Blog

CoreLogic Reports 700,000 Homes Emerge from Negative Equity

There wasrnheartening news this morning from CoreLogic which reports that nearlyrnthree-quarters of a million homes emerged from negative equity between the fourthrnquarter of 2011 and the first quarter of 2012. rnAt the end of Q1 11.4 million homes, or 23.7 percent of all mortgagedrnresidential properties in the U.S. were underwater, 700,000 fewer than the 12.1rnmillion or 25.2 percent in the previous quarter. </p

An additional 2.3 million borrowersrnhad less than 5 percent equity, referred to as near-negative equity, in thernfirst quarter. Together the negative andrnnear-negative equity mortgages accounted for 28.5 percent of mortgagedrnproperties, down from 30.1 percent a year earlier. Approximatelyrn1.9 million of the borrowers who were underwater in Q1 had five percent or lessrnnegative equity. CoreLogic said if homernprices continue rising over the next year these borrowers too could move into arnpositive equity position.</p

The dollar volume of negative equityrnin the country decreased by $51 billion, from $742 billion to $691 billion,rnlargely due, CoreLogic said to improving house prices. Homes with only one lienrnaccounted for $326 billion aggregate negative equity out of the total $691rnbillion while homes with both first liens and home equity loans accounted forrn$365 billion. </p

Slightly more than half – 6.9rnmillion – borrowers had only a first lien and on average they owed $212,000 onrntheir mortgages, an average of $47,000 more than their home value. The remaining 4.5 million upside-downrnborrowers had both first and second mortgages with an average mortgage balancernof $299,000 with a negative balance of $82,000. rnOf all borrowers with only a first mortgage, 19 percent are in negativernequity territory while 39 percent of borrowers with two liens are underwater.</p

</p

</p

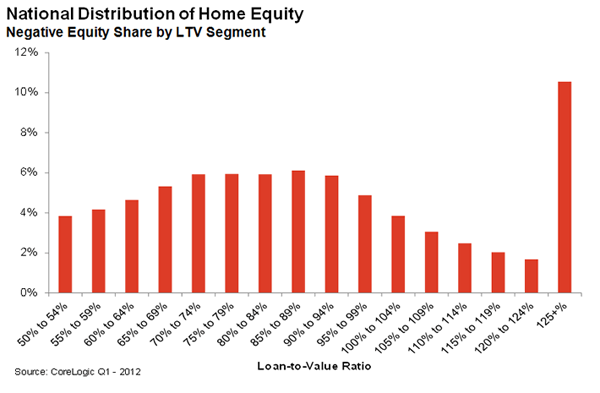

The bulk of the negative equity isrnlocated at the low end of the market. Forrnexample, of borrowers with homes valued under $200,000 about 31 percent arernunderwater compared to 15.9 percent of homeowners with homes valued overrn$200,000. CoreLogic said that nearly 17rnmillion borrowers were between 80 percent and 125 percent LTV in Q1 2012 and,rnpurely from an LTV perspective, eligible for the Home Affordable RefinancernProgram (HARP) under the original requirements first introduced in March 2009.rnThe removal of the 125 percent LTV cap via HARP 2.0 means that more than 22rnmillion borrowers are currently eligible for HARP 2.0 when just considering LTVrnalone. </p

“In the first quarter of 2012,rnrebounding home prices, a healthier balance of real estate supply and demand,rnand a slowing share of distressed sales activity helped to reduce the negativernequity share,” said Mark Fleming, chief economist for CoreLogic.rn”This is a meaningful improvement that is driven by quickly improvingrnoutlooks in some of the hardest hit markets. While the overall stagnatingrneconomic recovery will likely slow housing market recovery in the second halfrnof this year, reducing the number of underwater households is an important steprntoward reducing future mortgage default risk.”</p

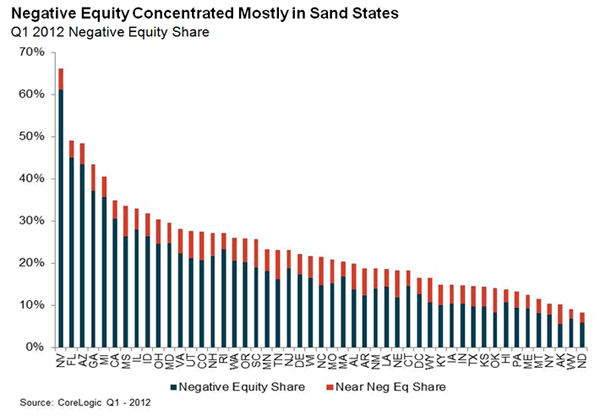

Nevada had the highest negativernequity percentage with 61 percent of all mortgaged properties underwater,rnfollowed by Florida (45 percent), Arizona (43 percent), Georgia (37 percent)rnand Michigan (35 percent). These top five states combined have an averagernnegative equity share of 44.5 percent, while the remaining states have arncombined average negative equity share of 15.9 percent.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment