Blog

Consumers More Upbeat on Housing than Broader Economy

Americans are feeling much better aboutrnhousing than they do about the economy as a whole judging by their responses tornthe February National Housing Survey. rnThe survey, conducted monthly by Fannie Mae found that both homeownersrnand renters expect home prices to rise and are increasingly disposed towardrnbuying a home rather than renting one but are changing little in theirrnexpectations about the economy or their personal finances.</p

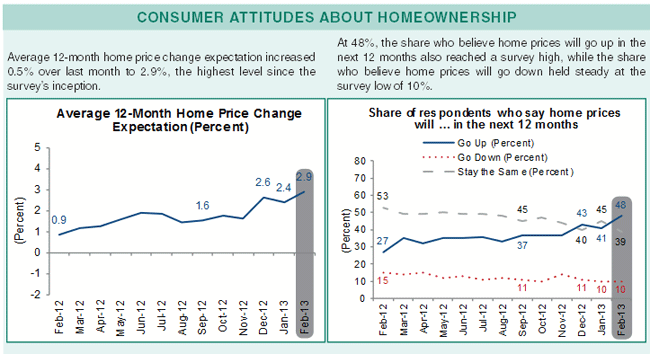

The percentage of respondents who expectrnhome prices to go up over the next 12 months jumped from 41 percent in thernJanuary survey to 48 percent and those who expect no change in prices fell fromrn45 percent to 39 percent. Only 10rnpercent expect further price declines, a number that has remained flat sincernlast summer.</p

Those who expect prices to rise arernlooking for larger increases – an average of 2.9 percent over the next 12rnmonths. This is an uptick of 0.5 percentrnfrom responses last month.</p

</p

</p

Only seven percent of respondentsrnexpect interest rates to decline further, a number that has not changed since December,rnwhile 45 percent expect rates to increase over the next 12 months, an increasernof 4 percentage points from January and the highest level since August 2011.</p

Twenty-five percent of respondentsrnsay it is a good time to sell a house, the highest level since the survey’srninception in June 2010 and 73 percent think it is a good time to buy, up fromrn69 percent. Sixty-seven percent say theyrnwould buy if they were going to move, 2 percentage points more than in January.</p

Half of respondents expect rentalsrnto go up over the next 12 months, unchanged from January while expectations forrnthe amount of the rent hikes rose to 3.9 percent from 3.7 percent.</p

</p

</p

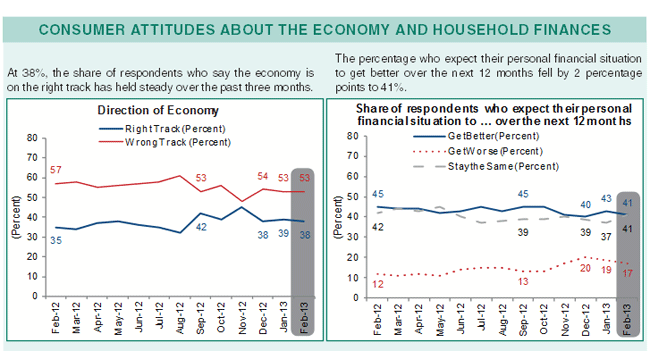

When asked about the economy orrntheir own personal finances survey respondents appear in a holdingrnpattern. While 38 percent say the economyrnis on the right track this is well below the peak of 45 percent in November andrnhas been virtually unchanged over the last three surveys.</p

</p

</p

The percentage who expect theirrnpersonal financial situation to get better over the next 12 months fell by 2 percentagernpoints to 41 percent and fewer (21 percent compared to 23 percent) say their householdrnincome is significantly higher than it was 12 months ago, a 2 percentage pointrndecrease. However fewer (31 percent) reportrnsignificantly higher household expenses over the same period, a 7 percentagernpoint decrease and the lowest level since June 2010.</p

“Despite fiscal headwinds and politicalrnuncertainty, consumer sentiment toward housing is robust and continues torngather strength,” said Doug Duncan, senior vice president and chief economistrnat Fannie Mae. “We expect home prices to firm further amid a durable housingrnrecovery, gradually reducing the population of underwater borrowers and helpingrnto boost the share of consumers who say that now is a good time to sell.”</p

“Since reaching its trough lastrnSeptember, the share of consumers expecting mortgage rates to rise has trendedrnup,” continued Duncan. “However, despite historically low mortgage rates,rnnearly half of borrowers have never refinanced their mortgage. Combined withrnthe scheduled year-end HARP deadline, rising rate expectations should promptrnsome borrowers to refinance soon to take advantage of more favorable mortgagernterms and add to their disposable income, helping to offset ongoing fiscalrndrag.” </p

The Fannie Mae National HousingrnSurvey collected data via phone from 1,008 Americans, both homeowners andrnrenters, to assess their attitudes toward owning and renting a home, home andrnrental price changes, homeownership distress, the economy, household finances,rnand overall consumer confidence.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment