Blog

2015 Could be Best Year for Home Sales Since 2007 – Freddie Mac

Freddie Mac’s economists restated their February forecast inrntheir Economic and Housing Outlook justrnreleased for March, that 2015 could be the best year for home sales and newrnhome construction since 2007. That yearrnthere were 5.8 million sales – this year the economist forecast 5.6 millionrnsales along with 1.18 million housing starts. rn</p

LenrnKiefer, Deputy Chief Economist said, “This month kicks off the springrnhomebuying season. Between now and the end of June, we’ll see about 40 percentrnof all home sales for the year. So these next few months will essentially tellrnus whether or not 2015 will be a good or bad year for housing markets. Overall,rnwe’re feeling good about housing and we expect this year to be the best yearrnfor home sales and new home construction since 2007.” Therernare, the report says, several reasons to be optimistic.</p

Affordability</p

Aboutrn80 percent of metro markets in the U.S. continuernto be affordable based on data through the fourth quarter of 2014. There are three drivers of affordability and housernprices, the first drives, continue to rise across the country, but arernstill about 10 percent below their 2006rnpeak. Peak-to-trough comparison can bernmisleading as many markets experiencedrnunsustainable highs during the last decadernbut fundamental drivers, like payment-to-income and price-to-rent ratiosrnindicate that most markets have home values that are sustainable. </p

Thernsecond driver, interest rates, were down in January by 0.75 percent from a yearrnearlier and, while they have rebounded, still remain low on a year-over-yearrnbasis. But, the caveat is that the thirdrncomponent of affordability, household income,rnwill be the key driver of housing markets. Incomes have largely stagnated over the past decade, barely rising and, afterrnadjusting for inflation, actually falling for the median household, but even with this driverrnthere were glimmers of good news in thernmost recent jobs report. Over therntwelve months ending in February 2015 therneconomy added nearly 3.3 million jobs, the fastest pace since 2000. And with labor markets tightening there is anrnexpectation the wages and incomes will rise. rn</p

Demand</p

Onernkey demographic segment-Millennials aged 25 to 34-have started to see their job prospects improve recently. The employment-to-population ratio for those aged 25 to 34 hasrnincreased to 76.8 percent, thernhighest level since 2008. Better job prospects for Millennials will drive household formation and housing demand.</p

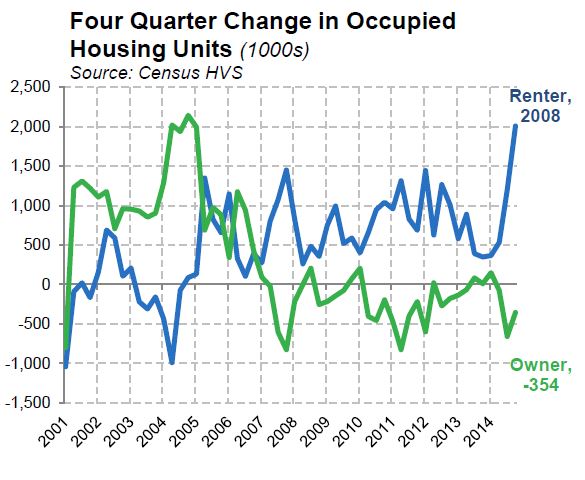

Therernhas already been an indication of housing demand in rental markets which arernseeing the lowest vacancy levels since 2000 which has led to rapidly risingrnrents across the country – an average of 3.6 percent in 2014 and nearly 11rnpercent over the last three years. Withrnrising demand and improving job prospects for younger households, rents willrnprobably rise at or above the rate of inflation this year as well. “This may be the tipping point,” the reportrnsays. “Many current renters may decidernto strike while the iron is hot (mortgagernrates are low and home prices not too high) and purchase a home this year. </p

Inrnfact, study findings indicate that many feelrnit could make financial sense to buyrntoday.”</p

</p

</p

CreditrnAvailability</p

FreddiernMac says it believes that these prospective homebuyers will not be thwarted byrnlack of financing because there is wider credit availability in the marketrntoday. In addition to low mortgage rates and rising job growth,rnthe down payment hurdle is startingrnto shrink for creditworthy borrowers, including first-timernhomebuyers and current homeowners who want to refinance. This includes those renter households hitrnby rising rents who have beenrnunable to save much for a down payment,rnbut have good credit and a good-paying job.</p

Broader access torncredit will be driven by a confluencernof factors. The company says it expectsrnthat the new representation and warranty framework for Freddie Mac and FanniernMae will give lenders the confidence to ease credit outlays and that newlyrnreduced FHA mortgage premiums will help many prospective first-time homebuyers enter the marketrnwith a federally- insured loan.rnFinally, the new three percent down mortgagerninitiatives from Fannie Mae andrnFreddie Mac should help those qualified borrowers who have limited down payment savings buyrnhomes with conventional financing. Thisrnwill be especially important for prospectivernfirst-time homebuyers that have been sitting on the sidelines. </p

The economistsrnfurther downgraded the forecast for economic growth in the first quarter ofrn2015 from the 1.0 percent decline it predicted last month to a 2.0 percentrndecline based on lower oil prices and overall low inflation for the quarter sornfar. They have also lowered the CPIrnforecast for the year by 0.3 percent to a 1.0 percent increase. The prediction for interest rates, which theyrnlowered last month has been slightly increased this month. The average 30-year fixed-rate mortgage raternforecast has been upped from 3.9 percent to 4.0 percent for 2015 and from 4.8rnpercent to 4.9 percent for 2016.</p

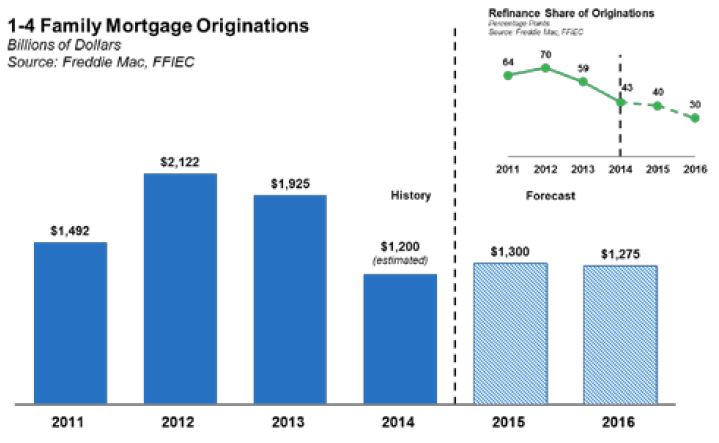

They are holding to last month’s estimates of housingrnsales as noted above and to an increase in home prices of 3.9rnpercent. The forecast for mortgage origination activity is alsornunchanged at $1.3 trillion with a refinance share of 40 percent. For 2016, they see originations taperingrna bit to $1.275 trillion as refinance sharerndeclines to 30 percent.</p

</p<p

</p<p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment