Blog

2012 GSE Home Retention Actions Near Half-Million Mark

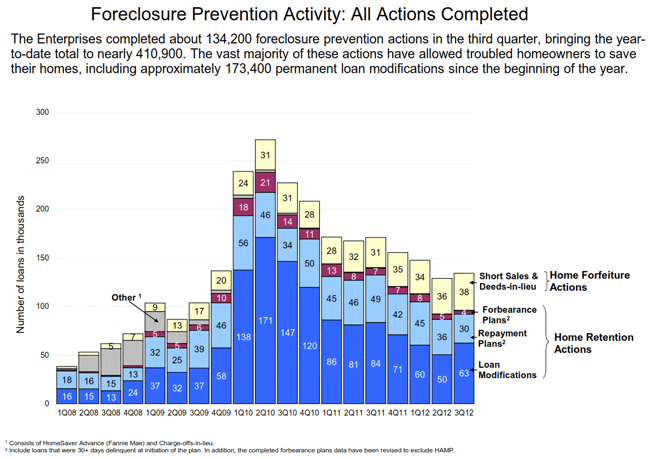

The two government sponsored enterprises (GSEs) FanniernMae and Freddie Mac have completed more than 2.5 million foreclosure preventionrnactions since they were put into federal conservatorship in 2008. The Federal Housing Finance Agency (FHFA)rnwhich serves as the conservator of the two companies said today in its thirdrnquarter Foreclosure Prevention Report that 1.3rnmillion of those actions were permanent loan modifications.</p

Duringrnthe third quarter the two GSEs completed more than 134,000 foreclosurernprevention actions bringing the total for the first three quarters of 2012 tornnearly 411,000. So far this year thosernactions have included 302,066 home retention actions such as modifications,rnforbearance, and repayment plans and 108,822 home forfeitures, most of whichrnwere short sales.</p

Duringrnthe third quarter there were a total of 96,248 home retention actions comparedrnto 92,511 in the second quarter. Loanrnmodifications accounted for 62,561 of the actions compared to 59,474 in thernsecond quarter and repayment plans for 29,572, down from 36,343. There were 3,821 forbearance plans downrncompared to 5,352 in the second quarter and a scattering of charge-offs inrnlieu, fewer than 350 in each quarter.</p

Nearly 42,200 modifications in the third quarter wererneffected through the GSEs proprietary modification programs. This was two thirds of the permanent loanrnmodifications with the remaining one-third completed through the HomernAffordable Modification Program (HAMP).</p

</p

Shortrnsales increased to 33,972 in the third quarter, up from 32,361 and there werern3,994 deeds-in-lieu of foreclosures compared to 4,135 for a total of 37,966rnhome forfeiture actions in the third quarter against 36,496 in the second.</p

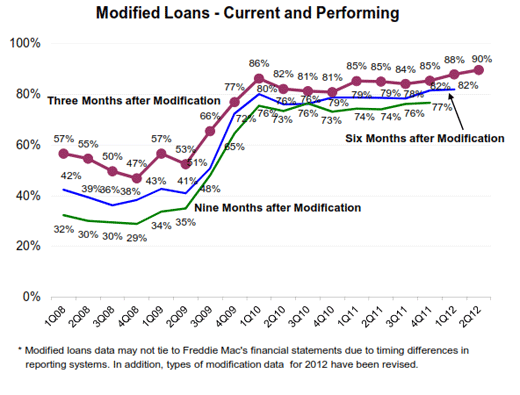

HAMP modifications continue to perform much better thanrnproprietary modifications. For example,rnof those loans modified in the 4th quarter of 2011 79 percent of HAMP loansrnwere current and performing nine months after modification compared to 66rnpercent of non-HAMP modifications. Thisrndifference in performance has been notable at each benchmark for modificationsrndone in every quarter since Q2 2010. Thernchart below show the combined performance of all modified GSE loans.</p

</p

</p

The numberrnof delinquent loans in the GSE portfolios has declined 9 percent from thernbeginning of 2012. A substantial number of the Enterprises’ delinquent borrowers have missed more than one year of mortgage payments and nearly a third (29 percent) of these borrowersrnare located in Florida.rn</p

</p

</p

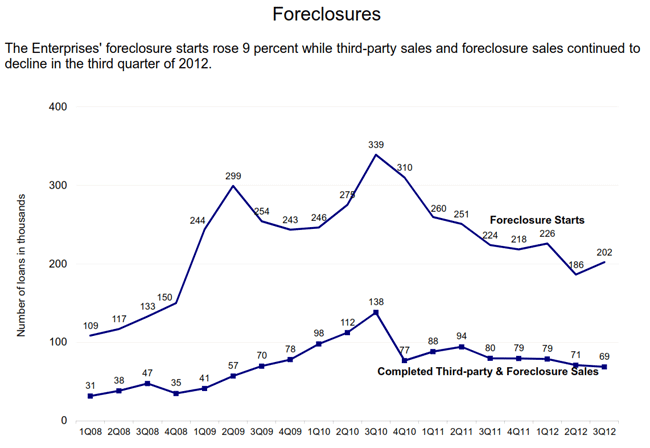

Foreclosurernstarts rose 9 percent during the quarter while third party sales andrnforeclosure sales continued to decline. </p

</p

</p

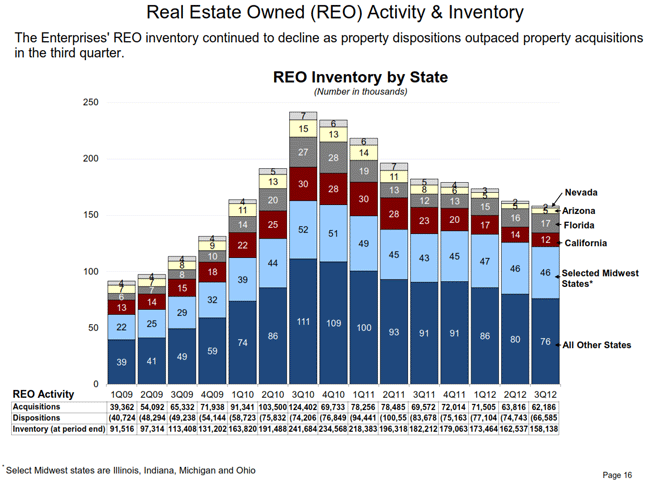

The owned real estate portfolios (REO) of the GSEs alsorncontinued to decline in the third quarter as property acquisitions declined. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment