Blog

CoreLogic: 2,400+ Foreclosures per Day over Last 12 Months

There were 63,000 completed foreclosures in May, about 1,000 more than were completed in April according to the National Foreclosure Report issued today by CoreLogic. In May, 2011 77,000 foreclosures were completed nationwide.</p

Mark Fleming, chief economist for CoreLogic said that the foreclosures in May brought the 12 month total to 819,000 foreclosures which is an average of 2,440 each day. “Although the level of completed foreclosures remains high, it is down 27 percent from a peak of 1.1 million in all of 2010,” Fleming said.</p

Since the financial crisis began in September 2008 there have been approximately 3.5 million completed foreclosures across the nation and, as of the end of May, another 1.4 million homes were in the national foreclosure inventory. The inventory, the number of homes in some stage of foreclosure, is down from 1.5 million in May 2011. The current inventory represents 3.4 percent of all homes with a mortgage.</p

</p

</p

The states with the highest numbers of completed foreclosures over the 12 months ended in May were California (133,000), Florida (92,000), Michigan (60,000), Texas (58,000), and Georgia (57,000). These five states account for nearly half (400,000) of the completed foreclosures in the entire country during that period.</p

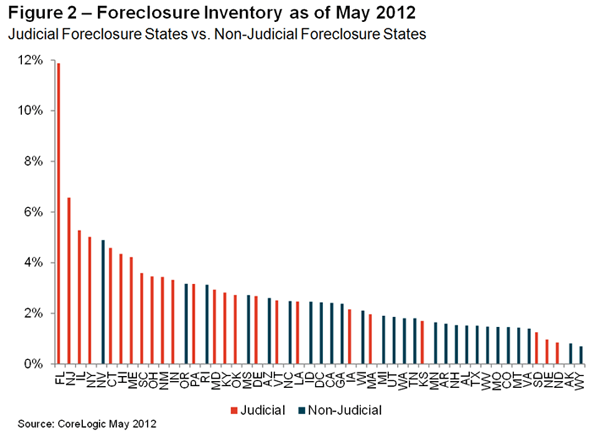

On a percentage basis the states with the most foreclosures were Florida (11.9 percent), New Jersey (6.6 percent), Illinois (5.3 percent), New York (5.0 percent), and Nevada (4.9 percent).</p

Though the national foreclosure inventory levels remain steady, around 1.4 million homes, there have been dramatic shifts at the state level,” said Anand Nallathambi, president and CEO of CoreLogic. “Nevada, Arizona and Michigan, for example, each experienced at least a 20-percent decline in the foreclosure inventory from a year ago. While foreclosure inventories in most states are declining, the foreclosure inventory is still rising in many judicial states, such as Hawaii, New York and Connecticut.”</p

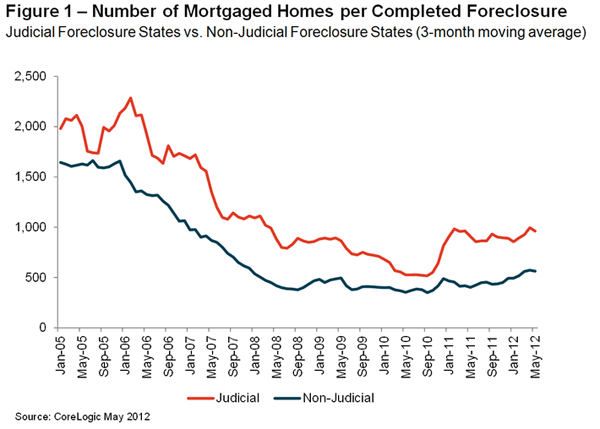

The five states with the most completed foreclosures are also the top states in terms of their foreclosure inventory. Four of the five states, Nevada being the exception, use primarily a judicial foreclosure process which has been blamed for much of the backlog of loans that are severely delinquent but not yet foreclosed.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment