Blog

Consumer Loan Defaults Hit New Lows while Mortgage Defaults Rise

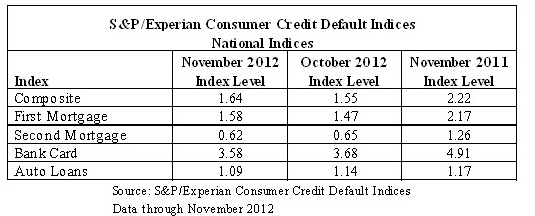

Default rates for first mortgage loansrnincreased in both October and November according to the S&P Dow JonesrnIndices and Experian. The increases drovernthe national default rate up from a post recession low reached in September despiterncontinued improvements in the performance of second mortgage, credit card, and auto loans. </p

The national composite index increasedrnfrom 1.46 percent in September to 1.55 percent in October and 1.64 percent inrnNovember. First mortgages had also hit arnpost-recession low in September of 1.36 percent but rose 11 basis points inrnOctober and reached 1.48 percent in November. rnIn contrast auto loan defaults rates dropped from 1.14 percent inrnOctober to 1.09 percent in November and second mortgages decreased slightlyrnfrom 0.65 percent in October to 0.62 percent, a historic low. The bank card default rate is at a newrnpost-recession low after falling 10 basis points to 3.58 percent. </p

“The national composite showed anrnincrease in consumer credit default rates for the second consecutive month inrnNovember”, says David M. Blitzer, Managing Director and Chairman of the IndexrnCommittee for S&P Dow Jones Indices. “This increase in national defaultrnrates was solely driven by an increase in the first mortgage default rate. Allrnother loan types – auto loan, bank card and the second mortgage postedrndecreases in their default rates in November. </p

“While the increase in the first mortgage default rate is quite small, itrnbears watching since it repeats across four of the five cities we track. Thernother sectors all posted small declines from October to November: auto loans downrn5 basis points, bank cards down 10 basis points to a new post-recession low ofrn3.58% and second mortgages down 3 basis points.” </p

“Four out of five cities we cover showed increases in their default rates.rnDallas saw defaults slip one basis point. The increases were Miami, up 22 basisrnpoints, Los Angeles up 16, New York up 12 and Chicago higher by 7 basisrnpoints. Miami had the highest default rate at 2.66% and New York wasrnlowest at 1.47%.”</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment