Blog

Completed Foreclosures Fall 25 Percent in October

There was a dramatic drop in the raternof completed foreclosures in October according to CoreLogic’s National ForeclosurernReport issued on Monday; however this good news should probably be approachedrnwith caution. The total of 58,000 foreclosuresrncompleted during the month was down 25 percent from the 77,000 completed inrnSeptember. September’s number howeverrnwas originally reported at 57,000 and revised upward in the current ForeclosurernReport release. The October total isrnalso 17 percent lower than in October 2011 when there were 70,000 completedrnforeclosures. . </p

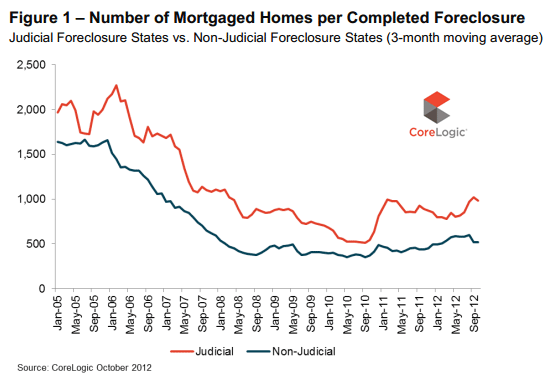

To put all of the numbers inrnperspective, CoreLogic notes that the average number of foreclosures reportedrnin the pre-housing crash years 2000 to 2006 was 21,000. Sincernthe financial crisis began in September 2008, there have been approximately 3.9rnmillion completed foreclosures across the country.</p

</p

</p

The national foreclosure inventory – the share of all mortgaged homesrnthat are in some stage of foreclosure – also dropped on both an annual and arnmonthly basis. There were 1.3 millionrnhomes in the inventory in October, a rate of 3.2 percent, compared to 1.5rnmillion or 3.6 percent one year earlier and down 1.3 percent from thernapproximately 1.4 million homes reported in September. </p

“A lower foreclosure inventory is a good indicator of improving housingrnmarkets,” said Anand Nallathambi, president and CEO of CoreLogic. “The downward trend in foreclosure inventoriesrnover the past year is yet another signal that a recovery in housing is gainingrntraction.”</p

</p

</p

“As a result of completed foreclosures and alternativerndisposition methods, the foreclosure inventory has declined by 9 percentrnyear-to-date. This is good news for housing markets as we look forward to 2013,” saidrnMark Fleming, chief economist for CoreLogic.</p

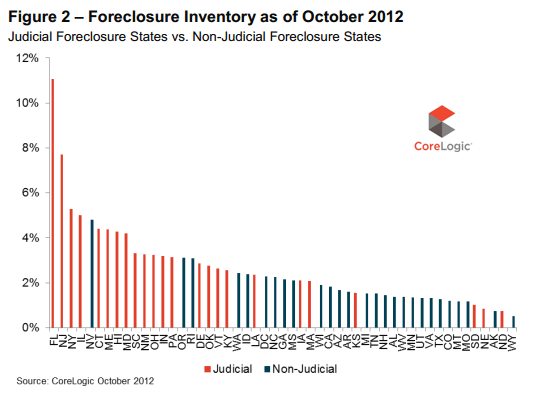

Five states, California, Florida, Michigan, Texas, andrnGeorgia accounted for 49 percent of all completed foreclosures in therncountry. The highest foreclosurerninventories were in Florida (11.1 percent), NewrnJersey (7.7 percent), New York (5.3 percent), Illinois (5.0 percent) and Nevadarn(4.8 percent). All of the high inventoryrnstates except Nevada use a judicial foreclosure process.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment