Blog

Default Rates near Eight-Year Lows

“Therernis only positive news in June’s numbers,” a spokesperson for S&P Dow JonesrnIndices said today as the company released the S&P/Experian Consumer CreditrnDefault Indices. Eight of the tenrnmeasures of the index decreased during the month and many are at historic lows.</p

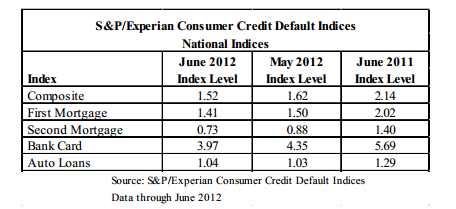

The Composite Index and four of its fiverncomponents were decreased during the month. rnThe Composite was down 10 basis points from May to 1.52 percent. It had been at 2.14 percent in June 2011. The First Mortgage Index fell to 1.41 percentrnfrom 1.50 in May and 2.02 in June 2011 and is now back to its May 2007 levelrnafter peaking at 5.67 percent in May 2009. rn</p

The Second Mortgage rate was 0.73rnpercent compared to 0.88 and 1.40 percent in the two earlier time periods. ThernJune figure is the lowest point for this component in the Indices’ eight yearrnhistory. </p

The index measuring bank card defaultsrnwas at 3.97 percent, 38 basis points below the May number of 4.35. It was 5.69 percent a year earlier. Only the auto loan component rose and thenrnonly one basis point to 1.04 percent from 1.03 percent, its historic low. ThernAuto Index was 1.29 percent a year earlier.</p

David M. Blitzer, Managing Director andrnChairman of the Index Committee for the company said “June 2012 data continued arnpositive trend in consumer credit quality. rnConsumer default rates are falling and we are approaching new lowsrnacross most loan types. In the lastrnrecession most default rates peaked in the spring of 2009; since then therndecline has been bumpy but consistent.</p

S&P Experian tracks five cities andrnfour of them saw default rates drop in June and are now at post-recessionrnlows. Only New York was up, increasingrnby 3 basis points from 1.61 percent in May to 1.64 percent in June. As can be seen in the chart below, Miami hasrnmade significant strides, cutting its default rate by more than half over thernlast 12 months. </p

</p

</p

“In the past three years,” Blitzer said,rn”households have come a long way in repairing their balance sheets. Looking across our 10 headline indices, onlyrnone – bank cards – shows default rates above 2.5 percent and even those arernclose to their eight year historic low.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment