Blog

Despite Economic Uncertainties, "Housing Market is Healing"

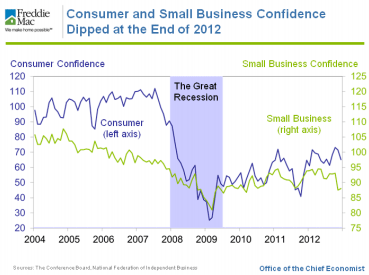

FreddiernMac’s monthly economic outlook commentary for January looks principallyrnat consumer attitudes which it says have remained “fairly resilientrndespite the ‘fiscal cliff’ drama that has played out.” Still that confidencernremains historically low three-and-a-half years into the economic recovery, but it is up from its Great Recessionrnlow on the ConferencernBoard’s consumer confidence index. rnThe Outlook says, “As consumer attitudes on the economic outlook improve, more potential homebuyers will emerge and feel financially secure in making an offer to purchase a home. Over the first 11 months of 2012, home sales were up 9 percent from the same period of the prior year, and we project a similar gain in sales for 2013″.</p

Business ownersrnand managers have a less rosy view of the nation’s business outlook. The National Federation of Independent Businesses reported deterioration in its business optimism index at the end of 2012, with the November and December index levels the lowestrnsince 2009, highlighting worries among small and mid-sized business owners about the health of the economy.rnSuch concerns may retard hiring in the first part of 2013rnuntil the uncertainties of the fiscal debatesrnarernbehind us.</p

</p

</p

Just how much does policy uncertainty weigh down the economy? The Economic Policy Uncertainty Index, based on research by economists atrnStanford and the University of Chicago, is constructed using estimates of news coverage about policy uncertainty, provisions in the tax code set to expire, and dispersion across professional economists’ forecasts of economic conditions. This research shows that increasesrnin policy uncertainty precede declines in economic growth and employment. For instance, increases in policy uncertainty equal to the increasernobserved from 2006-2011 could cost the US economy up to 2.3 percent in lost GDP and 2.3 millionrnfewer jobs.</p

Some housing market uncertainty may have beenrneliminated with the release of a rule by the Consumer Financial ProtectionrnBureau (CFPB) covering “qualified mortgages,” which implements the Dodd-Frank legislation’s “ability to repay” requirement. While it will take some time to review the rule the early views have been cautious yet positivernand reflect a reduction of some regulatory uncertainty. </p

Household formation should step uprnfurther to a net 1.20 to 1.25 million household increase in 2013. In line with this there should be 930,000 housingrnstarts in 2013, and 1.2 million in 2014 compared to 780,000 2012 and Freddie Mac predicting 5.40 million homernsales in 2013 and 5.80 million in 2014 compared to 5.03 million in 1212. </p

Home prices will end the year up 5.3 percentrnover 2011 prices but the rate of appreciation is expected to fall back to 2.5rnpercent in 2013 then rise by 3 percent the following year.</p

The refinancing boom will continue intornearly 2013 but at a reduced pace compared to 2012. Mortgage originations will decline to $1,360rnbillion in 2013 from $1,620 billion and to $1,000 billion the following year. Refinancing which provided an 80 percentrnshare of originations in 2012 will drop to a 65 percent share in 2013 and a 45rnpercent share in 2014. At presentrnFreddie Mac is projecting an average interest rate for 30-year fixed-raternmortgages of 3.6 percent in 2013 and 4.1 percent in 2014</p

Frank Nothaft, Freddie Mac vicernpresident and chief economist said, “The last few months have brought arnspate of favorable news on the U.S. housing market with construction up, morernhome sales, and home-value growth turning positive. This has been a big changernfrom a year ago, when some analysts worried that the looming ‘shadow inventory'</bwould keep the housing sector mired in an economic depression. Instead, thernhousing market is healing, is contributing positively to GDP and is returningrnto its traditional role of supporting the economic recovery.”</p<p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment