Blog

Confidence in Housing Market Grows, Despite Fiscal Cliff Turmoil

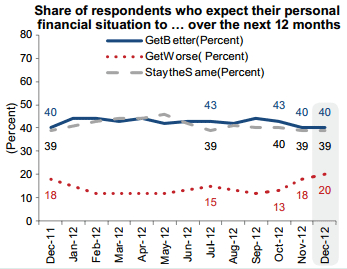

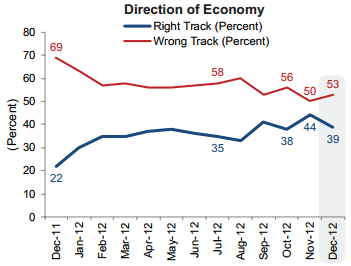

Fannie Mae’s Chief Economist pointed tornthe turmoil over the fiscal cliff and debt ceiling for a sharp drop in consumerrnconfidence in December. Fannie Mae’srnNational Housing Survey recorded a 5 point month-over-month decline in thernpercentage of respondents who think the nation’s economy is “on the right track”rnto 44 percent while “wrong track” responses rose from 50 to 53 percent.</p

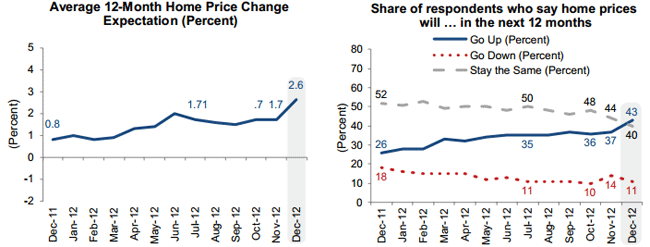

At the same time confidence in thernhousing sector grew with consumers showing continued positive attitudes towardrnhome prices, rents, and mortgage rates. rnThe percentage of respondents who expect home prices to increase overrnthe next 12 months rose from 37 to 43 percent, the highest share in the survey’srn2.5 year history. The percentagernexpecting price decreases fell from 44 percent in November to 40 percent inrnDecember. Expectations for pricernincreases averaged 2.6 percent compared to 1.7 percent in November, anotherrnhistoric high for the survey. </p

</p

</p

Twenty-one percent of respondentsrnsay it is a good time to sell, a 2 percentage point decrease from last month’srnrecord high, but a 10 percentage point increase year over year. Seventy-one percent view it as a good time tornbuy, down one point from November and the share of respondents who said theyrnwould buy if they were going to move decreased slightly to 66 percent. </p

</p

</p

Doug Duncan, senior vice presidentrnand chief economist of Fannie Mae said, “This view is consistent with FanniernMae’s expectation that home prices will rise going forward on a national basis.rnCombined with consumers’ growing mortgage rate and rental price increasernexpectations, the positive home price outlook could incentivize those waitingrnon the sidelines of the housing market to buy a home sooner rather than laterrnand thus support continued housing acceleration. Despite continued strengthening in thernhousing market, consumers’ concerns over the fiscal cliff and debt ceiling haverncaused considerable volatility in their perceptions of the larger economy. Thisrnuncertainty seems to be prompting a growing share of consumers to expect theirrnpersonal finances to worsen and may contribute to weaker near-term economicrngrowth.” </p

Thernpercentage who think mortgage rates will go up continued to rise, increasing byrn2 percentage points to 43 percent, the highest level since August 2011. </p

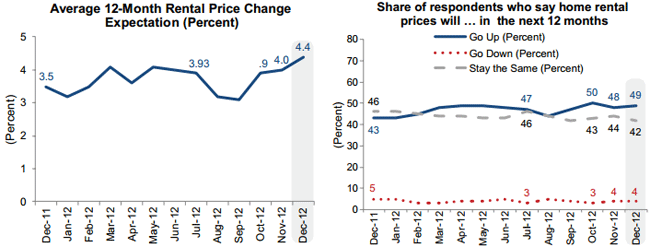

Almost half (49 percent) ofrnrespondents expect rental prices to increase over the next 12 months with thernaverage increase expected to be 4.4 percent compared to 42 percent inrnNovember. The percentage who thinksrnmortgage rates will go up continued to rise, increasing by 2 percentage pointsrnto 43 percent, the highest level since August 2011. </p

</p

</p

The percentage of consumers whornexpect their personal financial situation to get worse over the next 12 monthsrncontinued to rise, reaching 20 percent and the highest level since August 2011.rn Twenty-two percent of respondents sayrntheir household income is significantly higher than it was 12 months ago, arnslight increase over last month and a 5 percentage point increase overrnSeptember while 37 percent reported significantly higher household expenses inrnthe last year, a 3 percentage point increase over the past month and thernhighest level since December 2011. </p

The Fannie Mae National HousingrnSurvey polls 1,000 respondents by phone each month to assess their attitudesrntoward homeownership, mortgage rates, household finances, the economy, andrnhomeownership distress. Respondentsrninclude renters, mortgaged homeowners, and those who own unencumbered homes.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment