Blog

ABA Summarizes Pending Mortgage Reform into 2013, "Critical to Lenders"

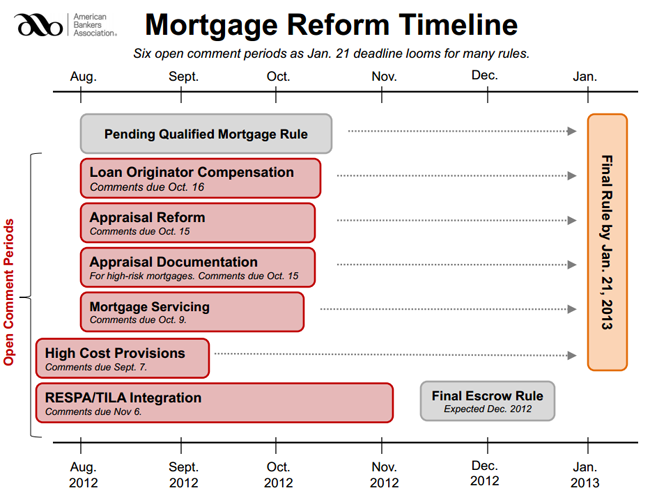

The American Bankers Association (ABA)rnhas reminded its members and others in the industry that the next few monthsrnare critical to lenders because of an even dozen new rules and regulations thatrnare pending. Comment periods are stillrnopen on some of the changes, affected parties need to be preparing to adapt tornothers, while some issues will require more time and discussion before anyrndecisions are made</p

Get out your calendars.</p

September:

Comments are due September 7 on twornissues. The Federal Housing FinancernAgency has voiced objections to proposals from the City of Chicago and twornCalifornia communities to use eminent domain to seize performing mortgages andrnrestructure them to reflect current market value of the collateral. FHFA is requesting input on its concerns.</p

The second comment period ending thatrnday regards a proposed rule from the Consumer Financial Protection Bureaurn(CFPB) that would expand the definition of “high cost mortgages” and increasernrestrictions on them. A final rule isrndue on or before January 21, 2013.</p

October:

October 9 is the deadline for commentsrnon proposed RESPA and Truth in Lending Act (TILA) rules that will requirernservicers to provide borrowers with periodic statements, rate reset notices, andrnerror resolution. ABA has expressed concernrnthat these new rules will prose an undue burden on servicers, particularlyrnsmall firms.</p

While the most significant appraisalrnreforms are already in place, CFPB has formulated the final Dodd-Frankrnappraisal reforms which require physical property visits and new requirementsrnfor appraisal independence. Finalrncomments are due by October 15. </p

Comments are also due by October 15 on arnjoint proposal from six federal regulators to require lenders writing high-riskrnmortgages to provide borrower with a free copy of appraisal reports and imposesrnother documentation requirements. </p

The most recent set of proposed rules governingrnloan originator compensation by CFPB are open for comments until Octoberrn16. ABA has expressed concern that thesernrules will open lenders to massive liability risks.</p

Final rules for all four of the rulesrnsets listed above must be finalized on or before January 21, 2013.</p

November:

After months of draft disclosures CFPBrnhas invited comments on proposed merged RESPA and TILA forms. ABA has expressed concern that the 1,100 pagernCFPB proposal neither adequately simplifies the forms nor takes into accountrnother pending mortgage reforms. Commentsrnare due November 6.</p

In addition to the open comment periods,rnABA also reminded its members and others in the industry of pending issues andrndiscussions of which they should be aware. rnThese include:</p<ul class="unIndentedList"<liGSErnReform. While a strategic plan wasrnissued over a year ago by FHFA, it is unlikely that Congress will undertake anyrnresolution of the Fannie Mae and Freddie Mac conservatorships until after thernelection. ABA generally supports FHFA'srnproposals but says there are likely to be further develops that will impact thernGSEs in the near term such as the use of income from increased guarantee fees.

</li<liFinalrnEscrow Rule: A Federal Reserve rulernamending TILA to lengthen the time requirement for maintaining escrow accountsrnfor high-priced mortgages is still pending.rnABA is concerned that the rule imposes heavy disclosure requirementsrnbeyond those mandated by Dodd-Frank and that the Federal Reserve has exceededrnits authority in proposing the rule. ABArnexpects a final rule in December.

</li<liFairrnLending: ABA said that Fair lendingrnissues continue to be a top priority for lenders. There is a proposed rule from Housing andrnUrban Development (HUD) and other proposals from federal regulators that are likelyrnto increase federal scrutiny in this area.

</li<liAbilityrnto Repay and Qualified Mortgages. Thernproposed rule establishes standards for qualified mortgages which are expectedrnto set the threshold for determining which mortgages meet the ability to repayrnstandards of Dodd-Frank. ABA said thatrnthis rule risks transforming the mortgage market in ways "that dramaticallyrnharm credit availability, the viability of the mortgage lending business andrnthe housing recovery." ABA is stronglyrnadvocating for the inclusion of a legal safe harbor over a lesser "rebuttablernpresumption" standard. The final rule isrndue January 21, 2013.

</li<liRiskrnRetention and Qualified Residential Mortgages.rnABA expects that, following an earlier comment period, the Federal Reservernand other agencies will re-propose the rule, probably after CFPB finalizes itsrnown qualified mortgage rulemaking.

</li</ul

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment