Blog

Completed Foreclosures Down 23% as Short Sales Gain Momentum

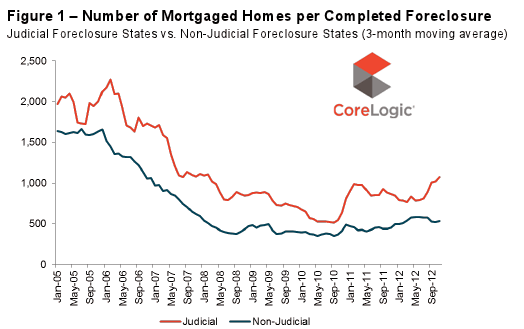

Completed mortgage foreclosures haverndeclined 23 percent in the last year according to information released thisrnmorning by CoreLogic. There were 55,000rncompleted foreclosures nationwide in November compared to 72,000 in Novemberrn2011. The November total is 6 percentrnbelow the 59,000 completed foreclosures in October.</p

Completed foreclosures are a measure ofrnthe number of homes taken by lenders; since the financial crisis began in 2008rnthere have been over 4.0 million. Evenrnwith the recent improvements in the rate of these transactions, CoreLogicrnpoints out that foreclosures are still running at better than twice the rate ofrnmore normal times. Between 2000 and 2006rncompleted foreclosures averaged 21,000 per month.</p

</p

</p

There were approximately 1.2 million homesrnin some stage of foreclosure (the foreclosure inventory) in November, about 3.0rnpercent of all homes with a mortgage. InrnNovember 2011 there were 1.5 million homes or3.5 percent of all mortgaged homesrnin the inventory. This is a decrease ofrn18 percent year-over-year.</p

</p

</p

Mark Fleming, chief economist forrnCoreLogic said, “The pace of completed foreclosures has significantlyrnimproved over a year ago as short sales gain popularity as a dispositionrnmethod. Additionally, the inventory of foreclosed properties continues torndecline while the housing market demonstrates an ongoing ability to absorb therndistressed sales that result from completed foreclosures.” </p

The five states with the highestrnnumber of completed foreclosures for the 12 months ending in November 2012rnwere: California (102,000), Florida (94,000), Michigan (75,000), Texas (58,000)rnand Georgia (52,000).These five states account for 50 percent of all completedrnforeclosures nationally.</p

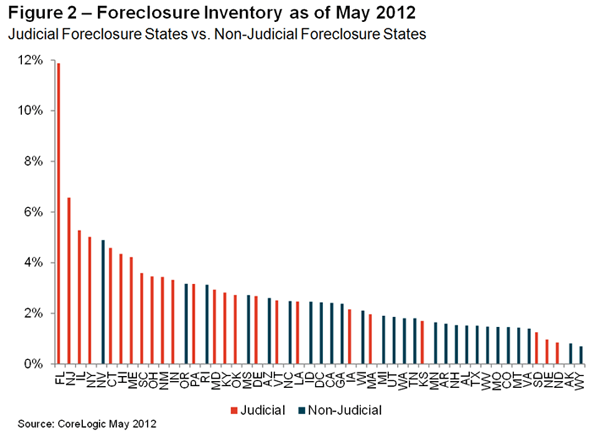

The five states with the highestrnforeclosure inventory as a percentage of all mortgaged homes were: Floridarn(10.4 percent), New Jersey (7.3 percent), New York (5.1 percent), Nevada (4.7rnpercent) and Illinois (4.7 percent).

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment