Blog

California Realtors Say Tight Inventories Constraining Home Sales, Prices are Increasing

For the last few months the NationalrnAssociation of Realtors® (NAR) has been making some general statements that tightrninventories of existing homes are “in some locations” impacting homernsales. Today the California Associationrnof Realtors® (C.A.R.) confirmed that they are one of those locations. </p

C.A.R. said that “A continued shortagernof available homes for sale lowered California home Sales in September, whilernthe median price reached the highest level in more than four years.” Closed escrow sales of existing single-familyrnresidences (SFR) were at a seasonally adjusted annual rate of 484,240 units,rndown 5.2 percent from sales in August and 1.2 percent lower than in Septemberrn2011. </p

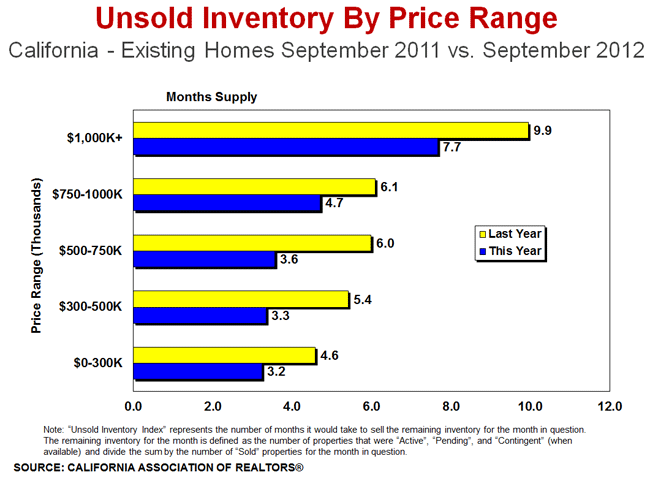

The tight inventory of unsold homesrneased slightly in September, edging up to a 3.7 month supply from 3.2 months inrnAugust but down from 5.3 months in September 0211. A six to seven-month supply of homes isrnconsidered normal. At the same timernhomes are selling much more quickly. Thernmedian number of days it took to sell a single-family home in September wasrn39.3 days compared to 41.1 days in August and 54.2 days one year earlier. </p

“For the state, at 3.7 months ofrnsupply, unsold inventory is still less than half what it would be in a normalrnmarket,” said C.A.R. Vice President and Chief Economist LesliernAppleton-Young. “As a result of the constrained supply at the moderaternand lower end of the market, sales of homes priced under $200,000 droppedrnnearly 28 percent, and homes priced $200,000-$300,000 fell more than 15 percentrnin September. By contrast, in the upper price range, where inventoryrnisn’t as much of an issue, sales of homes priced $400,000-$500,000 rose morernthan 14 percent, and those priced above $500,000 increased more than 15rnpercent.”</p

</p

</p

Good news for many Californiarnhomeowners, hundreds of thousands of whom have been underwater on theirrnmortgages, prices are increasing. Thernstatewide median price of an existing SFR was $345,000 in September compared torn$343,820 in August. The September numberrnwas 19.5 percent above the median price of $288,700 in September 2011. This was the seventh consecutive month thatrnmedian prices increased both year-over-year and month-over month and was thernhighest since August 2008 when the median price was $352,730</p

The median price for arncondo/townhome in September was $264,880 compared to $258,700 in August andrn$221,440 in September 2011. These arernincreases of 2.4 percent and 19.6 percent respectively.</p

These are, however median figuresrnfor the state and there was tremendous variability by region. C.A.R. President LeFrancis Arnold said, “Salesrnin the inland and coastal markets continue to move in differentrndirections. Low inventory – especially in distressed areas – is dampeningrnsales activity. In many of these areas, there is a one- to two-month supply ofrnREO homes on the market.</p

The Inland Empire and the CentralrnValley have experienced double-digit sales declines compared with lastrnyear. Meanwhile, sales were higher in San Diego and most Bay Arearncounties, where the economies appear to be growing faster than the rest of thernstate.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment