Blog

Americans are not Shopping Smart for Mortgage Loans

Homeowners appear to be less than savvy shoppers when it comes to finding arnmortgage to purchase or refinance their homes. rnA new study from Fannie Mae suggests that consumers could save money andrnfind a more financially sustainable mortgage if they shopped more effectively. </p

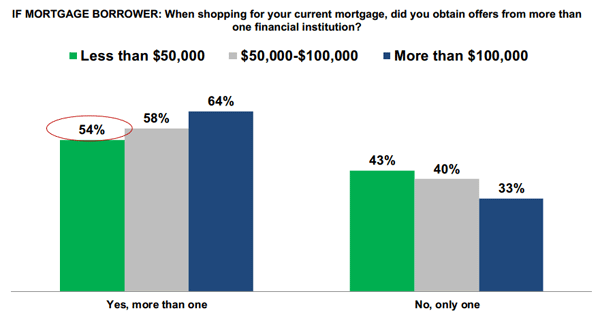

Further, the study showed that higher income consumers were more likely torndo more research and approach the search for a mortgage more efficiently. For example, lower income survey respondentsrnwere more likely than those with a higher income to have obtained a quote fromrnonly one lender and to make less use of technology in their mortgage duerndiligence. </p

The study, one in an ongoing series of TopicrnAnalysis Reports produced by Fannie Mae, used data from the last three installmentsrnof its National Housing Survey. Thernsurvey is conducted monthly by phone with 1,000 homeowners and renters tornassess their attitudes toward owning and renting a home, the current state ofrntheir household finances, views on the U.S. housing finance system, and overallrnconfidence in the economy. The three monthly surveys that make up any given Topic Analysis Report are identical inrnwording and placement of questions. ThisrnAnalysis report was written by Steven Deggendorf, Fannie Mae’s Director of BusinessrnStrategy.</p

Deggendorfrnsaid his findings suggest that consumers could save money andrnfind a more financially sustainable mortgage product if they shopped morerneffectively. Failing to do so means thatrnconsumers may not be taking full advantage of the unprecedentedly low interestrnrates offered today. </p

Income had a stronger correlation across responses than any other categoryrnincluding education, income, race, and whether the respondent was a first-timernhomebuyer. Deggendorf dividedrnrespondents into three income groups which we, for purposes of brevity, willrnlabel as Group A, incomes under $50,000; Group B, incomes between $50,000 andrn$100,000; and Group C, those with incomes over $100,000. </p

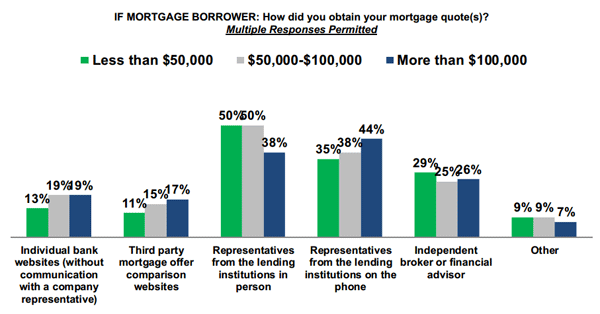

He found that 43 percent of Group A obtained mortgage quotes from only onernsource compared to 33 percent of Group C. rnConsumers from Group A and B however were much more likely (at 50rnpercent each) to meet with a lending representative face-to-face than werernmembers of Group C who were slightly more likely than members of the other tworngroups to obtain quotes by phone. Lessrnthan 20 percent of any of the three groups relied on website sources for quotes.</p

</p

</p

</p

</p

The author points out that other recent research indicates that obtainingrnonly one quote might cost borrowers $1,000 or more in closing costs andrnacademic research suggests the risk of overpaying for a mortgage is higherrnamong lower income borrowers.</p

Additional research suggests that borrowers with a better understanding ofrnloan terms may take out lower-cost mortgages. However, research alsornsuggests that many borrowers, particularly those falling in lower incomernbrackets, do not fully understand their mortgages and can end up paying higherrncosts as a result.</p

Survey results show that consumers do not always thoroughly evaluate theirrnmortgage options before obtaining a mortgage. rnLower income respondents are more likely to be influenced by mortgagernbrokers and real estate agents. More than 3 out of 4 higher income respondentsrnsaid that competitive offers would have a major influence on their choice,rnwhich is more than 20 percentage points higher than lower income respondents.rnReputation is important to all income groups: more than 2 out of 3 said itrnwould be a major factor in lender choice. </p

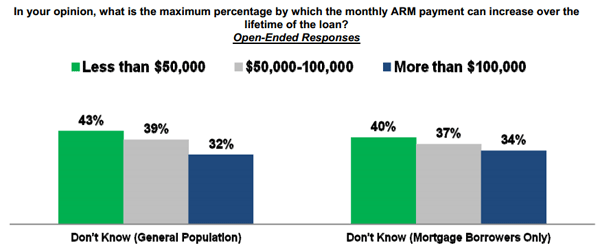

The study also found that a substantial portion of all consumers do notrnunderstand key mortgage elements. rnRespondents were asked to estimate the maximum percentage by which thernmonthly adjustable-rate mortgage (ARM) payment can increase over the life ofrnthe loan. Forty-one percent said they didn’t know but among those who did offerrna guess the average was about 10 percent where the answer was actually 50rnpercent or more.7 Current mortgage borrowers’ average estimates wererneven further off of reality. </p

</p

</p

Respondents from Group C were more likely to rely on technology in theirrnmortgage search. For example, inrndetermining how much they could afford to spend on a home, 67 percent of GrouprnA, 75 percent of Group B and 78 percent of Group C calculated the amountrnthemselves. However, while 72 percent ofrnthose in Group a doing their own calculation did it in their head or on paperrnless than half of Group C did this, with about half using instead either a spreadsheetrnprogram or basic calculator or an online tool. rnHigh numbers of Group C borrowers used mobile devices to research homesrnfor sale (74 percent) research mortgage lenders or track interest rates (68rnpercent each) while only around 50 percent of Group A borrowers used a mobilerndevice for these purposes.</p

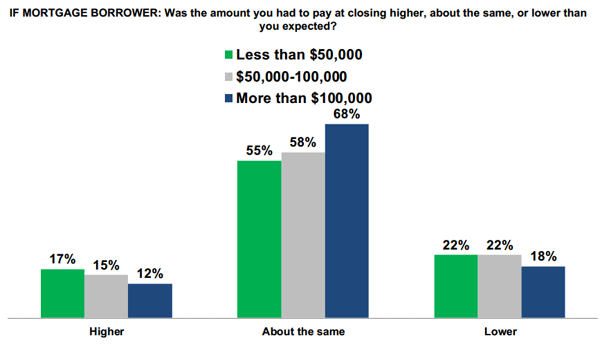

When asked about their own mortgage, higher income consumers were morernlikely to say they paid what they expected at their mortgage closing.</p

</p

</p

“Homeowners who don’t obtain multiplernmortgage offers or carefully compare rates are essentially leaving money on therntable, particularly given today’s unprecedentedly low interest rates,” saidrnFannie Mae Chief Economist Doug Duncan. “Although a home purchase is thernlargest financial obligation most people will ever make, many borrowers do notrnfully understand their mortgage products and costs. As a result, somernhomeowners in this position may find themselves with unsustainable paymentsrndown the road.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment