Blog

Case-Shiller: Home Price Double-Dip Materializing

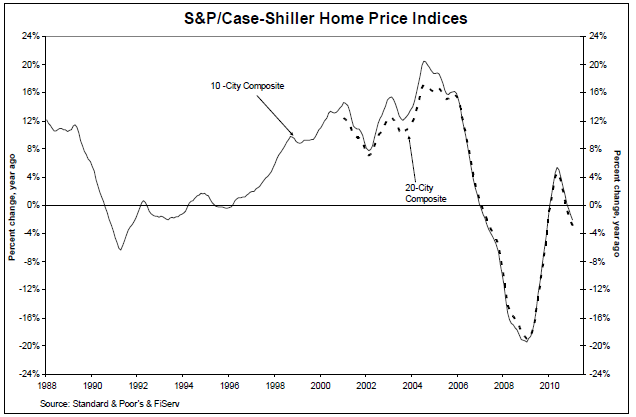

The January S&P/Case Shiller Home Price Indices, releasedrnby Standard & Poor’s this morning, show further deceleration in the growthrnrates of home prices in most of the cities in the survey. </p

The indices, which are billed by S&P asrnthe leading measure of U.S. home prices, are constructed to track the pricernpath of typical single-family homes in a number of metropolitan statisticalrnareas (MSAs). The study uses matchedrnprice pairs of individual houses to construct a 20-City Composite Index and arn10-City Composite Index which are updated monthly. The indices have a base value of 100 which was set inrnJanuary 2000. Thus a current index valuernof 150 indicates there has been a 50% appreciation since that date for arntypical home in the subject market. </p

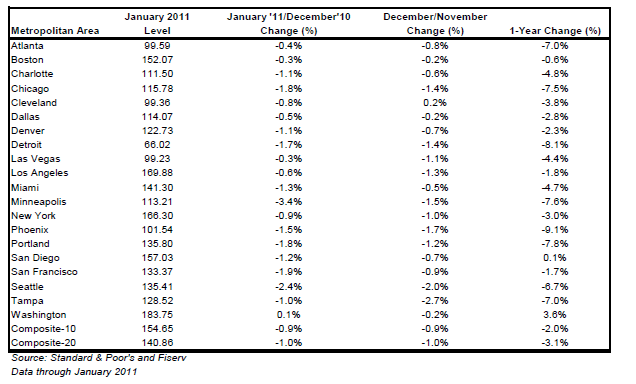

The 10-CityrnComposite was down 2.0 percent to 154.65 and the 20-City was 3.1 percent belowrnthe previous year’s level at 140.86. Both composites were down about 1 percentrnfrom December figures. </p

</p

</p

“Keeping with the trends set in late 2010, January brings us weakening home prices with no real hope in sight for the near future” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “With this month’s data, we find the same 11 MSAs posting new recent index lows. The 10-City and 20-City Composites continue to decline month-over-month and have posted monthly declines for six consecutive months now.”</p

Thirteen of the 20 MSAs and both of the Composites were belowrntheir January 2010 levels. Only two of thern20 cities included in the indices, Washington, DC and San Diego, Californiarnimproved year over year; Washington was up 3.6 percent and San Diego inched uprn0.1 percent; these same two MSAs were also the only ones to have positivernannual rates all year. Each of the otherrn18 cities either moved back into negative territory or never left since thernstart of the current housing downturn.</p

Many of the MSAs appear to be experiencing the double-dip inrnhousing prices that has been predicted for some time. Eleven of the cities posted new lows inrnrelationship to their 2006-2007 peak levels. rnAll of these cities, Atlanta, Charlotte, Chicago, Detroit, Las Vegas,rnMiami, New York, Phoenix, Portland (OR), Seattle, and Tampa, had posted newrnlows in December as well. The nation asrna whole has slipped back to the price levels that existed in 2003.</p

</p

</p

The Phoenix MSA had the largest year-over-year decrease atrn9.1 percent, returning that city to an index of 101.54, near a base year level. Detroit with an index number of 66.02, thernlowest of the 20 cities, was down 8.1 percent year-over-year followed byrnPortland, Oregon down 7.8 percent; Minneapolis,-7.6 percent; and Chicago, -7.5 percent.rn </p

David M. Blitzer,rnChairman of the Index Committee at Standard & Poor’s said “The datarnconfirm what we have seen with recent housing starts and sales reports. The housing market recession is not yet over,rnand none of the statistics are indicating nay form of sustained recovery. At most, we have seen all statistics bouncernalong their troughs; at worst, the feared double-dip recession may be materializing.”</p

S&P/Case-Shiller reports data on both a seasonallyrnadjusted and non-adjusted basis but recommends using the latter as being a morernreliable indicator. We have used onlyrnthe non-adjusted data in compiling this summary.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment