Blog

Administration Offers Monthly Recap of Housing Metrics

Excerpts From the Release…</p

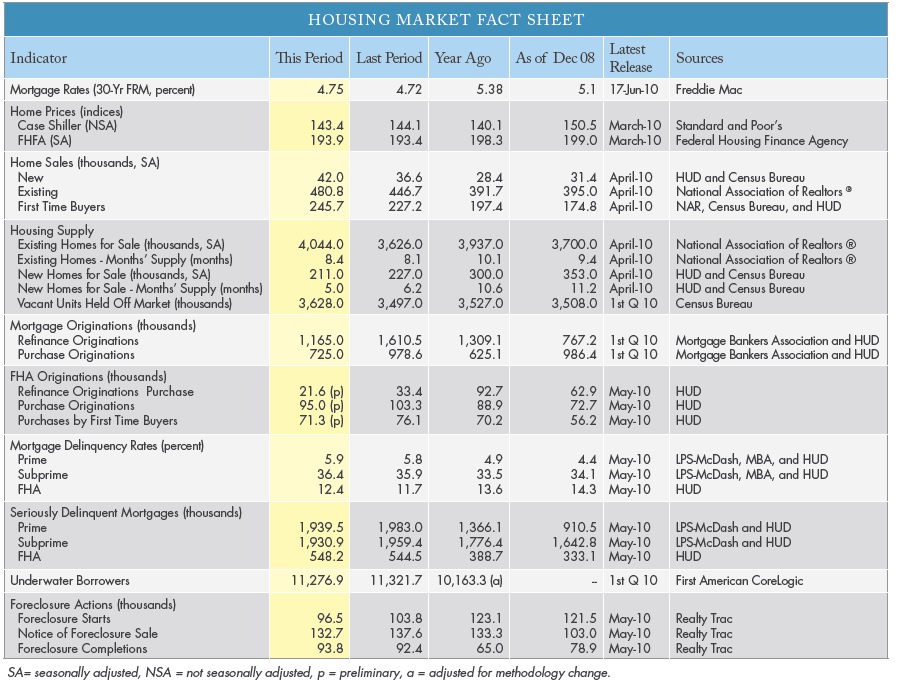

The U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of the Treasury today introduced a monthly scorecard on the nation's housing market.</p

Each month, the scorecard will incorporate key housing market indicators and highlight the impact of the Administration's unprecedented housing recovery efforts, including assistance to homeowners through the Federal Housing Administration (FHA) and the Home Affordable Modification Program (HAMP). </p

This scorecard contains key data on the health of the housing market including…</p<ul

HUD Secretary Shaun Donovan says:</p

“We already know that due to the Obama Administration's efforts, the housing market is significantly better than anyone predicted a year ago…This scorecard will allow the American people to monitor the Administration's efforts to strengthen the housing market on a monthly basis and hold the government and industry accountable. Demonstrating the progress in the housing market due to the Administration's policies, this month's report provides a broad set of indicators showing encouraging signs of recovery.”</p

The housing scorecard now incorporates the monthly Making Home Affordable Program Servicer Performance Report, including HAMP modification data that once again shows a month-over-month increase in permanent modifications, with average growth of roughly 50,000 permanent modifications per month over the last four months. Servicer data indicates close to half of the homeowners in HAMP trial modifications who were ultimately ineligible for a HAMP permanent modification were offered an alternative modification and less than 10 percent move to foreclosure sale. </p

HERE are some of the findings (see page 8)… </p<ul

</p

</p

MND will publish a full recap of May HAMP data tomorrow.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment