Blog

December Housing Scorecard Points to Improving Home Equity and Prices

ThernU.S. Department of Housing and Urban Development (HUD) and the U.S. Departmentrnof the Treasury today released the December edition of the ObamarnAdministration’s Housing Scorecard. ThernScorecard is a summary of housing data from various sources such as thernS&P/Case-Shiller house price indices, the National Association of Realtors®rnexisting home sales report, Census data, and RealtyTrac foreclosurerninformation. Most of the information hasrnalready been covered by MND. </p

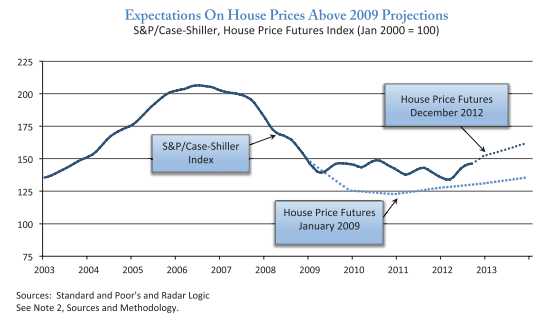

Thernreport pointed to a number of positives for the housing market. For example, Home prices showed large annualrngains for the 12 months ending October 2012. rnBased on Case-Shiller data, house prices have increased much fasterrnthan predicted and are now running about 25 points higher than futures on thernCase-Shiller Index. </p<p </p

</p

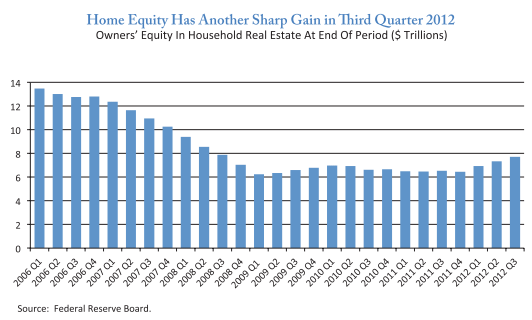

Thernequity Americans have in their homes continues to rise and is nearing $8rntrillion. This is still well below thernnearly $14 million in equity that existed before the housing downturn but isrnnearly $2 trillion above the trough it reached in the first quarter of 2009.</p

</p

</p

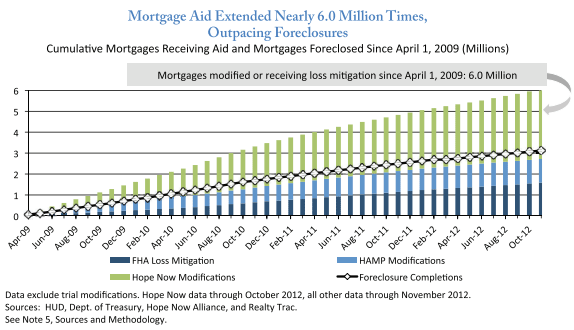

Mortgagernaid has been extended to nearly 6 million homeowners through various programs sincern2009. This includes loan modificationsrnand other forms of assistance provided through the Making Home Affordable Program,rnHOPE Now, and FHA modification programs. rnThe home preservation programs have reached nearly twice as manyrnhomeowners as have been foreclosed.</p

</p

</p

ThernScorecard includes by reference the monthly report on the Making Home AffordablernProgram which includes subsidiary programs Home Affordable Modification Programrn(HAMP), the Second Lien Modification Program (2MP), the Home AffordablernForeclosure Alternative Program (HAFA), and the Principal Reduction Alternativern(PRA). The current report covers informationrnthrough October. </p

ThroughrnOctober there had been 1.96 million HAMP trial modifications started withrn21,816 of them initiated since the previous report. Over the life of the program 1.12 million ofrnthese trials have been converted to permanent modifications and about 68,000rnhomeowners remain in trial status. </p

HAFArnwhich assists homeowners to exit homeownership without going throughrnforeclosure has now completed 85,881 transactions, 5,618 since the last report. Of the total, 83,741 of the transactions havernbeen short sales; the remaining numbers were deeds in lieu of foreclosure.</p

Nearly 102,000 second lien modifications have been completed through 2MP. rnAbout a quarter of these modifications (25,078 full) resulted in a fullrnextinguishment of the second lien at an average cost of $61,850.</p

Sincernthe HAMP program underwent substantial revisions to the modification process andrnHAMP ramped up supervision of participating servicers in June 2010 thernconversion rate of trial modifications to permanent modifications has risen torn87 percent from the 44 percent average pre- program changes. All majorrnservicers now have at least an 81 percent conversion rate and the length of anrnaverage trial is 3.5 months.</p

“Asrnthe December housing scorecard indicates, our housing market is continuing tornshow important signs of recovery – with the FHFA and Case-Shiller housing pricernindices up 5.6% and 4.3%, respectively, from one year ago,” said HUD SeniorrnAdvisor on Housing Finance Michael Berman. </p

“ThernAdministration’s programs to prevent foreclosure have helped millions ofrnfamilies stay in their homes and prompted critical changes in the way thernmortgage industry assists struggling homeowners, which have helped our countryrnrecover faster from an unprecedented housing crisis,” said TreasuryrnAssistant Secretary for Financial Stability Tim Massad.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment