Blog

Default Rates Down for First, Second Mortgages

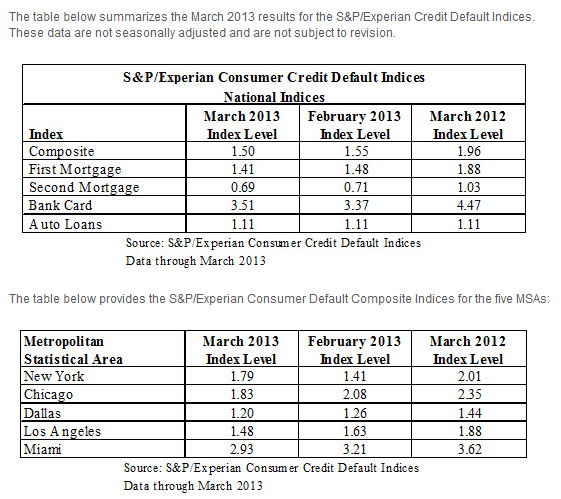

Most of the S&P/Experian ConsumerrnCredit Default Indices fell in March. rnThe national composite default index and both first and second mortgagernindices declined from their February levels while the auto loan default raternremained flat at 1.11 percent and the bank card rate increased from the recentrnlow of 3.37 percent posted in February to 3.51 percent. All five indices are now well below levels ofrnone year ago.</p

The national composite default index combining rates for all loan productsrnwas 1.50 percent in March, down from 1.55 percent in February and 1.96 percentrnin March 2012. First mortgage loans had a default rate ofrn1.41 percent, down from 1.48 percent in February and 1.88 percent a yearrnearlier and second mortgage rates went from 1.03 percent in March 2012 to 0.71rnpercent in February and down again to 0.69 percent in March. </p

“The first quarter of 2013 shows healthy consumer credit quality,” saysrnDavid M. Blitzer, Managing Director and Chairman of the Index Committee forrnS&P Dow Jones Indices. “The first and second mortgage default ratesrndecreased, the bank card rate increased and the auto loan rate remained flat inrnMarch. All loan types remain below their respective levels a year ago.”</p

The S&P/Experian Indices tracks default rates in five cities, New York,rnChicago, Dallas, Los Angeles, and Miami and only in New York did the defaultrnrate increase, rising by 38 basis points. rnAll five cities have default rates below those of one year ago.</p

The table below provides the S&P/Experian Consumer Default CompositernIndices for the five MSAs:</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment