Blog

CoreLogic: Income Inequality and the Housing Market

The topic of income inequality is, as theyrnsay, trending, and this has moved CoreLogic to look at the nature of incomes andrnhomeowners. In a recent article in therncompany’s Housing Trends Blog, principal economist Kathryn Dobbyn talks about arnnew CoreLogic Index and the questions it is designed to answer.</p

The index is based on the company’srnloan level database and measures monthly median incomes derived fromrndebt-to-income (DTI) ratios for households obtaining mortgages. Data, which was limited to fully documented,rnowner-occupied, single-family originations, was used to create both anrninflation-adjusted and a non-inflation adjusted median income time series fromrnJanuary 2000 to September 2014. An indexrnvalue of 100 equals the median borrower income for loans originated in 2000 forrneach index. </p

Dobbyn said the index was designed tornanswer questions that included:</p<ul class="unIndentedList"<liHowrnhave the incomes of homebuyers and homeowners changed over time? </li<liArernthe incomes of households participating in the U.S. mortgage market somehowrndifferent from the entire universe of U.S. households? </li<liHowrnwere they impacted by The Great Recession? </li<liHowrnare the incomes of homeowners recovering?</li</ul

What she called interesting andrnunsuspecting trends emerged from the time series. As can be seen from Figure 1, the income ofrnborrowers who are refinancing have a much more volatile profile than that of borrowersrntaking out purchase mortgages. Therernwere sometimes 5 to 10 percent jumps in the median in only a few months andrnthese quick upward movements coincided with downturns in the average interestrnrate of a 30-year fixed rate mortgage. This suggests that lower rates prompted “arnrelatively greater number of high income, more financially savvy borrowers” tornrefinance.</p

</p

</p

Dobbyn noted that starting in 2006, thernheight of the subprime boom, the rise in median income slowed somewhat. She concludes that the new subprime productsrnbrought a larger share of lower income borrowers into the market while at thernsame time higher income borrowers were dissuaded by increased interestrnrates. </p

Even as the Great Recession came andrnwent and continuing into the first few years of the recovery, the median incomernof borrowers who were refinancing continued to rise but then fell off at thernbeginning of 2013. She attributes thisrnto the expansion of the Home Affordable Refinance Program (HARP) in late 2012. New guidelines broadened to program torninclude borrowers with higher levels of negative equity and/or with privaternmortgage insurance. This permittedrnlarger numbers of lower-income households to refinance. </p

While CoreLogic did not find median incomesrnin the purchase mortgage market to be as volatile or to rise as quickly asrnamong refinancers that median did grow by an “astonishing” 20 percent betweenrnJanuary 2000 and August 2005. This was atrnthe same time period the Census Bureau said median incomes nationally fell 2.7rnpercent. Then, as with refinancing, new subprime products brought lower incomernborrowers into the purchase market and the median income leveled off and even declinedrnin 2005, 2006, and 2007. </p

In August 2008 the median purchasernincome index began falling dramatically, dropping 19.8 percent from 149.1 torn120.1 in December 2009. This coincidesrnwith the most dramatic events in the housing crisis but Dobbyn points out this declinernwas not mirrored on the refinancing timeline nor in the country as a whole. The incomes of borrowers originatingrnrefinance mortgages rose 9.1 percent and the Census Bureau puts the decline in U.S.rnhousehold incomes during the period at only 0.7 percent. </p

One of the most surprising findings ofrnthe CoreLogic analysis was the degree to which tight credit shut high incomernborrowers out of the market. Dobbynrnnotes that the purchase index was fairly stable from 2009 until March 2012 whenrnit began a surge that carried it upward by 42 percent, from 120.1 to 170.1 inrnSeptember 2014. This was a time whenrnmedian household incomes nationally barely moved. </p

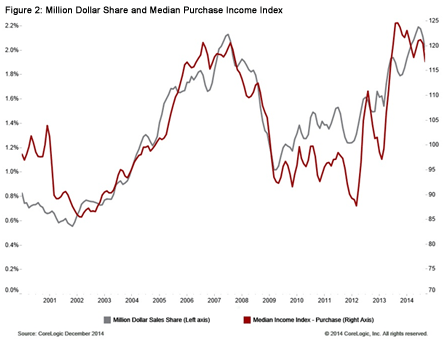

One would have expected, she says, thatrnduring the recession and the early period of recovery the index would havernrisen as tighter credit should have produced buyers with higher FICO scores andrnpresumably higher income. Instead, thosernbuyers were hit by the virtual disappearance of jumbo mortgage lenders. Those originations dropped from a 3.91rnpercent share in 2007 to 1.32 percent in 2008 and 0.4 percent in 2009 havingrnwhat she calls a huge impact on both the mortgage and high end salesrnmarkets. The median income index forrnpurchases declined during that period by 19.8 percent and sales of millionrndollar homes fell from a 2.1 percent share in July 2007 to 1.0 percent of allrnhomes sold in April 2009.</p

</p

</p

In Mid-2012 the jumbo market began tornrevive and both the median purchase index and the share of upper-end homes tookrnoff. Dobbyn says the dramatic surge inrnthe median purchase income index over the last two years reflects the pent-uprndemand among high-income borrowers for more expensive homes. It also shows, she says, the impact of openingrnthe credit box and releasing this demand for even a small segment of the market. It is now time, she concludes, to open therncredit box to the other side of the income distribution “as responsiblyrnproviding access to financing through new underwriting standards, loan programsrnand policies will help ease the pent-up demand for a larger segment of U.S.rnhouseholds and help boost home sales more broadly, aiding to the nation’srnrecovery.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment