Blog

California, Florida Cities Still Hammered by Foreclosures

Foreclosure rates rose</bduring the first half of 2012 in many of the largest U.S. metropolitan areasrnwhen compared to the second half of 2011. rnRealtyTrac said this morning that 125 of the nation's largest 212rnmetropolitan areas (those with a population over 200,000 persons) saw increasedrnforeclosure activity during the period. rnDespite these increases, more than half of the areas still had fewer foreclosurernfilings than one year earlier.</p

The greatest increasesrnin the first half of the year came in Tampa-St. Petersburg-Clearwater, up 47rnpercent, Philadelphia (30 percent), Chicago (28 percent), New York City (26rnpercent) and Baltimore (21 percent). Atrnthe other extreme, Seattle saw a 24 percent drop in foreclosure activity withrnSan Francisco (21 percent), and Detroit (17 percent) also showing improvement.</p

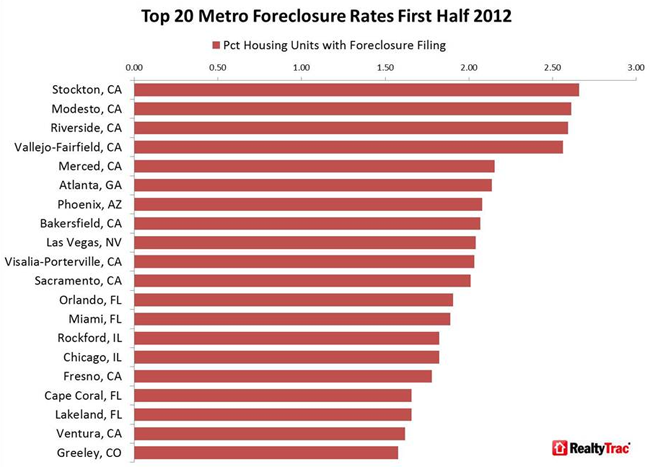

Seven of the top tenrnmetropolitan areas in terms of the foreclosure rate were located in Californiarnwith Stockton posting the highest rate with 2.66 percent or one of every 38rnhousing units receiving a foreclosure filing during the six month period, morernthan three times the national average. rnStockton was followed by Modesto (2.61 percent), Riverside-San Bernardinorn(2.59 percent), Vallejo-Fairfield (2.56 percent) and Merced (2.15rnpercent.) The Riverside area also hadrnthe highest rate among the 20 largest metropolitan areas followed by Atlanta,rnPhoenix, Miami, and Chicago. </p

</p

</p

“Increasingrnforeclosure starts in many local markets helped push total foreclosure activityrnhigher in the first half of this year compared to the second half of 2011,”rnsaid Brandon Moore, CEO of RealtyTrac. “Those foreclosure starts are welcome newsrnfor prospective buyers and real estate brokers in many local markets where arnshortage of aggressively priced inventory has been holding up sales activity.rnMarkets with increasing foreclosure starts will likely see more distressedrninventory for sale in the form of short sales and bank-owned properties in thernsecond half of the year.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment