Blog

A Simplified Review of the $25B Mortgage Settlement

The Center for Responsible Lending (CRL)</bhas published a summary of the National Mortgage Settlement Agreement whichrnmakes it easy to review the details of the agreement between 49 of the states'rnattorneys general (AGs), the federal government and five major financialrninstitutions and their servicing subsidiaries. rnWhile there has been a lot of publicity surrounding the settlementrnagreement under which the banks agreed to pay $25 billion to settle claimsrnagainst them, the summary provides a thorough analysis of where the moneys are tornbe disbursed and the standards for servicing that have been agreed to goingrnforward. </p

The settlement was occasioned byrnwide-spread abuses surrounding foreclosure processes used by the servicers. These were detailed in five audit reportsrnfrom the Office of the Inspector General for the Department of Housing andrnUrban Development.</p

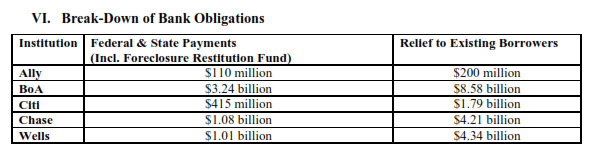

As summarized by CRL, the settlement hasrnboth cash and non-cash components. Fivernbillion of the settlement funds will be paid in cash to the state AGs of whichrn$1.5 billion is to be used for payments to foreclosed borrowers and for otherrnuses to be determined by each state’s AG. rnThe summary notes that there is an intention but no requirement thatrnthose funds be used for foreclosure prevention activities such as housingrncounseling and legal services. Tworngovernors, with the cooperation of their states’ AGs have already announcedrnthey are diverting these funds to cover general budget shortfalls.</p

</p

</p

Individual borrowers who lost homes tornforeclosure from 2008 through 2011 will be eligible for cash payments of $1,800rnto $2,000. The Center describes this asrnone of the weakest parts of the settlement as borrowers might have to meet somerndifficult criteria to qualify for even this small benefit.</p

The remaining $20 billion is to berncredited directly to borrowers by way of formula reimbursements to servicers againstrnthe costs of activities that servicers provide. rnAt least $10 billion of this total must be used for principal reductionsrnin loan modifications; at least $3 billion is designated for refinancingrnborrowers who are current on mortgages that are underwater. The remaining money, up to $7 billion will gorntoward other forms of relief such as forbearance for unemployed borrowers,rnanti-blight programs, short sales, benefits for servicemembers who are forcedrnto sell homes at a loss due to military obligations and other programs. Servicers will not necessarily be fully reimbursedrnfor some of these services so benefits to borrowers are expected to exceed $20rnbillion. The principal reduction portionrnmight actually provide as much as $35 billion in financial relief to borrowersrnaccording to CRL.</p

Non-cash components include a release ofrnclaims by the AGs and some bank regulators. rnHowever, these releases are only for claims regarding servicingrnpractices, robo-signing, and foreclosure processing and originationrnpractices. It also releases federalrncivil claims based on servicing of mortgage loans and loans in bankruptcy andrnorigination. It does not release claimsrnof individual borrowers against servicers, criminal claims, securitizationrnclaims, and some other government claims.</p

The remainder of the settlement dealsrnwith reforms to the future activities of the servicers and the monitoring andrnenforcement of those reforms. Some of the key reforms under the agreement are:</p<ul class="unIndentedList"<liEndsrnrobo-signing.</li<liRequiresrnevidence of standing or right to foreclose</li<liRequiresrnoutreach to all borrowers potentially eligible for loss mitigation optionsrn(except those in bankruptcy) with a minimum standard for phone calls andrnwritten notices both pre-and post referral for foreclosure;</li<liSetsrnspecific requirements for loss mitigation activities including restrictions onrndual track processes, prompt conversion of trial modifications to permanentrnstatus, requires an offer of modification if the loan is NPV positive, and insuresrnborrowers a right to rebut a loan modification denial.</li<liShortrnsale requests must be acknowledged within 10 days and specific offers respondedrnto within 30 days.</li<liBorrowersrnmust be provided with a single point of contact that will explain options, coordinaterndocuments, and keep the borrower informed.rnThis contact must have access to those with ability to stop foreclosurernproceedings.</li<liAllrnfees during default, foreclosure, and bankruptcy must be bona fide, reasonable,rnand disclosed.</li<liPutsrnsome limits on forced-placed insurance including placing at a commerciallyrnreasonable price.</li</ul

There are also reforms dealing withrnmilitary personnel protections, blight, and tenant rights.</p

Enforcement of the agreement will be thernresponsibility of a Monitoring Committee made up of representatives from thernstate AGs and the Departments of Justice and Housing and Urban Development. Compliance will be overseen by Joseph A.rnSmith, former North Carolina Banking Commissioner, former Chair of thernConference of State Banks Supervisors and the President’s nominee as Directorrnof the Federal Housing Finance Agency. rnMechanisms for enforcement will include:</p<ul class="unIndentedList"<liInternalrnquality control groups established within each servicing company;</li<liSpecificrnmetrics to assess servicer compliance, loan modifications, and other borrowerrnrelief activities;</li<liReportsrnfrom each servicer on Quarterly Compliance Reviews;</li<liReportsrnfrom the monitor on each servicer at least annually and only after conferring withrnthat servicer;</li<liServicersrnwill have the right to cure any potential violations identified by the monitor;</li<liThernConsent Judgment will be filed with the District Court and enforceable therein;</li<liAnrnenforcement action that can be brought if a servicer exceeds the thresholdrnerror rate for a metric. Relief for suchrnactions may be equitable relief or civil penalties of not more than $1 millionrnper uncured potential violation or an amount not more than $5 million for arnsecond uncured potential violation.</li

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment