Blog

Are There More First-Time Buyers Than we Think?

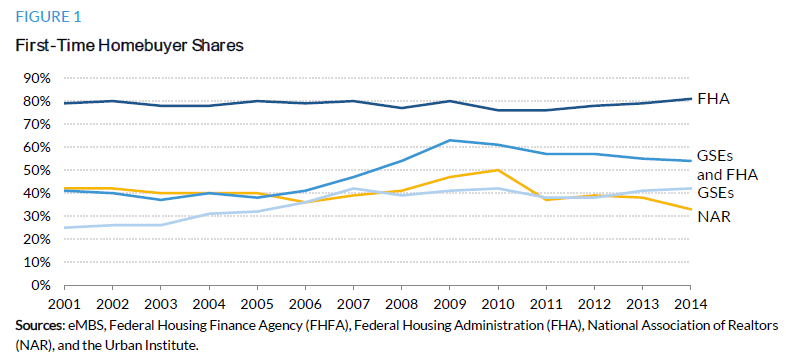

Given how critical first-time homebuyers arernto the housing system the Urban Institute says it is important to accuratelyrnmeasure how present they are in the market. rnThe National Association of Realtors® (NAR) has consistently said thatrnsuch homebuyers typically represent 40 percent of buyers in a healthy marketrnand has reported the share as remaining below this mark since mid-2010. In a House Policy Research Center brief forrnthe Institute, The Urban Institutes Housing Finance Policy CenterrnDirector Laurie Goodman and fellow researchers Bing Bai and Jun Zhurncontend that the widely accepted measures of the percentage of first-timernbuyers such as those provided by NAR “are overbroad and sometimesrnmisleading.” </p

Untilrnrecently loan-level data was not available on most of the largest group ofrnmortgages loans, those backed by FHA and the two government sponsoredrnenterprises (GSEs) Fannie Mae and Freddie Mac. rnWhile Freddie Mac began publicly providing loan-level data in 2005 thernsame was not true of Fannie Mae and Ginnie Mae (which securitizes FHA loans)rnuntil 2013 and such data is still not available from FHA itself. The authors based their work on completernloan-level single-family purchase-money mortgage data from the GSEs and GinniernMae combined with estimates reported by FHFA and the FHA to review the trend inrnfirst-time homebuyer shares over the past 14 years. </p

</p

</p

Accordingrnto the data about one-quarter of GSE-guaranteed mortgages originated betweenrn2001 and 2003 were made to first-time buyers for a home purchase. This percentage grew steadily through thernhousing boom to 42 percent in 2007. This was followed in 2008 by a spike inrnhome refinancing that lasted four years and dropped the first-time homebuyerrnshare of mortgages to 38 percent by 2012 except for 2009 and 2010 when therntemporary homebuyer tax credit boosted it back a bit above 40 percent. As interest rates began to climb at thernbeginning of 2013 refinancing eased and the first-time buyer share rose back torn42 percent. </p

FHArnis designed to provide mortgage access to households not adequately served byrnthe conventional market including first-time buyers. As a result its share ofrnhomebuyers has always fluctuated around 80 percent of its purchase-loanrnoriginations, peaking at 81 percent in 2014. rn</p

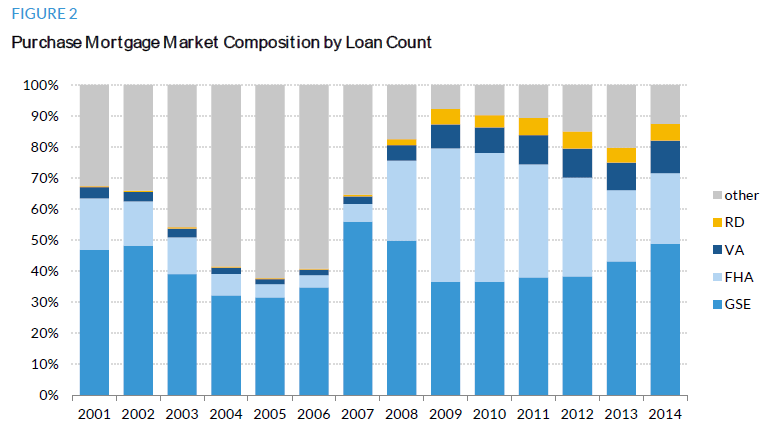

Whenrnthe housing market began to collapse in 2007 and private mortgage moneyrndisappeared the GSEs and FHA stepped in to provide nearly all home mortgagernfinancing and have accounted for between 67 and 79 percent of purchase mortgagernloans between 2008 and 2014. </p

</p

</p

Because of FHA’s traditional focus on first-time buyers, the jointrnFHA-GSE first time homebuyer time series rntends to be driven by shifts in FHA’s market composition and as itsrnshare of the purchase market skyrocketed from 6 percent in 2007 to over 40rnpercent in 2010 this was reflected in the joint first-time homebuyerrnshare. Then from 2011 to 2014 FHArninsurance premiums rose and more buyers shifted to conventional loans. FHA’s market share shrank to 23 percent inrn2014 and the joint first-time homebuyer share declined from 61 percent in 2010rnto 54 percent in 2014. </p

As shown in Figurern1 there is a substantial difference between the shares of first-time homebuyersrnas estimated by NAR and those derived from the GSEs and FHA. The combined GSE/FHA share (bright blue line)rnand the NAR reported share (gold line) both hovered around 40 percent until 2006rnthen they diverge. (The temporary spikernin 2009 and 2010 coincided with the tax credit program) By 2014 there was a significant difference withrnNAR estimating a first-time buyer share of 33 percent while the authors put itrnat 54 percent. The authors go to greatrnlengths to explain the discrepancy. </p

First, they sayrnthat NAR looks at all recent buyers while they focused only on those whornobtained GSE or FHA mortgages. Secondly there was a vast difference in samplernsize with the Nar survey surveying about 148,000 recent homebuyers and sellersrnin 2014 with a 6.1 percent response rate while the Urban Institute looked atrnover 1.8 million loans. </p

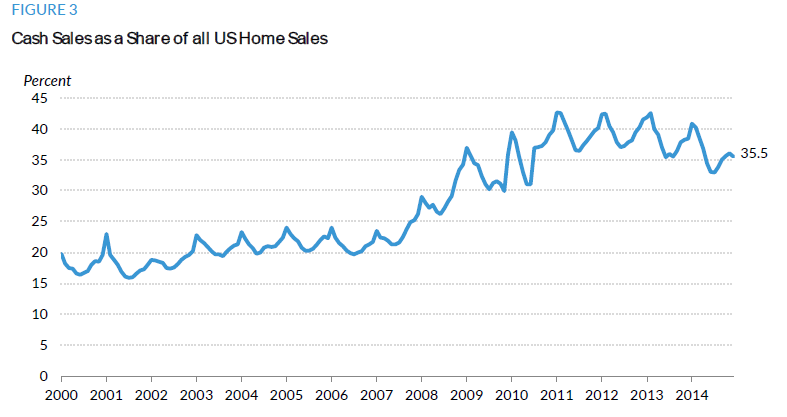

There was also arndifference in the denominators. NAR’srnpurchases differed from the study’s in two important ways. The study’s universe was mortgages originatedrnto purchase homes intended for the owner to live in while NAR’s included bothrnowner-occupied homes and those purchased as investment properties or vacationrnloans and homes purchased without a mortgage. rnThere was a nationwide surge in cash sales starting in 2007, rising tornover 40 percent of all sales in 2011 and remaining at elevated levels. A surge in cash salesrnby investors wouldrnreduce the percentage of first-time homeowners in any surveyrnthat counts bothrncash sales and mortgage-financedrnpurchases.</p

</p

</p

These denominatorrndifferences explain much of the discrepancy. rnFor example, adding purchases for other than principal residences intornthe GSE/FHA share in 2014 would lower it from 54 to 49 percent. Assuming 30 percent of purchase transactionsrnwere cash would lower the share further to 34 percent, very close to the NAR’srnfigure.</p

The study alsorndescribes a technical issue with Ginnie Mae’s reporting which may bernunderrepresenting first-time buyers and urge that FHA begin making their datarnpublicly available.</p

The authors lookedrnat differences between first time and repeat borrowers in 2014 in the amountrnthey borrowed, their credit scores, loan to value (LTV) and debt-to-incomern(DTI) ratios and the mortgage interest rates they obtained. Not surprisingly loan amounts taken throughrnthe GSEs were larger overall than FHA loans and also not surprisinglyrnfirst-time borrowers took out smaller loans than repeat borrowers. However the gap between loan amounts forrnfirst time and repeat buyers was only about $26,000 for both GSE and FHArnloans. </p

Thernaverage credit score of first-time homebuyers lagged 14 points behind the scorernof repeat homebuyers for GSE purchase loans, compared with only a 2 pointrndifference for FHA loans. For GSErnborrowers, the average LTV for first-time buyers stood at 85 percent; thernaverage repeat buyer was able to pay slightly more than 20 percent up front tornavoid mortgage insurance. Because of its low down payment requirement, FHA’srnLTV averaged about 95 percent for both types of buyers. Repeat buyers however had a slightly higherrndebt-to-income ratio than first-time buyers, reflecting in part higherrnhomeowner-related obligations. </p

With higherrncredit scores and lower LTVs, the GSE repeat homebuyers enjoyed more favorable interest rates, 12 basis points lower than their first-time buyerrncounterparts. By contrast,rnthe rates were about the same for FHA borrowers, as both types of buyersrnshared similar creditrnscores and LTVs.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment