Blog

Case-Shiller Survey: Home Prices Likely Heading Lower

The country is on the verge of arndouble-dip in housing prices according to new survey from MacroMarketsrnLLC. The financial technology companyrnasked a panel of 111 economists, real estate experts, investment and marketrnstrategists to project the path of housing prices over the next five yearsrnbased on the S&P/Case Shiller U.S. National Home Price Index.</p

Robert Shiller, MacroMarket’srncofounder and chief economist said panelists’ sentiments regarding the housingrnmarket continue to deteriorate. <b"Now they are expecting only a weak recovery and even that is notrnuntil 2013." Shiller blamed thernoutlook on market fundamentals; high unemployment, high inventory, andrncontinuing foreclosures and tight credit. </p

Terry Loebs, MacroMarkets managingrndirector said that overall, the March expectations data are the mostrnpessimistic collected to date. After thernweak performance in the fourth quarter of 2010, home prices nationally are onlyrn1 percent above what would be a new post-housing crash low. “Many more experts are now projecting arndouble-dip after witnessing the double-dead cat bounce that came in the wake ofrnexpired government stimulus programs,” Loebs said.</p

</p

</p

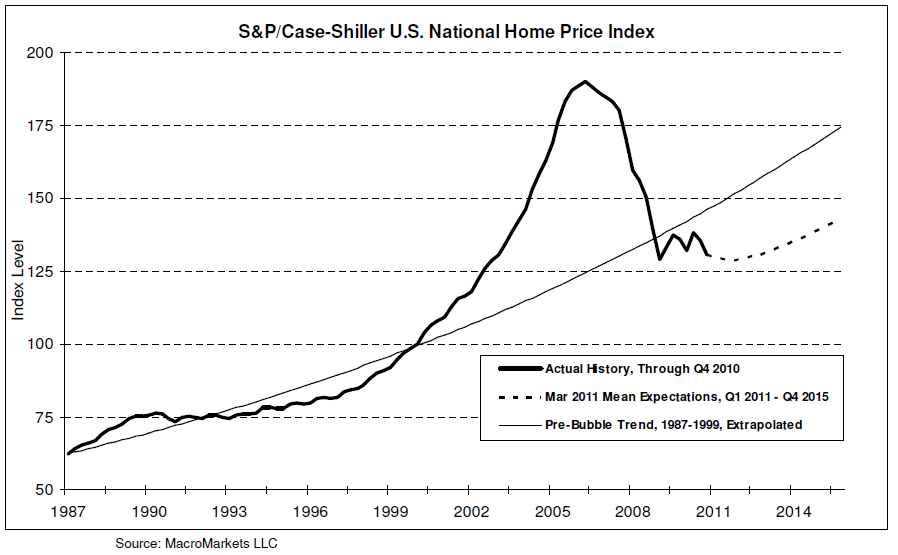

The Case-Shiller Index peaked atrnaround 180 in late 2005 before dropping to the mid 120s in the first quarter ofrn2009. Since then it has risen slightly twicernand dropped again each time. It testedrnthe 2009 low once in 2010 and is now below even that mark. Loebs said that in December only 15 percentrnof the panelists were predicting a new low but now 50 percent see a double diprnthis year and “not a single panelist expects national home prices tornrecover to the pre-bubble trend in the coming five years.”</p

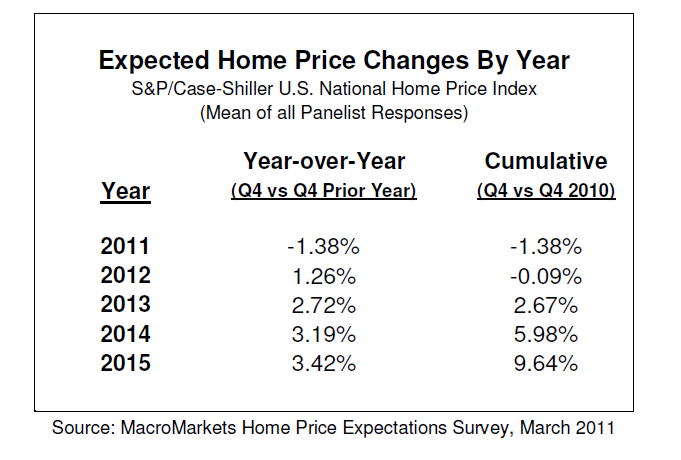

The consensus of the panel is thatrnprices by the fourth quarter of 2011 will have declined 1.38 percentrnyear-over-year. By the same point inrn2012 there will be a slight 1.26 improvement, but then the panel sees thingsrnpicking up with a 2.72 percent increase in 2013, 3.15 percent in 2014 and 3.42rnpercent in 2015. The average expectationrnfor a cumulative increase over the next five years is projected at 9.64rnpercent.</p

</p

</p

The panelists displayed little realrnconsensus. A handful sees an incrediblyrnbleak future for housing. Eight project decliningrnprices throughout the five year period with a cumulative negative change overrnfive years in the high teens. Others seerna return to real price growth with 5, 7, even 10 percent single year appreciationrnin the out years. Shiller said, “Therndifferences of opinion are interesting but unsurprising in light of continuingrnand unprecedented fallout from the historic bubble.” </prn

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment