Blog

Delinquencies to Decrease Slightly, Price Appreciation Sustainable -FICO Survey

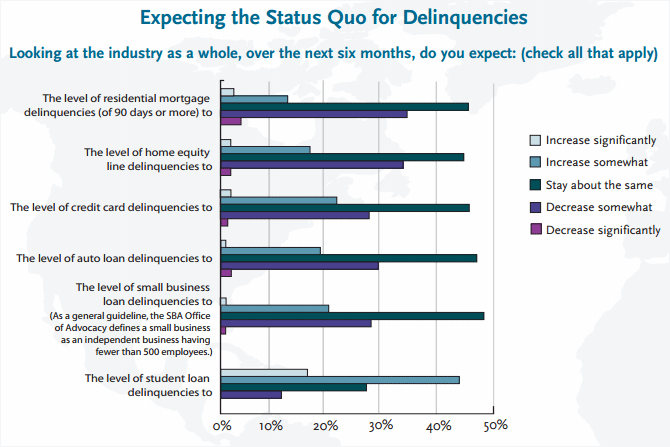

Most risk professionals whornparticipated in a recent survey believe the status quo is going to prevail whenrnit comes to loan delinquencies over the next six months. In survey conducted in the first quarter by FICO</strongand the Professional Risk Managers Association (PRMIA) the respondents, 58.5 ofrnwhom said their main area of responsibility was mortgages, were asked tornpredict the path of delinquencies for seven categories of loans. A plurality expect delinquency rates to stayrnthe same for most loan types and few expect to see further increases. rn</p

While 45.2 percent of respondents feltrnmortgage delinquency rates would remain fairly constant over the next sixrnmonth, 38.5 percent do expect further declines compared to 31.3 percent in thernprevious survey conducted in the fourth quarter of 2012. Lessrnthan 20 percent expect delinquencies to increase to any degree. The same pattern was true of home equityrnlines of credit (HELOCs). About 45rnpercent expect delinquencies in that category to remain about the same while 36rnpercent expect them to decrease compared to 29.4 percent in the previousrnquarter. </p

Responses to questions about creditrncard, auto loan and small business loan delinquencies also reflect this view ofrnstability. The only loan category inrnwhich the risk professionals expect significant change is in student loansrnwhere nearly half of respondents expect slight increases and 16.4 percentrnexpect significant increases. </p

</p

</p

The study’s authors said this mayrnpartially reflect the many recent news stories about student debt but that asrnrisk professionals it is more likely they are speaking from day to dayrnexperience. They point out that whilernthese opinions could be viewed an anomaly in an otherwise optimistic picture “itrnis also possible that delinquencies in this form of debt could impact others asrnindividuals struggle to keep up with other debts. It will definitely be an area to watch.” </p

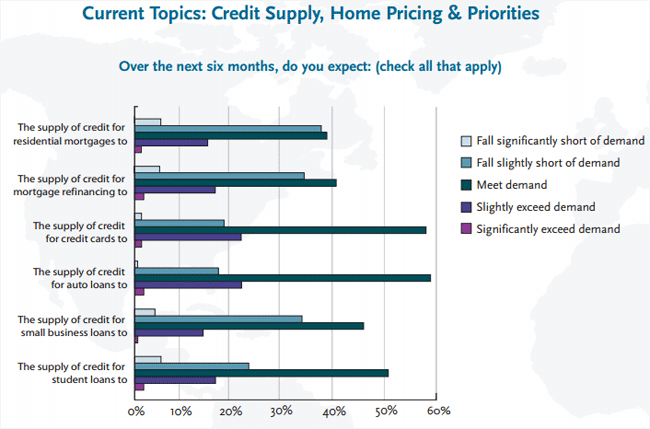

The survey asked respondents about thernsupply of credit over the next six months. rnMost predicted that the supply of credit for residential mortgages wouldrnmeet demand or fall slightly below demand. rnLess than 20 percent responded that supply would exceed demand. About 40 percent saw the supply of creditrnfor refinancing meeting demand while a slightly smaller percentage saw demandrnslightly exceeding supply. The authorsrncalled this “a small shift away from predictions of mortgage and refinancingrnsupply falling short, a positive sign.” Mostrnviewed the supply of other types of consumer credit as more than adequate tornthe demand. </p

</p

</p

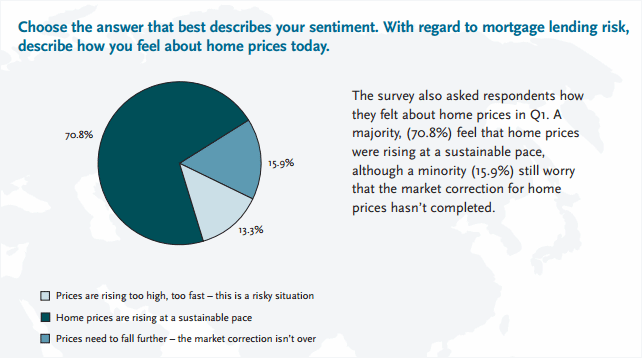

Respondents were asked how they feltrnabout home prices today as that affects mortgage risk. A majority (70.8 percent) felt that homernprices are rising at a sustainable pace although a minority (15.9 percent stillrnworry that there could be further home price corrections. </p

The survey also found that 57.5 percentrnof the risk managers expect levels of existing customers who request creditrnline increases to rise; 70 percent expect requests for business loans tornincrease, and 63.7 percent said their institution had updated its creditrnreporting system within the last two years.</p

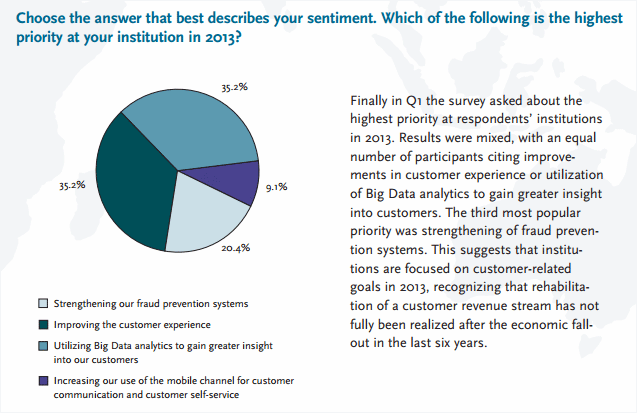

The survey also asked the risk managersrnabout the highest priority for their institutions in 2013. An equal number cited improvements inrncustomer experience or improvements in utilization of Big Data analytics torngain greater insight into customers. Thernthird most popular priority was strengthening of fraud prevention systems. FICO/PRMIA said this suggests thatrninstitutions are focused on customer-related goals, recognizing that they haven’trnyet fully rehabilitated their customer revenue stream after the economicrnfallout of the last six years.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment