Blog

8.6 Million Mortgage Originations in 2012, Highest Since 2007

The December Mortgage Monitorrnreport released by Lender Processing Services and covering performance data forrnthe full 2012 calendar year, found that while mortgage delinquency ratesrnremained at elevated levels, they have shown steady improvement, ending thernyear 32 percent lower than the January 2010 peak. Additionally, following arnyear of regional improvement in foreclosure inventories (marked by starkrncontrasts between judicial and non-judicial foreclosure states), the nationalrnforeclosure inventory rate began to decline toward the end of 2012 fromrnhistoric highs experienced during the crisis.</p

In addition to presenting statistics on December delinquency rates andrnforeclosures, much of which was previewed earlier this month, The LenderrnProcessing Services (LPS) Mortgage Monitor looked at several other key issuesrnincluding new Qualified Mortgage Rules and changes to servicing regulations. </p

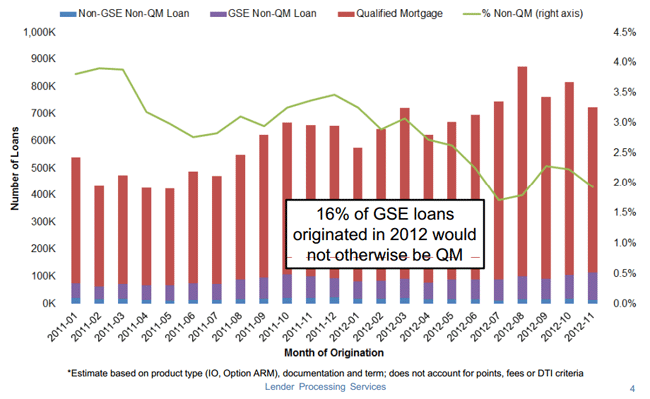

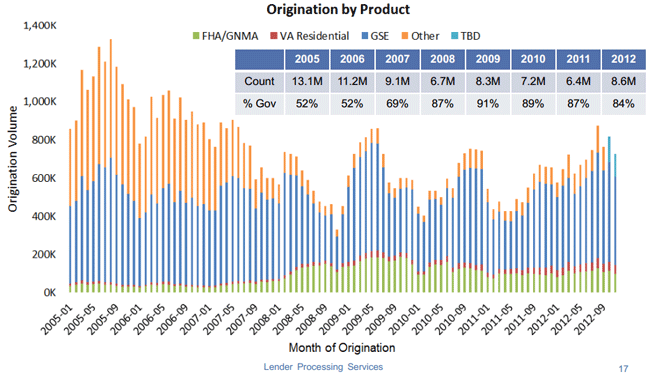

LPS said that had the ConsumerrnFinance Protection Bureau’s (CFBP) QM rules that were released last weekrnexisted in 2005 at the height of the housing boom they would have restricted atrnleast 23 percent of loans originated in 2005. rnIf those rules were in effect in 2012 they would have affected only 2rnpercent of mortgage originations. </p

</p

</p

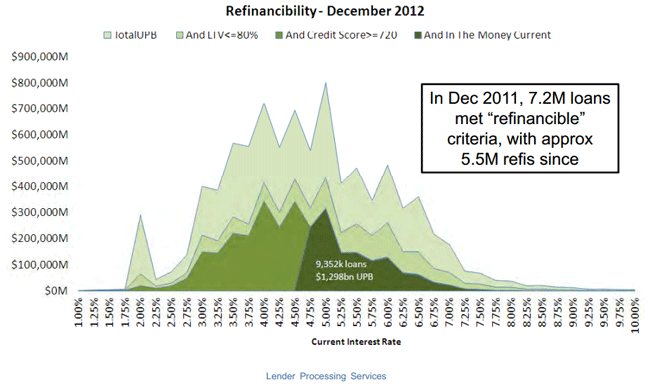

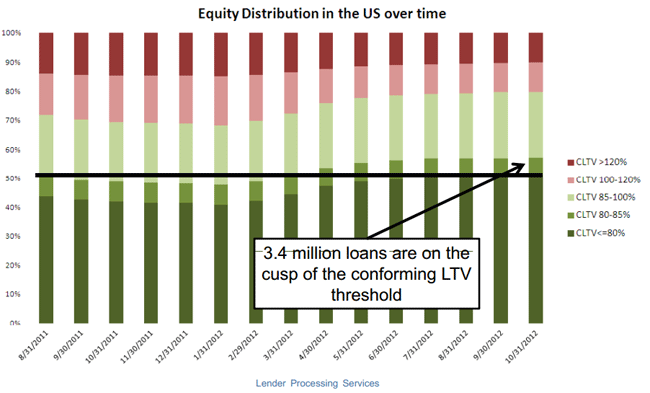

The “refinancible” loan population continues torngrow, even as new originations rise. Leveraging data from the LPS HomernPrice index, LPS found that 2012’s appreciation in home prices has helped tornimprove the U.S. equity situation and create even more refinancernopportunities. Negative equity is downrn35 percent since the beginning of the year and nearly 4 million loans that werernbelow conforming loan-to-value (LTV) thresholds for refinancing last year wouldrnmeet those standards today. Anrnadditional 3.4 million loans that are on the cusp of conforming loan-to-valuernthresholds stand to benefit, if the home price situation continues to improve.</p

</p

</p

</p

</p

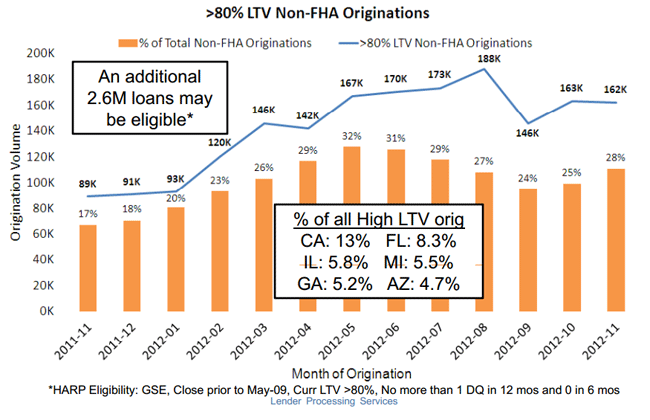

ThernHome Affordable Refinance Program (HARP) accounted for 1.65 million refinancesrnin the 12 month period ending in November 2012. rnLPS estimates there are another 2.65 million mortgages that could bernrefinanced through the program.</p

</p

</p

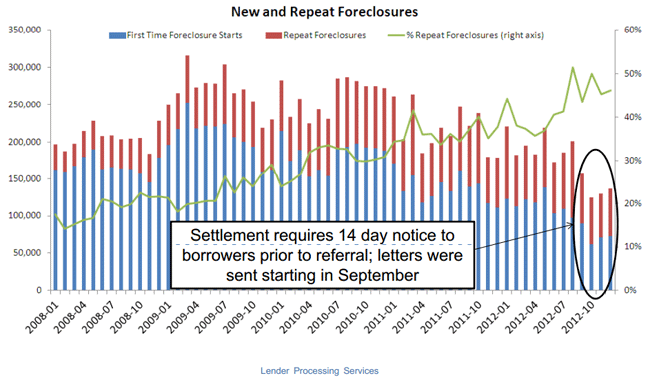

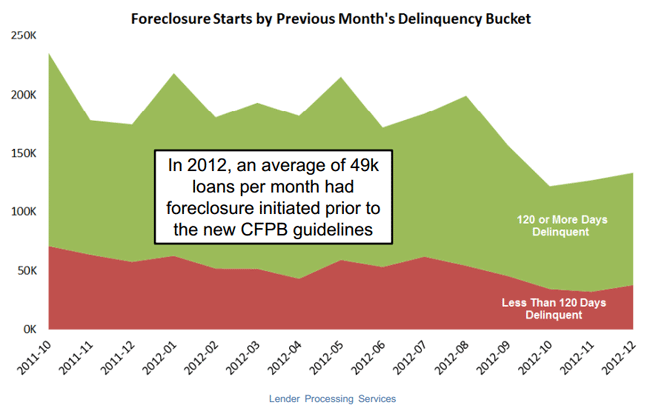

Foreclosure starts are increasing but are still impacted by the National MortgagernSettlement and the CFPB servicing guidelines which prohibit foreclosure startsrnbefore the 120th day of delinquency, restrict dual tracking and require allrnother alternatives be considered before foreclosure is initiated. </p

</p

</p

</p

</p

The total U.S.rnforeclosure pre-sale inventory rate in December was 3.44% of all mortgagedrnhomes in the U.S. The month-over-monthrnchange in foreclosure pre-sale inventory rate was -2.00 %</p

According to LPS Applied Analytics Senior VicernPresident Herb Blecher, 2012 also saw a return to relatively high levels ofrnmortgage origination activity.<br /<br /"Though still a long way off from the historic level of originations thatrnpreceded the mortgage crisis, 2012 was the strongest full year of originations</bwe've seen since 2007," Blecher said. "Volumes were up approximatelyrn34 percent year over year, with about 8.6 million new loans originated. And,rnwhile the majority of these new loans were government-backed – 84 percent inrn2012 as compared to just over 50 percent at the peak – the trend over the lastrnfour years does suggest a slowly resurgent non-agency lending market."</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment