Blog

Clock Ticks for Fannie and Freddie as FHFA Designs New Secondary Market Platform

In February, the Federal Housing Finance Agency (FHFA)rnissued a strategic plan for its ongoing conservatorship of Freddie Mac andrnFannie Mae (the GSEs). The plan hadrnthree primary goals:</p<ol

Yesterday FHFA published a white paper proposing anrninfrastructure that attempts to connect these goals. To maintainrnthe efficient flow of mortgage credit, the existingrnantiquated and inflexible GSE infrastructuresrnmust be upgraded. Arntransition to a future securitization framework would require a morernflexible infrastructure thanrnis currently available to accommodaternfuture policy decisions. Given that the expendituresrnfor the upgrades are necessary, it makesrnsense to direct them towardrnthe development of a common flexiblerninfrastructure to accommodate various structures and policy goals. </p

FHFA said it believes that work can begin on these elementsrneven while the structure of housing finance and government’s role in it are debatedrnthrough an incremental approach, starting with the very basic elements andrnbuilding with feedback from the industry and regulators and decisions fromrnpolicymakers.</p

At present approximately 75 percent of mortgagernsecuritizations is done through the GSEs and 25 percent through GinniernMae. Two key goals of the proposal arernto preserve liquidity while developing a framework that will include thernreentry of private capital into risk taking.</p

Somerncore functionalities of a securitization infrastructure can be standardized andrnserve a utility function; issuance, master servicing, bond administration, collateralrnmanagement, and data integration and these are where FHFA suggests focusing itsrnefforts. The securitization platformrnmust be flexible enough to adapt to the evolving standards and requirements ofrnstakeholders including originators/lenders, securitizers/issuers, trustees andrnbond administrators, investors, and regulators. rn</p

ThernGSEs currently perform many securitization functions including issuance, trustee, guarantee, credit underwriting and pricing, master servicing, and credit loss management. Their functions are essentially similar andrnthe GSEs are working to align them so markets don’t have to manage two distinctrnprocesses. Additionally, each Enterprise continues to make separaterninvestments in maintaining its set of guides andrncontractual framework, increasing therncost to taxpayers. </p

</p

</p

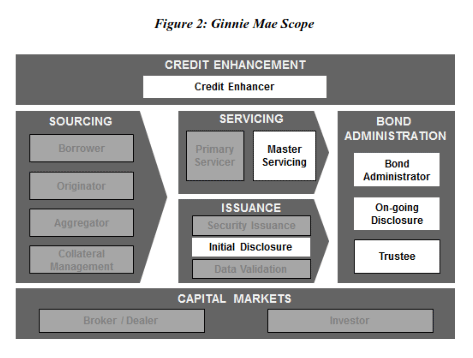

GinniernMae administers the mortgage-backed securities program for FHA, VA, and thernDepartment of Agriculture (USDA) where the pooled loans are issued asrnsecurities by the issuers. The standardsrnthat govern the origination and default servicing of loans in the Ginnie Maernpools are established by the sponsoring agencies which also bear the creditrnrisk. The issuers are responsible forrnservicing and Ginnie Mae mainly has exposure to servicer counterparty riskrnwhile the GSEs also have exposure to mortgage insurers and borrowers.</p

Thernsecuritization platform in the Ginnie Mae model has the same elements as thosernof the GSEs, but Ginnie Mae is responsible for few of them, outsourcing all butrnpolicy-making and contract and non-contract resource and relationshiprnmanagement functions to third parties.</p

</p

</p

ThernPrivate Label Securities (PLS) market relies on private investment capital for supportrnand private parties perform all of the functions shown above. Credit risk is either retained by thernaggregator or investor, guaranteed by a third party or re-packaged into newrnsecuritization structures. This marketrnrelies on customizing its own rules rather than following the GSE model. Since 2008 investors have largely avoidedrnmortgage credit risk but there signs some capital is returning although not atrnsignificant scale.</p

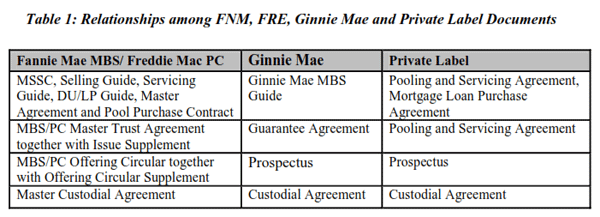

Eachrnof the three securitization platforms uses its own contracts and guidelines andrnwhile those used by the GSEs and Ginnie Mae result in fairly uniform andrnstandard outcomes, many versions of PrivaternLabel PSAs have produced divergentrnbusiness practices that led to ambiguity in interpretation andrnplaced different marketrnparticipants (i.e., sellers,rnborrowers, servicers, trustees,rnsenior investors and subordinaterninvestors) at direct odds with each other. rn</p

</p

</p

Thernframework proposed by FHFA contains certain key principles it views as criticalrnto the success of a functional secondary mortgage market; promotingrnliquidity, attracting private capital, benefiting borrowers and operatingrnflexibly and efficiently, while minimizing marketrndisruption during transition. This frameworkrnfocuses on functions repeated across the industry where greater standardization would benefit the overall market while not limiting market choices or valuable independent innovations.</p

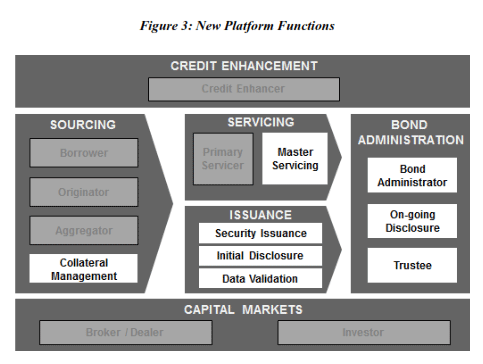

The functions highlighted in Figure 3 could be accommodatedrnvia the securitization platformrnthrough standardized processing, and possibly offered to the marketrnas a form of utility.</p

</p

</p

Functions are defined as:</p<ul class="unIndentedList"<liCollateral management, specifically centralized note tracking.</li<liMaster servicing within the overall servicing relatedrnfunctions, including asset and cash management,rnstandardized interfaces to servicers,rnguarantors, and aggregators,rnservicing metrics, data validationrnand reporting.</li<liIssuance, including eligibility rules, data quality standards,rnpool delivery, settlementrnand disclosure.</li<liData validation (servicing andrnissuance) with the securitization platform storing loan level,rnpool level, and bond level data. </li<liBond administration, includingrnstandardized investor and third party disclosures, bond processing, principalrnand interest distributions,rnsecurities monitoring, portfoliornreporting and role of Trustee.</li</ul

In addition to these key functions, greater consistency isrnnecessary to a more stable, liquid, and efficient market so another proposed functionrnis the creation of standardized documents including a new PSA incorporating a robustrnselling and servicing guide.</p

FHFA proposesrnthat a new platform would include credit risk distribution designed to be flexible tornaccommodate multiple models of housing finance so that policy makers can ultimatelyrnchose those that could be less dependent on government assumption of risk. It could also support the distribution of credit risk tornthe private sector through variousrncredit risk sharing arrangements and support credit structuredrnsecurities where various classes of securities holders agree to receive cashrnflows based on contractual distribution rules. </p

The envisioned platform would bundle mortgages into anrnarray of securities structuresrnand provide all the operationalrnsupport to process and track the payments from borrowers through to security creation to payoff. </p

The platform must maintain existing liquidity, while enablingrnthe entry and participation of private capital. rnThus is should be able to support the current TBA market and securities across a range of interestrnrates and should include the highrnlevel of automation. necessary tornprocess the current volume ofrnindustry issuance – morernthan $100 billion per month.</p

Privately guaranteedrnsecurities could bernsimilar to the guarantee provided byrnthe GSEs today but different in the future and the platform must to be flexible enough to supportrnall potential options while bringingrntransparency to investors and facilitatingrnthe return of private capital by supporting various options for credit investors to participate in the market.</p

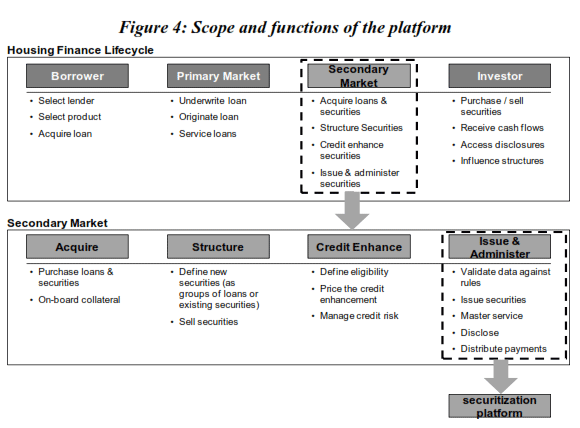

The housing finance lifecycle, shown in Figure 4 below, framesrnthe scope and functions that a platform wouldrnserve, and how it would benefit the industry and the housing finance system:</p

</p

</p

It is at the final phase that the automated securitizationrnplatform could serve both the GSEs and the wider securitization market ofrnthe future by providing a discrete set of services at the time of issuance and on an ongoing (typically monthly)rnbasis in support of principalrnand interest payments torninvestors. </p

The initial core services proposed by the paper are intentionallyrnselected as foundational due to their place within thernhousing finance lifecycle. The initialrncore services of the proposed platform havernthe following characteristics:</p<ul class="unIndentedList"<liThey lend themselves tornstraight-through, highly automated processing of large volumes with limited manualrnintervention;</li<liThey accommodate setting andrnadjusting market standards and assist in market and data transparency.</li<liThey are rules driven and canrnreadily adapt to changes in standards and policy.</li<liThey are flexible to service manyrnindustry models.</li<liThey can enable the private sectorrnto continue to drive security selection, loan pooling and underwriting, andrnother non-GSE functions.</li</ul

The platform scope would include the issuance ofrnsecurities as requested by a user, the monthlyrnmasterrnservicing of loans while in the securities, the payment of monies to securities investors, and the tracking andrndisclosure of securities balances,rnpayments and underlying loan performancerndata. The data validation service would verify that the request conforms to standards and the format forrnloans and securities is correct andrncomplete. </p

The masterrnservicing functions performed by thernplatform include asset and cash management activitiesrnincluding collecting and processing primaryrnservicer loan activity and verifying that principal and interest paymentsrnare correct for each reportingrncycle.</p

The platform could monitor and direct document custody, and monitorrnprimary servicer performance for adherence to standards as well as allrnotherrncompliance directives requestedrnby the trustee or other governing documents. </p

Bond administration would be responsible forrncalculating investor payment factorsrnand making data available to therndisclosure function for ongoing investor reporting for each payment cycle. rnBond administration would support both first level securitizationsrnand second level re-securitizations. Bond administrationrnwould also ensure payments to investors and other parties are managed in a timely manner.</p

Disclosures describe a security and underlying loans orrnpools published to the marketplace before and when the securityrnsettles describing the securities’ fundamental characteristics and detailedrninformation on the pool and security structure. rnOn-going disclosure occurs monthly,rnor when relevant changes occur. Disclosurerndocuments proposed by FHFA wouldrninclude the prospectus supplementsrnand supplemental oversight documents. Disclosure information would be published by the platform on the Internet and possibly in other forms.</p

There a handful of other, more specific design principles that will guide how thernplatform is designed and built. rn</p<ul class="unIndentedList"<liOpen architecture: standard external interfaces would bernestablished and the platform would leverage existing data standards</li<liFunctional modularity – internalrncomponents would communicate via standard interfaces to ensure thatrnchanges can be accomplished with minimal impact.</li<liScalability – Integration architecturernwould be based on standardrntechnologies with proven scale in financial services and multiplernindustries. </li<liData transparency – Architecturernwould provide data traceabilityrnand accessibility via common infrastructurernand standards.</li</ul

Under previous FHFA guidance, the Enterprises are transitioning theirrnsingle-family loan deliveryrndata formats to one that leverages the industry-recognized standard. The platformrnwould expand upon this model, allowing the primary market to deliverrnbundles of mortgages into any of anrnarray of securities structures,rnincluding those that support PLS and other innovative creditrntransfer facilities. It wouldrnalso provide operational support tornprocess and track the payments from borrowers through to the investors, by leveraging the Uniform MortgagernServicing Dataset Initiative torndefine a standard servicing dictionary and data exchange.</p

This, in conjunction with the proposed PSA framework,rncould improve service to borrowers,rnreduce financial risk to servicers,rnand provide flexibility and data forrnguarantors to better managernnon-performing loans. The Uniform Mortgage Servicing Dataset Initiative willrnmake standard servicing interactionsrn(such as servicing transfers, loan removals from securities, etc.)rnconsistent and transparent acrossrnthe industry.</p

The proposed integrated infrastructurerncannot function without the appropriate legalrnagreements, rules and allocations of responsibilities, including a framework for an effective contractualrnPSA.</p

The key elementsrnfor private capital to return to the housing finance market hinge on clearrnrules and standards about: 1) thernintegrity of mortgage originations in termsrnof data and seller responsibilities; 2) thernadequacy of servicing; 3) servicer compensation; and 4) disclosures to investors. In addition,rnthere are examples of ongoing work atrnthe GSEs that can be incorporated into the model PSA: 1) alignment and enhancement of the existing policies, practices, and legal documents of the GSEs; and 2) standardizedrnservicing, disclosure and other practices of the GSEs.</p

The proposed PSA framework would leverage the existing structure. The frameworkrnwould include a short PSA containingrnlender/seller specific requirements and variances, general trust provisions and incorporate robust program guides which would set out the requirementsrnfor underwriting, disclosure, servicing and loan delivery and setting forth thernminimumrnstandards for eligibility to use the platform, specifying dutiesrnand responsibilities, reflect a compilationrnof “best practices” and applicable regulatory requirementsrnfor servicing and the other transactionrnparticipants, and address certainrnshortcomings of the Private Label PSA.rn</p

</p

</p

The design of the common securitization platform would support a government guarantee whilernnot assuming that the future housing market will incorporate one and will havernthe flexibility to accept different levels of credit standards and mortgagernproducts. The structure could help enforcernQualified Mortgage (QM)/Qualified Residential Mortgagern(QRM) guidelines, screening for QM/QRM eligibility, and identifying anyrncorresponding risk retention requirements.</p

Here are a few of the questions about the proposal for whichrnthe FHFA is soliciting comments.</p<ol

Directions forrnsubmitting comments which are due December 2, 2012 can be found here.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment