Blog

Administration Issues Housing Market Scorecard for September

The Obama Administration’s September Housing Scorecard produced by the Departments of Housing and Urban Development (HUD) and Treasury continues to paint a picture of a slowly stabilizing housing market, with slight marginal improvements in many areas.Even the bad news such as housing sales was mitigated by a reference to more recently released information. </p

This illustrates a problem with the Scorecard’s format. While it is helpful to have a lot of information about the housing and housing finance markets in one place, the data points are so scattered (information in the current report was collected in July, August, and September or for the second quarter that ended in June) that it is difficult to get a true picture of any solid trends.</p

Sources for the report include the National Association of Realtors, Mortgage Bankers Association, Census Bureau, CoreLogic, Cash-Shiller, RealtyTrac, as well as the departments issuing the report. Much of the information has been previously reported by Mortgage News Daily.</p

While housing sales figures covered by the current report were dismal, the report brushes them off, referring to the recent improvements in both housing starts and home sales reported in the last few days.</p

New Home Sales Mixed Regionally. Still Near Record Lows</p

DATA FLASH: Housing Starts +10.5%. Building Permits +1.8%</p

Existing Home Sales Improve from Record Low. “Subpar” Activity Expected</p

Homebuilder Outlooks Reflect Stagnation in Housing Market</p

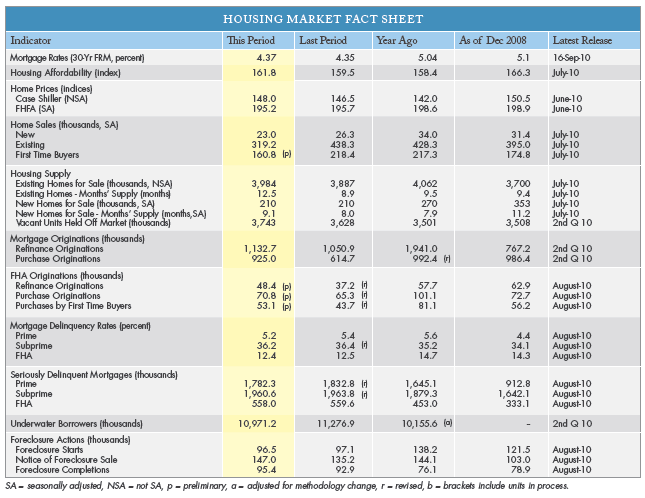

The Scorecard notes further decreases in delinquency rates across all three categories it tracks from the previous month although comparisons with one year earlier are mixed. </p<table id="blogtabledata" border="0" cellpadding="0" cellspacing="0"<thead<tr

Here is the Housing Market Fact Sheet as presented in the release…</p

</p

</p

The foreclosure picture is mixed. At the beginning of the pipeline, starts decreased from 97,100 to 96,500 from July to August. Notices of sales, however, jumped from 135,200 to 147,000 and actual foreclosures were up from 92,900 to 95,400</p

Banks Add REO Inventory at Record Pace in August. More Homes Hit Auction Block</p

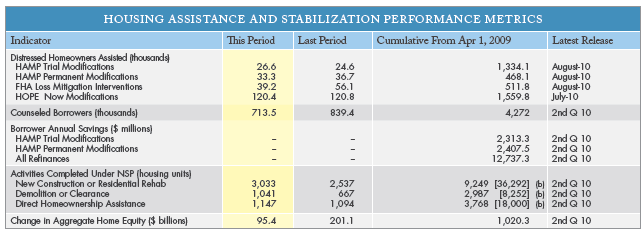

Figures for the Home Affordable Modification Program (HAMP) were relatively flat. Trial modifications were initiated for 26,600 homeowners compared to 24,600 in July and 33,300 trials were converted to permanent status during the month compared to 36,700 the previous month. 1.33 million homeowners have entered the program since it was started in the winter of 2009, 468,100 have received permanent modifications, and 487,522 trials have failed. The most common reasons for trial cancelation are insufficient documentation, failure to make payments during the trial, and borrowers found to be ineligible because housing expenses were already below the maximum 31 percent level. </p

The backlog of borrowers who have been in trial modification status for six months or more is now fewer than 95,000. Three servicers, J.P. Morgan, CitiMortgage, and Bank of American account for 62 percent of the total backlog. </p

FHA initiated 39,200 loss mitigation interventions during the August compared to 56,100 in July and HOME Now modifications totaled 120,000, down from 120,800 the previous month. </p

In August there were 48,400 FHA mortgages initiated for refinancing compared to 37,200 in July. 70,800 FHA purchase mortgages were originated, up from 65,300 the previous month. First-time homebuyers accounted for 53,100 of the purchase mortgages originated in August.</p

</p

</p

Americans More Cautious on Homeownership. Borrower Credit Profiles Impede Recovery

Common Sense Not Found in Automated Underwriting Engines</p

Refinance Apps Decline for Third Consecutive Week. Has Demand Topped Out?</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment