Blog

Construction Industry Optimism at 20-year High

While its ultimate focus is the futurernof the construction equipment business, Wells Fargo’s Equipment Financerndivision has some predictions for residential construction as well. The company’s 2015 Construction Industry Forecast, presents results of a survey itrnhas conducted for the last 19 years of industry executives representing largernand small contractors as well as equipment distributorships and equipment rentalrncompanies. </p

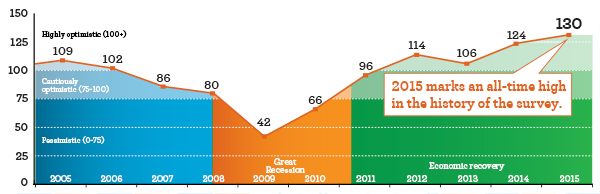

Wells Fargo’s survey attempts to track<bindustry optimism using what it calls the Optimism Quotient (OQ). John Crum, National Sales Manager for thernEquipment Finance Construction Group said that, after tumbling to an all-timernlow of 42 in January 2009, the OQ has climbed steadily, reaching new highs inrnthree of the last four years and landing this year at 130, up six points fromrn2014. </p

</p

</p

Crum said “In the nearly 20 years thatrnwe’ve been tracking the OQ we’ve neverrnseen such widespread optimism about the direction of the industry compared tornthe prior year.” He noted that the 2015rnnumber is particularly significant as the survey was conducted during a periodrnof sharp decline in crude oil prices leading to an assumption that the energyrnsector might negatively impact the survey and dampen enthusiasm about the nearrnfuture. “Yet overwhelmingly the industryrnindicated,” he said, “that the trajectory of the broader construction industryrnis still going in the right direction – up.” </p

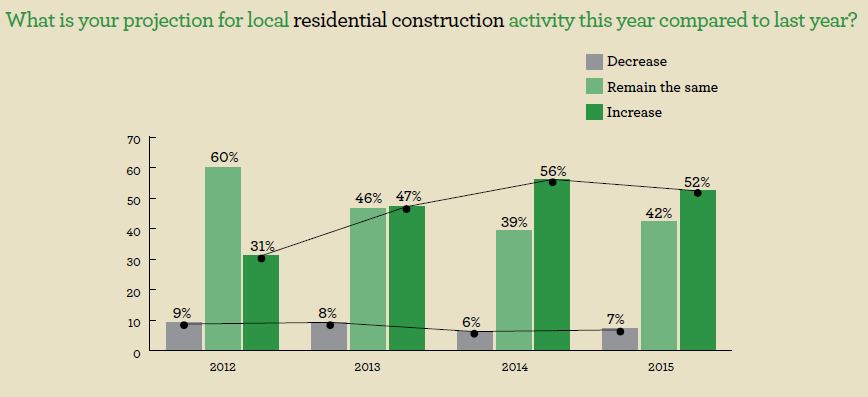

As the OQ has trended up over the lastrnfour years the residential and non-residential construction segments have notrnmoved in lockstep. This year the numberrnof respondents who expect non-residential construction to increase shot up 8rnpoints to 63 percent while residential construction expectations dropped fromrn56 percent expecting an increase in 2014 to 52 percent this year. </p

</p

</p

</p

</p

Few respondents over the last fourrnyears have looked for a decrease in activity in either sector. Responses in that regard have been stable inrnthe mid-single digits.</p

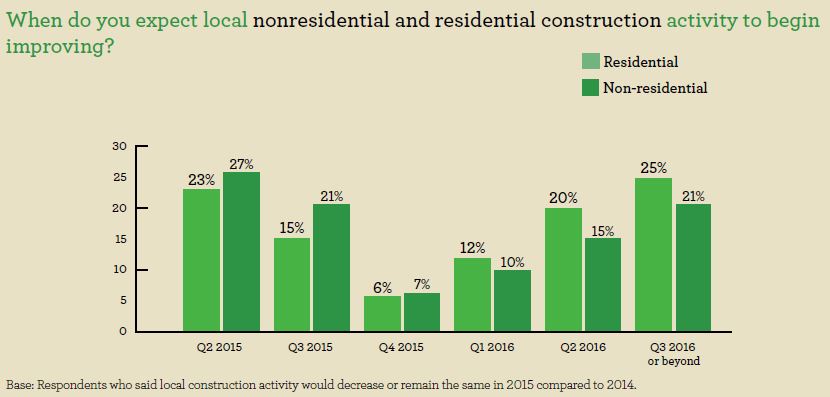

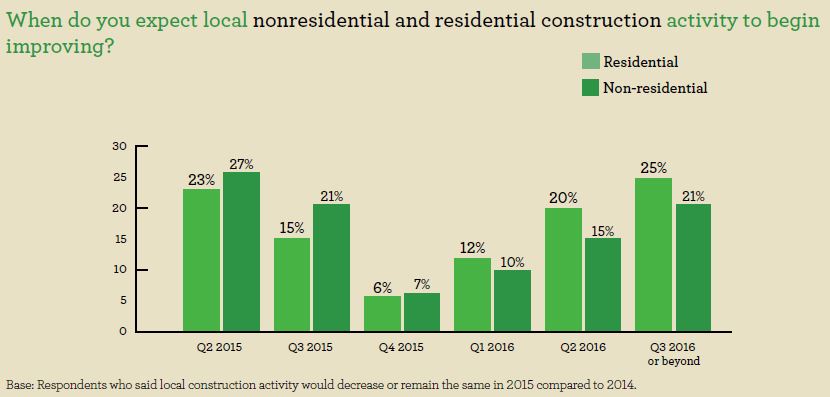

Among those respondents who are notrnlooking for an immediate uptick in either sector 44 percent indicated they didrnexpect to see at least some improvement in the latter part of 2015. However, a quarter of these executives saidrnthat any improvement in residential construction wouldn’t occur until the secondrnhalf of 2016 or later. </p

</p

</p

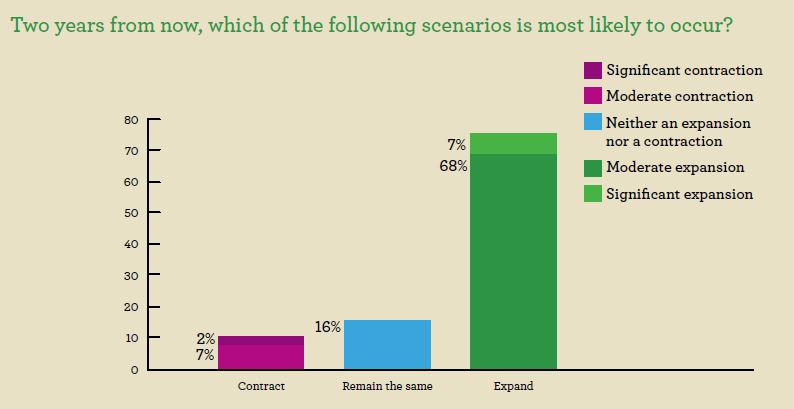

Respondents were also asked about theirrnexpectations for the industry as a whole over the next two years. More than two-thirds of respondents said that a “moderaternexpansion of the U.S. construction industry” would likely occur within the next two years. Another 16% were confident the construction industry would maintain a mostlyrnflat growth trajectory for the next two years. About one in ten said they expectrneither moderate (7%) or significant (2%) contraction in the U.S. construction industry.</p

</p

</p

In her ConstructionrnIndustry Overview accompanying OQ report Anika Khan, Senior Economist,rnWells Fargo Securities said she also expects construction activity tornaccelerate further in 2015 and that single-family construction should improvernas well. This sector, she said, grew atrna solid clip in 2014 with much of that activity occurring in the second half ofrnthe year. Improving employment andrnincome growth should allow this to continue. rn”The largest impediments to a more robust recovery in the housing marketrnhowever,” Khan says, “have been the low level of inventories and first-timernhomebuyers. Still, low mortgage ratesrnand easier credit standards should help boost activity.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment