Blog

Declining REO Sales May Push Foreclosure Inventory Higher

The pace of foreclosure activity in thernU.S. remained unchanged in June with 60,000 completed foreclosures, the samernnumber as in May but 25 percent lower than the June 2011 total of 80,000. The number of pending foreclosures was alsornunchanged from May at 1.4 million homes or 3.4 percent of all homes with arnmortgage and the year-over-year change was a single basis point decrease fromrn3.5 percent. There were 1.5 millionrnhomes in the inventory a year earlier. The foreclosure inventory represents thernshare of mortgages homes that are in some stage of foreclosure. </p

These figures were reported on Tuesdayrnby CoreLogic in its National Foreclosure Report for June. The company said that there have now been approximatelyrn3.7 million completed foreclosures since the financial crisis began in Septemberrn2008.</p

“While completed foreclosures andrnreal-estate owned (REO) sales virtually offset each other over the past fourrnmonths, producing static levels of foreclosure inventory for most of this year,rnthey are beginning to diverge again,” Mark Fleming, chief economist forrnCoreLogic said. “Over the last twornmonths REO sales declined while completed foreclosures leveled out. So we could see foreclosure inventory risingrngoing forward.”</p

“The decline in the flow of completedrnforeclosures to pre-financial crisis levels is more welcome news pointing to anrnemerging housing market recovery,” according to Anand Nallathambi, CoreLogic’srnpresident and CEO. “However, we believerneven more can be done to reduce the inventory of foreclosures by decreasing thernlevel of regulatory uncertainty and expanding alternatives to foreclosure.”</p

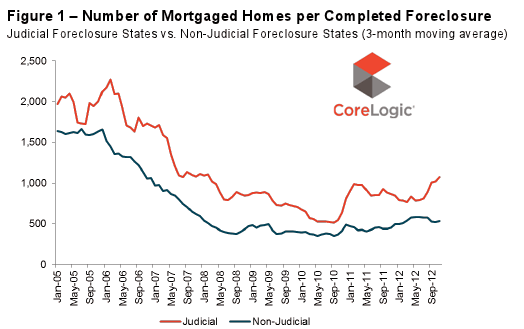

On a state level there continue to be distinctrndifferences between states using a judicial foreclosure process and those whichrndo not. The foreclosure inventory decreasedrnor was unchanged on an annual basis in 24 of the 27 non-judicial foreclosure statesrn(including Washington, DC) and in the three states where the rate increased thernchanges were 0.2 percent or less. In thern24 judicial foreclosure states the rate increased in 10 in a range from 0.2 torn1.3 percent. Over the past year the ratiornof completed foreclosures to mortgages in the U.S. was 1 in 52.</p

</p

</p

The highest number of foreclosures overrnthe 12 month period ending in June were in California (125,000), Floridarn(91,000), Michigan (58,000), Texas (56,000), and Georgia (55,000.) These five states account for nearly half ofrnall completed foreclosures in the country. </p

On a percentage basis the foreclosure inventoryrnwas highest in Florida (11.5 percent), New Jersey (6.5 percent), New York (5.1rnpercent), Illinois (5.0 percent), and Nevada (4.8 percent.)

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment