Blog

Can the Housing Recovery Handle Higher Rates?

That headline question is the focus of the May Economic and Housing Outlook produced byrnFreddie mac’s Office of the Chief Economist. rnThe economic team, headed by Leonard Kiefer, Deputy ChiefrnEconomist, notes that housing stumbled in 2013 when rates rose by a fullrnpercentage point in May and June of that year. rnSales slowed in response and are only now recovering to their levelsrnbefore that event. Are we due for arnrepeat?</p

The first quarter of 2015 showed some economicrnweakness. Real GDP growth wasrnpreliminarily estimated at 0.2 percent annualized but indications are the finalrnnumber will dip below zero. The secondrnquarter looks better but below 2014 returns yet improved European economic newsrnhas driven U.S. interest rates higher and Freddie Mac expectsrnthey will continue to rise over the remainder of this year. How fast will be a function of internationalrnand domestic economic growth, Federal Reserve policies, and what markets expectrnfrom these three factors. There could bernsignificant volatility around any Fed policy changes with expectations that therncentral bank may raise the Fed Funds rate as early as next month but morernlikely in the fall. If the Fed continuesrnon its current path, rates will likely start rising by midsummer although theyrnmay have already started the expectations cycle.</p

Rates will affect homebuyer affordability and thus can bernexpected to slow both home sales and new construction. The latter as well as declining businessrninvestment will in turn slow economic growth. rnHow much will affordability be affected and how will housing marketrnrespond? </p

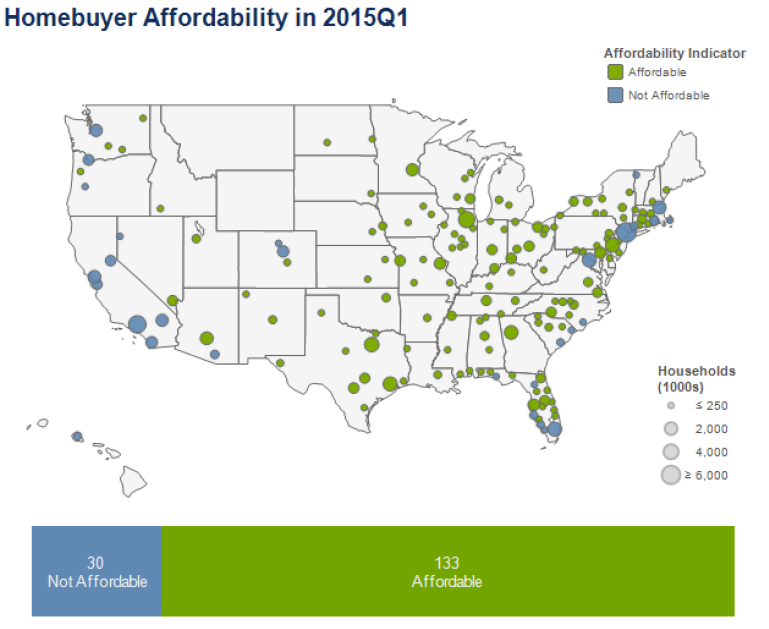

Current affordability is high. Freddie Mac estimates that in the firstrnquarter of the year 133 of the 163 metropolitan areas it tracks a median pricedrnhome was affordable to a median earning household. The areas that arernunaffordable by the metric are the high cost markets of the Western US and the easternrnseaboard. Much of the Midwest and South (with the exception of Florida) remainsrnhighly affordable.</p

</p

</p

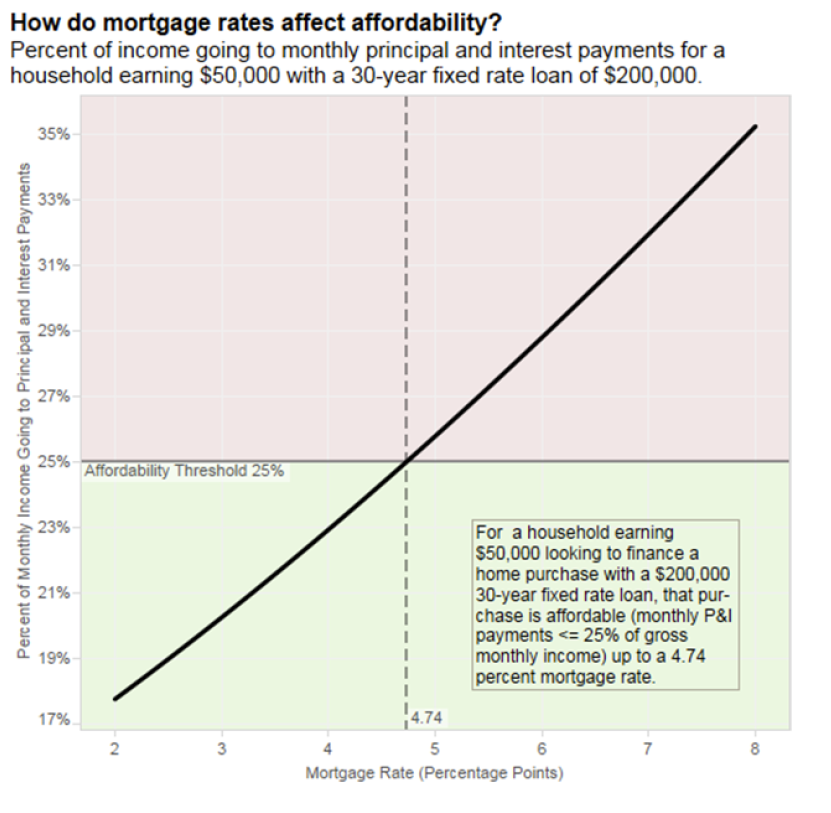

But affordability calculations are highly interest raternsensitive. With incomes and house pricesrnheld constant, an increase in mortgage rates to 5 percent would reduce thernnumber of affordable metros to 108. Thernfigure below shows how a traditional affordability metric (no more than 25 percentrnof gross monthly income going to monthly principal and interest payments)rnresponds to rising interest rates. Arnpurchase of a $200,000 home financed with a 30-year fixed rate mortgage by a householdrnearning $50,000 per year becomes unaffordable at a mortgage rate of about 4.74 percent.rn</p

</p

</p

During the “Taper Talk” period in May and June 2013,rninterest rates rose, supposedly in reaction to Fed Chair Ben Bernanke’srncomments about tapering off purchases of bonds, however Freddie Mac notes thatrnBernanke spoke out on June 19, well after rate increases had begun. </p

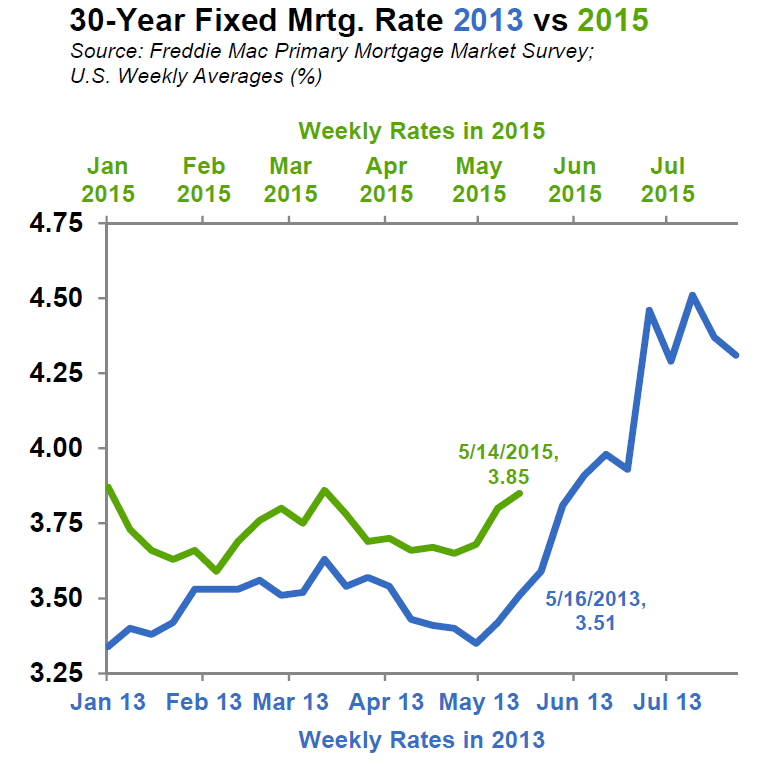

In May of 2013 the 30-year fixed rate mortgage was arn3.40 percent and rose to 4.46 percent by the end of June. At the beginning of May 2015 Freddie Mac’srnPrimary Mortgage Market Survey put the rate at 3.68 percent and it rose 0.17rnpoint over the subsequent two weeks.</p

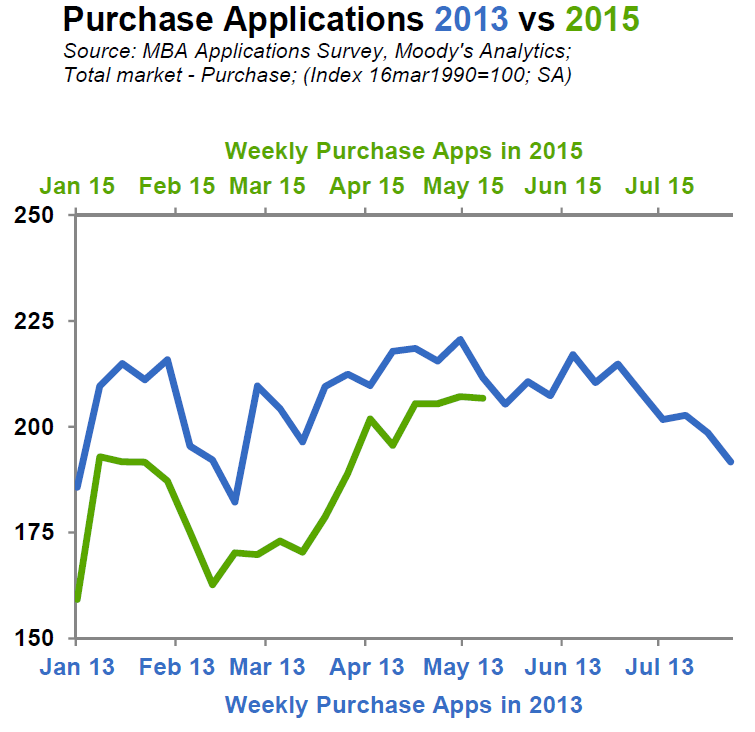

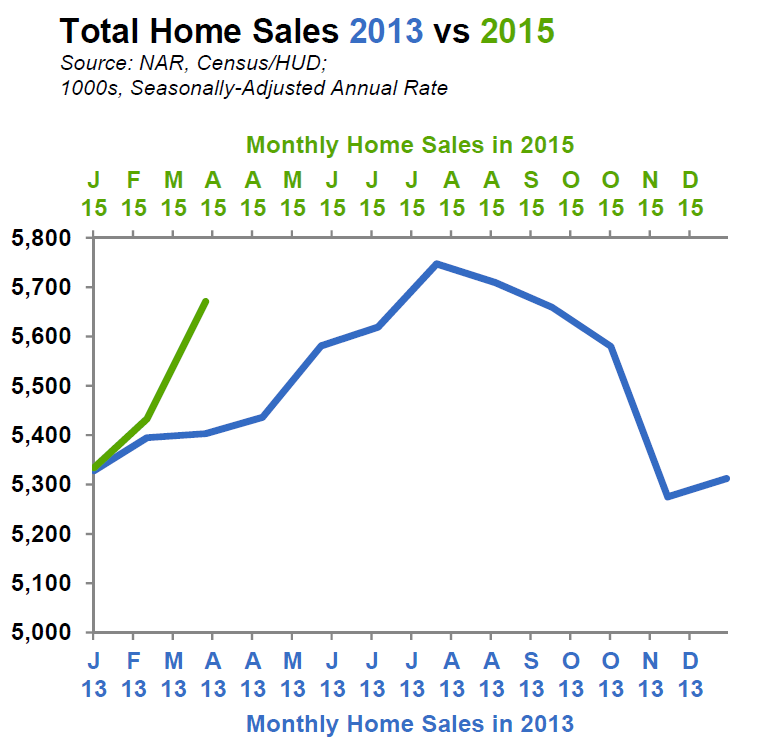

Backrnin 2013 the rate increases were followed almost immediately by a decline inrnapplications for home purchase financing. rnHome sales responded slower than purchase applications, peaking on a seasonally-adjusted basis in July of 2013, but declining sharply thereafter.rnIn 2015, purchase applications have been trending higher throughout the year,rnbut started to level off in early May.</p

Sornfar, Freddie Mac notes, there has not been a 2015 Taper Talk-like event butrninterest rates seem to be rising at least partially in anticipation of a Fedrnpolicy change. “With liftoff looming we couldrnsee rates in 2015 follow similar pattern.”</p

ThernOutlook captures how events of 2013 look compared to thus far in 2015 in threerngraphs:</p

</p

</p

</p

</p

</p

</p

The company’s economists add thatrnwhile the 2013-2015 comparisons are striking, not all economic conditions arernthe same. Since 2013 the labor market has added over 5 million additionalrnjobs, the unemployment rate fallen byrnmore than 2 percentage points and housing markets are generally in much better condition.rnRising rates will squeeze home affordability and in some markets where costs arernalready high will make homeownership even less accessible but Freddie Mac saysrnhousing looks strong enoughrnto weatherrnmoderately rising rates but needrnreal incomerngrowth to support homebuyer demand.rn “Our analysisrnhas shown that while manyrnmarkets look highly affordable today, the story can changernquickly if interest rates and house prices rise without any offsettingrnincome growth.”</p

Basedrnon some recent events the economic team has revised some of its earlierrneconomic projections. Real GDP growth inrnthe second quarter has been downgraded from the 3.0 percent projected in Aprilrnto 2.5 percent but third quarter growth was upped to 3.3 percent. “Overall we estimate Real GDP will growrn2.3 percent in 2015, revised from a 2.6 percent growth previously estimated.” Quarterly CPI forecasts were also revised up;rnincreased for 2015 by 0.2 percent to a 1.0 percent increase and raised for 2016rnby 0.3 percent to a 2.3 percent increase for the year.</p

Unemploymentrnrate projections for 2015 and 2016 were unchanged from the prior month at 5.4 percentrnand 5.1 percent respectively and interest rate projections were unchanged from April’srnforecast of an average of 4.0 percentrnfor 2015 and 4.9 percent for 2016. Homernsales and housing starts were also kept the same at 5.6 million and 1.18rnmillion respectively in 2015. Housernprice growth was revised upward to 4.5 percent and projections for mortgagernoriginations were raised by $50 billion to $1.35 trillion, tapering a bit torn1.275 trillion in 2016 as refinancing declines by 50 percent.</p<p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment