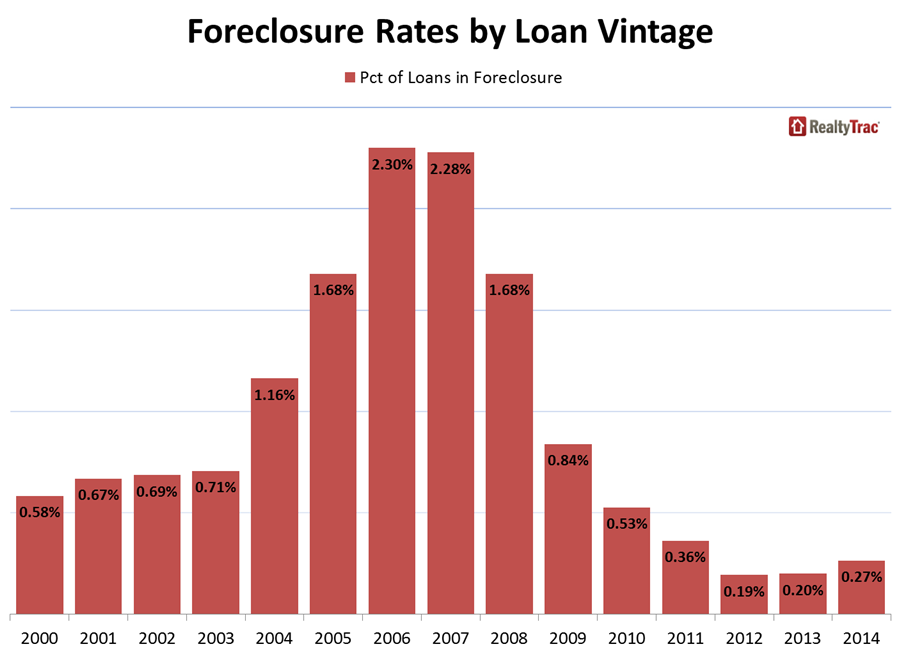

RealtyTracrnalso said that the 2012 vintage of mortgages is not performing as well as somernof its predecessors. The company howeverrndid not link this to the recent increase in early stage defaults.</p

Thernincrease in foreclosure starts was not an isolated one. Starts were up in 30rnstates with the greatest increases in New Jersey (+256 percent), Nevada (+138rnpercent), and Massachusetts (+137 percent). </p

</p

</p

Scheduledrnauctions, which in some states are identified as foreclosure starts, also rosernin November compared to one year earlier although they declined by 16 percentrnfrom October’s figure which had been the highest in 18 months. There were 50,102 properties scheduled forrnthe first time for foreclosure in November, a year-over-year increase of 5rnpercent. Thirty states shared in the increase with Kentucky (+163 percent),rnTennessee (+159 percent) and North Carolina (+157 percent) heading the list. </p

Despiternthe increases in starts and scheduled auctions, overall foreclosure filingsrnwere down 9 percent from October and 1 percent from a year earlier. A total of 112,498 properties or one in everyrn1,170 U.S. housing unit was the subject of a filing during the month.</p

Therndip in total filings was due to a 10 percent reduction in bank repossessions orrncompleted foreclosures compared to October. rnA total of 25,249 properties were taken into bank inventories or REO, downrn17 percent from November 2013. It wasrnthe 24th consecutive month in which completed foreclosures were lowerrnon a year-over-year basis</p

Therernwere increases in completed foreclosures in 15 states, most notably Maryland (+93rnpercent), North Carolina (+66 percent), New York (up 64 percent), Kentucky (+56rnpercent), and New Jersey (+54 percent). </p

“Thernhousing market is struggling to find the new normal when it comes to arntolerable level of foreclosure activity in this post-Great Recession economy,”rnsaid Daren Blomquist, vice president at RealtyTrac. “Finding that new normalrnrequires striking a balance between too much loan risk, which would result inrnanother housing meltdown, and too little risk, which could result in a stuntedrnrecovery.</p

“Foreclosurernrates on 2014-originated loans are actually higher than 2013-originated loansrnnationwide and in many markets, indicating that lenders are open to a slightlyrnhigher level of risk than we’ve seen over the past five years of extremelyrntight lending standards,” Blomquist continued. “But it’s unlikely that lendersrnwill dial up that risk level too quickly going forward given that many arernstill dealing with working through a lengthy and messy foreclosure process onrnrisky loans from the last loose lending spree.”</p

</p

</p

Floridarnretained its position as the number one state for foreclosure activity for thern13th out of the last 14 months. rnDespite a dip of 4 percent in overall activity compared to October and arn15 percent decrease year-over-year, the state’s foreclosure activity was at arnrate of one in every 463 housing units.</p

NewrnJersey jumped from 9th position among the states to number 2 inrnforeclosure activity with a filing on one in every 478 housing units. Foreclosure activity in the state hasrnincreased 196 percent since last November and has increased year-over-year forrn11 of the last 12 months. Atlantic City may be largely responsible for thernstate’s foreclosure explosion. The cityrnhad the highest foreclosure rate among larger metro areas with filings on onernin every 289 housing units in November and has seen completed foreclosures soarrn264 percent in the last year. </p

Anrnincrease of 93 percent in activity over the last year put Maryland in thirdrnplace among states with one in every 581 housing units affected by arnfiling. The other states in the top fivernwere Delaware, up 24 percent from the previous month with a rate of 1 in 693rnunits and Utah where REO activity jumped 83 percent in a single month, boostingrnthe state from 12th in overall activity to number 5. One in 750 units had a filing during thernmonth.</p

FourrnFlorida metropolitan areas followed Atlantic City in their level ofrnactivity. Miami dropped from firstrnposition to second after filings decreased 22 percent on an annual basis. Jacksonville, Palm Bay-Melbourne-Titusville,rnand Orlando rounded out the top five.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment