Blog

Biggest Quarterly Drop in Underwater Homes since Peak

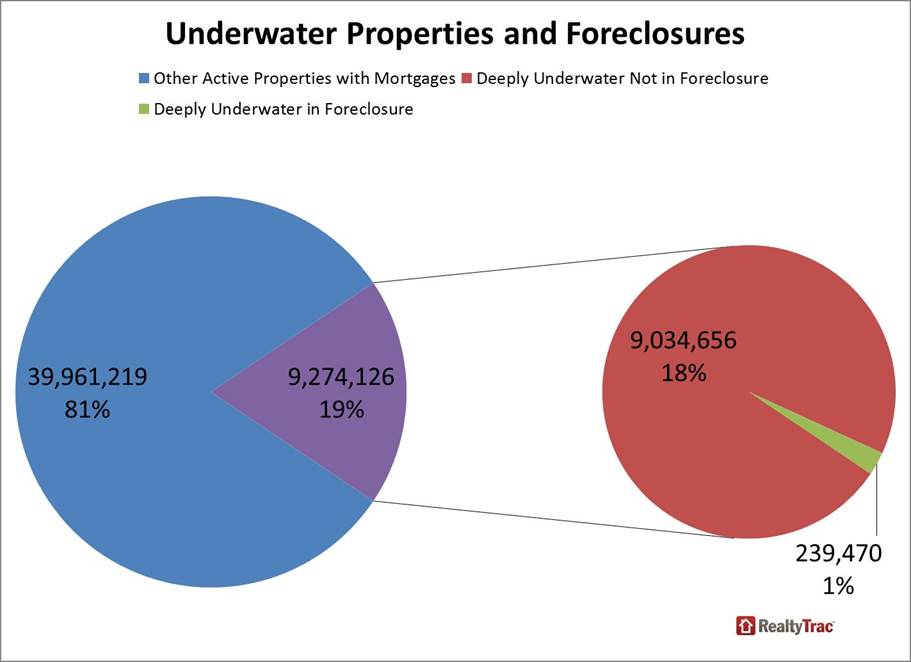

Rising home prices are returning more and more homesrnto a positive equity position and RealtyTrac said today that about 31 percentrnof the homes currently in the process of foreclosure now appear to have some valuernabove the balances of their mortgages. Therncompany reports that as of December homes nationwide that were seriouslyrnunderwater, that is with loan-to-value ratios exceeding 125 percent, numberedrn9.3 million or 19 percent of all properties with a mortgage. This is down from 10.7 million properties orrn23 percent of mortgaged homes that were deeply underwater in September. At the peak, in May 2012 the numbers stood atrn12.8 million properties or 29 percent. </p

</p

</p

In December, of a total of 239,470 properties inrnforeclosure, 48 percent were valued at least 25 percent less than their outstandingrnmortgage balance, 60,000 fewer than in September when 56 percent were deeplyrnunderwater. Another 31 percent had somernequity in December compared to 24 percent in September. </p

</p

</p

Homeowners who retained equityrnduring the period of plummeting prices and rising foreclosures are now alsornbenefiting as well from rising prices and watching that equity grow. The universe of equity-rich properties,rndefined as 50 percent or more, grew during the fourth quarter from 7.4 millionrnrepresenting 16 percent of all residential properties with a mortgage inrnSeptember, to 9.1 million representing 18 percent in December. </p

“During the housing downturn we sawrna downward spiral of falling home prices resulting in rising negative equity,rnwhich in turn put millions of homeowners at higher risk for foreclosure whenrnthey encountered a trigger event such as job loss,” said Daren Blomquist, vicernpresident at RealtyTrac. “Now we are seeing the reverse trend: rising homernprices resulting in falling negative equity, which in turn is giving millionsrnof homeowners a lifeline to avoid foreclosure when they encounter a triggerrnevent. On the other end of the spectrum, the percentage of equity-richrnhomeowners is nearing a tipping point that should result in a larger inventoryrnof homes listed for sale and give the overall economy a nice shot in the arm inrn2014.</p

Blomquist said however thatrnmillions of homeowners remain in such a deep equity hole it will take years tornclimb out. “The longer these homeownersrnremain in a negative equity position without relief in the form of a principalrnloan balance reduction, the more likely that foreclosure will become the pathrnof least resistance for them.”</p

Nevada remains the state with thernhighest percentage of deeply underwater properties at 38 percent. In Florida the percentage is 34 followed byrnIllinois (32 percent), Michigan (31 percent) and Missouri and Ohio at 28rnpercent. On the other side of the equation, 36 percent of properties inrnHawaii are considered equity rich followed by New York with 33 percent,rnCalifornia, 26 percent, Montana, Maine, and the District of Columbia, all at 24rnpercent.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment