Blog

Consumer Defaults Down Again in July, Second Mortgages Increase

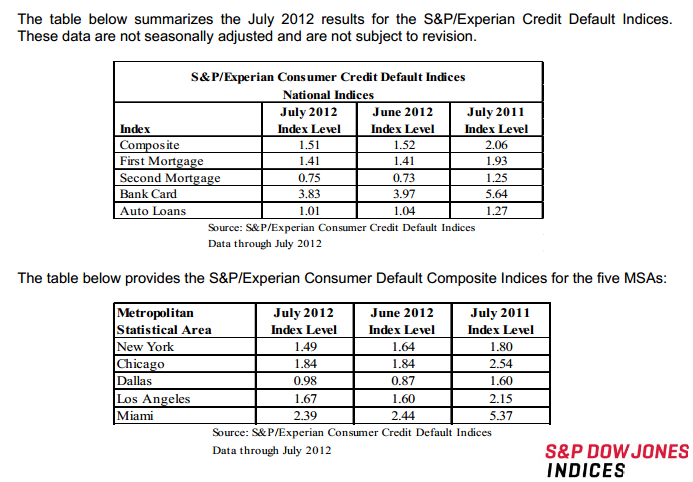

Default rates for most types of consumerrnloans continued to ease during July according to the S&P/Experian ConsumerrnCredit Default Indices released on Tuesday. rnOnly second mortgages increased from June levels and those were up onlyrnmarginally from .73 percent to .75 percent. rnFirst mortgage defaults were unchanged from June at 1.41 percent whichrnis their recent low.</p

The Composite Index, which measuresrnconsumer defaults in four categories, was down one basis point to 1.51rnpercent. In July 2011 the Compositernstood at 2.06 percent. While unchangedrnmonth-over-month, the first mortgage default rate is down significantly fromrn1.93 percent last year and the slight uptick in second mortgage defaults stillrnleft the July 2012 rate 50 basis points lower than the 1.25 percent posted in Julyrn2011.</p

The largest reduction was in bank cardrndefaults which fell from 3.97 percent in June to 3.83 percent in July. The rate one year earlier was 5.64 percent. Auto loans delinquencies also decreased, fromrn1.27 percent in July 2011 to 1.04 in June 2012 to 1.01 in July 2012.</p

“While continuing to show decreasing defaultrnrates, most of the changes in July were small compared to the magnitude ofrndecline we had seen in the first six months of the year,” David Blitzer,rnManaging Director and Chairman of S&P Down Jones Indices IndexrnCommittee. “Consumer default ratesrnshowed small movement from June to July, in most cases the trend continued downrnor flat, as the consumer’s financial condition continues to improve.”</p

Blitzer said that looking at the rate ofrnnew defaults in mortgages or auto loans, it appears that consumers creditrnpositions have recovered from the financial crisis. “However, other data show that previouslyrndefaulted mortgages remain an issue and many consumers still face an overhangrnfrom old debts. Bank card trends arernalso favorable although the experience of the last eight years is more variable.”</p

The S&P/Experian Index focuses onrnfive geographically dispersed cities, New York, Chicago, Dallas, Los Angeles,rnand Miami. The year-over-year rate was down significantly in all five metropolitanrnareas but rose in two from June to July and was unchanged in a third. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment