Blog

Americans see Better Climate for Home Sellers

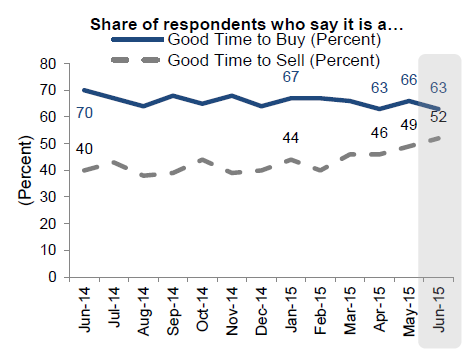

Probably the headline take-away from Fannie Mae’s JunernNational Housing Survey was the more upbeat attitude of potential home sellersrntoward the housing market. The surveyrnfound the number of respondents who think this is a good time to sell a home atrna survey high of 52 percent, up three percentage points from May, and the firstrntime in the survey’s history it has passed 50 percent. Fannie Mae’s analysts said that continuedrnstrong job and income growth and a more favorable outlook on the sellingrnclimate might portend an uptick in the current housing supply. At the same timernhowever those respondents who feel it is a good time to buy a house fell to 63rnpercent tying the all-time survey low.</p

</p

</p

Another sizeable jump was in the numberrnof respondents who expect rents will go up over the next 12 months which alsornhit a survey high at 59 percent, up four points from the previous month. The average expectation for an increase wasrn4.2 percent, down slightly from April. FanniernMae said an increase in housing supply from those ready to sell, combined with higherrnrental cost expectations might propel more potential homebuyers off of thernsidelines.</p

Doug Duncan, senior vice president andrnchief economist at Fannie Mae said, “Our June survey results show thernpositive impact on housing of job and income growth. The expectation of higher rents is a naturalrnoutgrowth of increasing household formation by newly employed individualsrnputting upward pressure on rental rates. A complementary rise in the good timernto sell measure suggests that limited inventory, which is putting upwardrnpressure on house prices, gives an increasing advantage to sellers. Together,rnthese results point to a healthier home purchase market, with more rentersrnlikely to find owning to be more cost-effective than renting and more sellersrnlikely to put their homes on the market.”</p

Fewer respondents expect home prices torncontinue their rapid rise. Forty-seven percentrnsay prices will increase over the next 12 months, down from 49 percent, whilernthe average increase expected eased back from 2.8 to 2.6 percent. Half of respondents expect mortgage rates tornrise compared to 47 percent in the May survey.</p

Those who said they planned to buy thernnext home they live in fell 2 percentage points to 64 percent. Those who say they will rent increased fromrn27 to 30 percent.</p

Attitudes about the overall economyrncontinued to improve. The share ofrnrespondents who say the economy is on the right track increased by 1 percentagernpoint to 39 percent, while those who say the economy is on the wrong track fellrnfrom 52 to 51 percent. </p

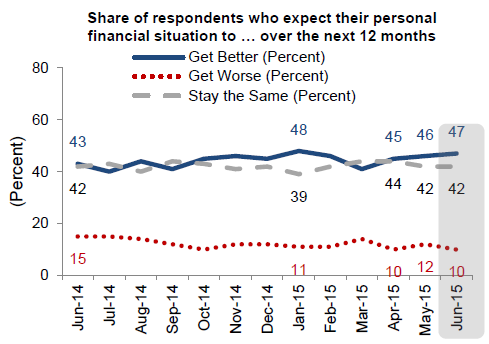

The percentage of respondents whornexpect their personal financial situation to get worse over the next 12 monthsrnfell back to 10 percent – tying a survey low. rnThere were only minimal changes to the number of respondents whornreported improvement or deterioration in household income or expenses over thernlast year. </p

</p

</p

Fannie Mae has conducted the NationalrnHousing Survey monthly since June 2010. rnIt polls 1,000 Americans, both homeowners and renters, by phone, askingrneach over 100 questions to assess their attitudes toward owning and renting arnhome, home and rental price changes, homeownership distress, the economy,rnhousehold finances, and overall consumer confidence.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment