Blog

Lenders see Increased Demand, Higher Profits in 2015

In its quarterly survey of lenders’ sentiment Fannie Maernfound increasing optimism about the mortgage business. The survey conducted in the first quarter ofrn2015 revealed that, compared with the fourth quarter of 2014, lenders expect bothrnmortgage demand and their profit margins to grow over the next three months.</p

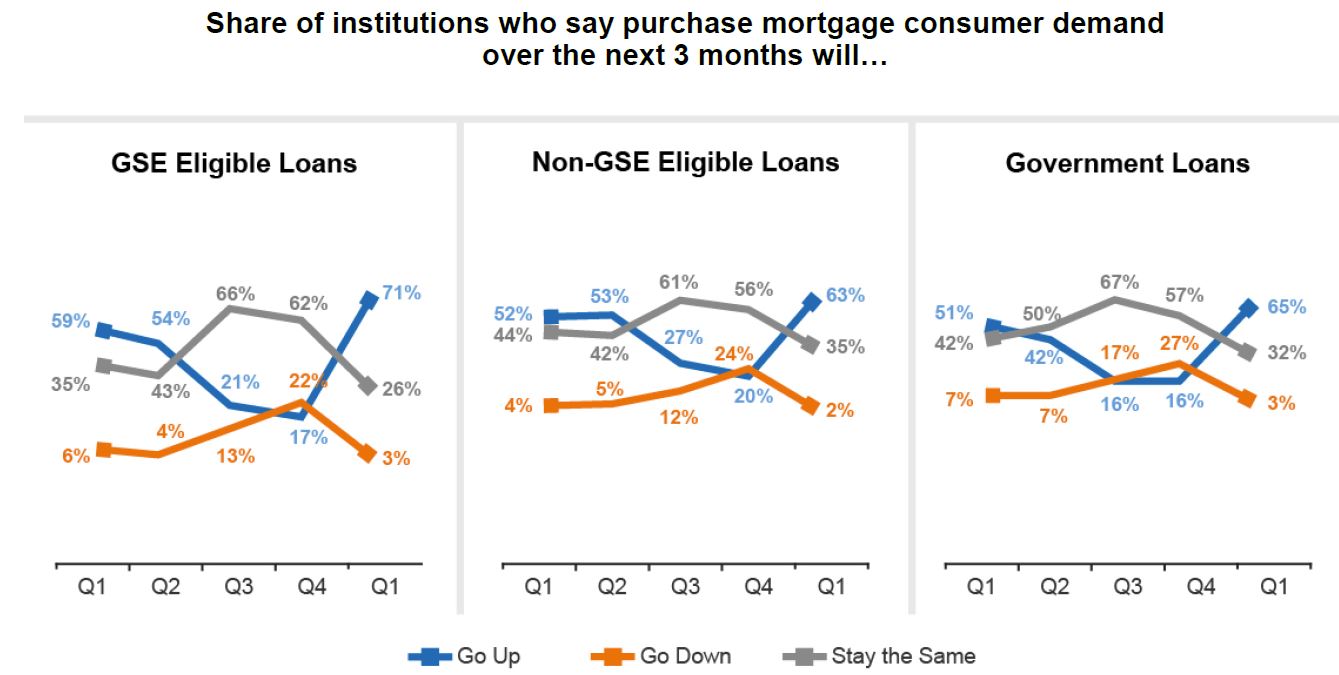

The number of lenders who expect near-termrnpurchase mortgage demand to grow finally reversed a downward trend that lastedrnthroughout 2014. More lenders expectrnthat, although there might be seasonal influences, the higher demand will extendrnto all types of loans and the increased optimism was present no matter whom thernrespondent represented; mortgage banks, depository institutions, or creditrnunions. Seventy-one percent of lenders say they expect purchasernmortgage demand to go up over the next three months compared with 59 percentrnreported during the same quarter last year. rnFor non-GSE eligible loans the increased demand was expected by 63rnpercent and for government loans by 65 percent.</p

</p

</p

Sixty-two percent of lenders interviewedrnexpect home prices to increase over the next 12 months compared to only 47rnpercent with that expectation in the fourth quarter 2014 survey. The average size of the increase was estimatedrnat 2.4 percent, up from 1.7 percent in the earlier survey.</p

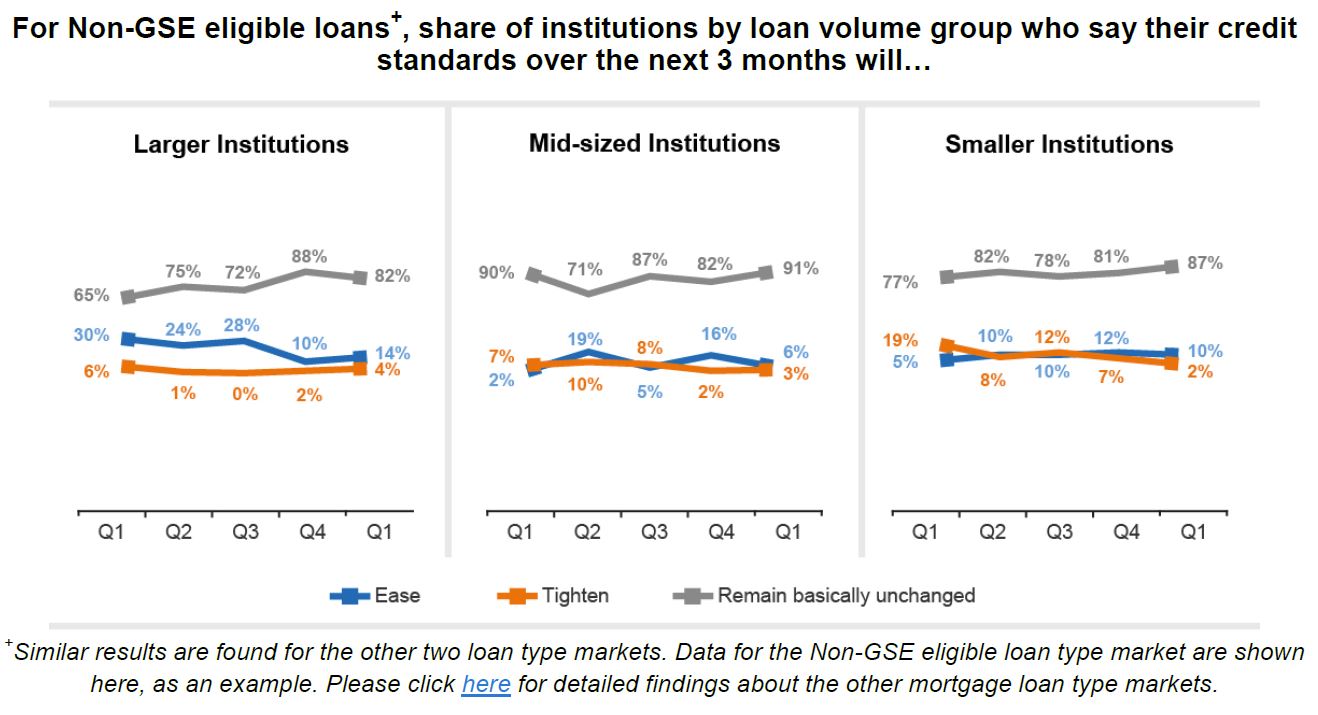

Thernsurvey found that the credit tighteningrnobserved last year has continued to lessen, gradually moving into 2015. More lenders reported easing than reportedrntightening with representatives of mortgage banks continuing to report easingrnmore frequently than those from depository institutions. </p

Compared with the general population ofrnconsumers, senior mortgage executives continue to be more optimistic about thernoverall economy and more pessimistic about consumers’ ability to get a mortgagerntoday. While 28 percent of lenders saidrnit would be somewhat or very easy for a consumer to get a loan today 47 percentrnof consumers asked a similar question in the most recent monthly NationalrnHousing Survey thought they could easily obtain financing for a home. </p

</p

</p

Most institutions reported that theyrnexpect to maintain both their strategies in relation to secondary marketrnoutlets and Mortgage Servicing Rights (MSR) execution over the next year. Amongrnlarger institutions and mortgage banks, more lenders reported they expect torndecrease rather than increase the share sold to GSEs and among mortgage banks,rnmore lenders reported plans to retain rather than sell their MSRs.</p

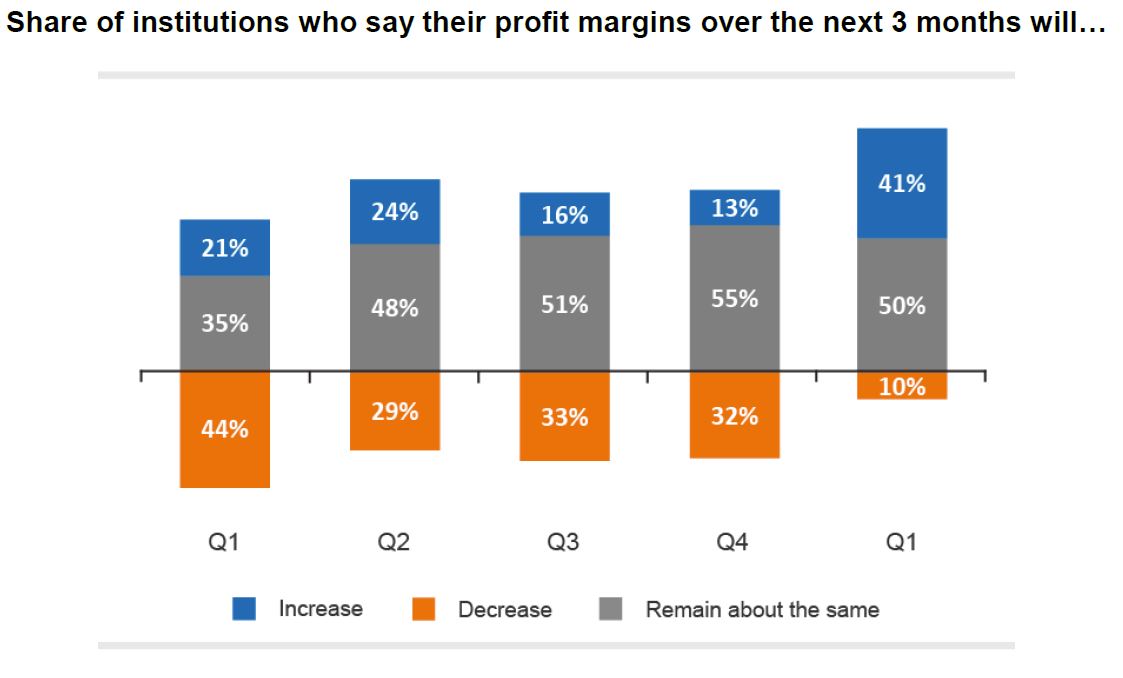

Lenders’ profit margin outlook hasrnimproved significantly from last year, in particular among larger lenders, withrnthe share of lenders expecting their profit margin to go up over the next threernmonths increasing significantly this quarter. Forty-one percent of lenders reportedrnincreased profit margin expectations, compared with 21 percent during the samernquarter last year and only 13 percent in the last survey-</p

</p

</p

Doug Duncan, Fannie Mae senior vicernpresident and chief economist said improving economic conditions and prospectsrnfor profit margins appear to be fueling increased optimism among mortgagernlenders at the start of 2015. “The first quarter results mirror a similar trendrnamong American households, as shown in our recently released National HousingrnSurveyTM data,” he said. “Thesernresults are consistent with our view that an improving economy, strengtheningrnemployment, and increasing consumer confidence should support a modest housingrnexpansion in 2015, after an uneven and disappointing year for housing activityrnin 2014.”</p

The Mortgage Lender Sentiment SurveyTM</supconducted by Fannie Mae polls senior executives of its lending institutionrncustomers on a quarterly basis to assess their views and outlook across variedrndimensions of the mortgage market. The survey was first conducted in Q1 2014.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment