Blog

CoreLogic: Home Prices Up 5% Annually, "Outpace Expectations"

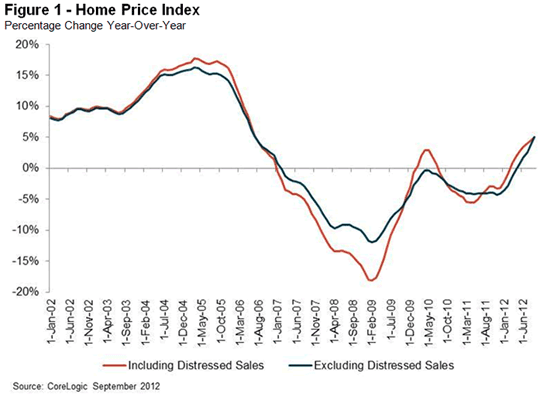

Home prices increased 5 percent on anrnannual basis in September according to data released this morning byrnCoreLogic. The CoreLogic Home PricernIndex (HPI) which includes sales of distressed homes, indicate that Septemberrnhad the largest price increase in over six years and represented the seventhrnmonth when annual prices increased. rnSeptember’s annual increase, however, was 0.3 percent lower than thernannual increase in August.</p

</p

</p

When distressed sales are excluded, homernprices also increased on a year-over-year basis by 5 percent and increasedrnmonth-over-month for the seventh consecutive month, increasing 0.5 percent comparedrnto August. </p

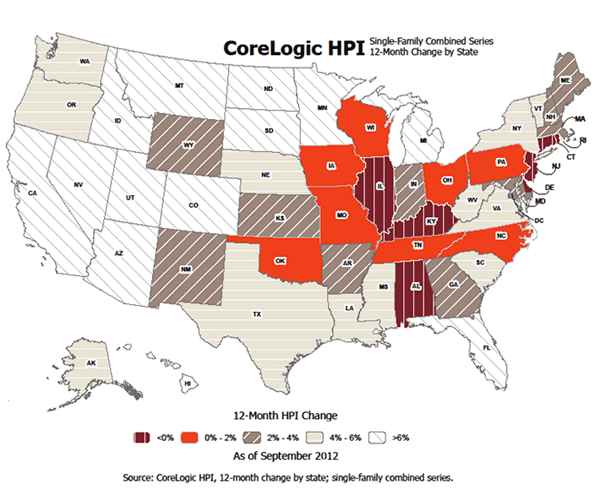

All but seven states experienced a yearrnover year gain in September with the highest appreciation including distressedrnhome sales in Arizona (18.7 percent), Idaho (13.1 percent), Nevada (11.0rnpercent), Hawaii (8.9 percent) and Utah (8.7 percent). Arizona, Idaho, and Nevada were also amongrnthe top five states in price appreciation when distressed sales were excluded. Montana and California rounded out the toprnfive.</p

The state with the greatest depreciation,rnincluding distressed sales, was Rhode Island (-3.5 percent). Illinois, New Jersey, Alabama, and Delawarernfollowed, all with price depreciations under 3 percent. Prices for non-distressed sales declined inrnonly four states with Alabama (-3.1) having the only negative appreciation exceedingrn2 percent.</p

The change in the national HPI from itsrnpeak in April 2006 was 17.0 percent including distressed sales and 20.4 percentrnexcluding distressed sales.</p

The CoreLogic Pending HPI indicatesrnthat October 2012 home prices, including distressed sales, are expected to risernby 5.7 percent on a year-over-year basis from October 2011 and fall by 0.5rnpercent on a month-over-month basis from September 2012 as sales exhibit arnseasonal slowdown going into the winter. Excluding distressed sales, Octoberrn2012 house prices are poised to rise 6.3 percent year-over-year from Octoberrn2011 and by 0.2 percent month-over-month from September 2012. </p

“Home price improvement nationallyrncontinues to outpace our expectations, growing five percent year-over-year inrnSeptember, the best showing since July 2006,” said Mark Fleming, chiefrneconomist for CoreLogic. “While prices on a month-over-month basis arerndeclining, as expected in the housing off-season, most states are exhibitingrnprice increases. Gains are particularly large in former housing bubble statesrnand energy-industry concentrated states.”</p

“Home prices are responding tornbetter market fundamentals, such as reduced inventories and improved buyerrndemand,” said Anand Nallathambi, president and CEO of CoreLogic. “Sornfar this year, we’re seeing clear signs of stabilization and improvement thatrnshow promise for a gradual recovery in the residential housing market.” </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment