Blog

Despite Overall Decline, Foreclosures Increasing In Judicial States

Foreclosure filings fell 5 percent inrnApril from the March levels and were down 23 percent from April 2012 RealtyTracrnsaid today. Default notices scheduledrnauctions and bank repossessions were filed against a total of 144,790 U.Srnproperties during the month compared to 152,500 in March and 188,780 in April 2012. RealtyTrac said that foreclosure filings inrnApril which equated to a filing for every 905 housing units, were the fewestrnsince February 2007.</p

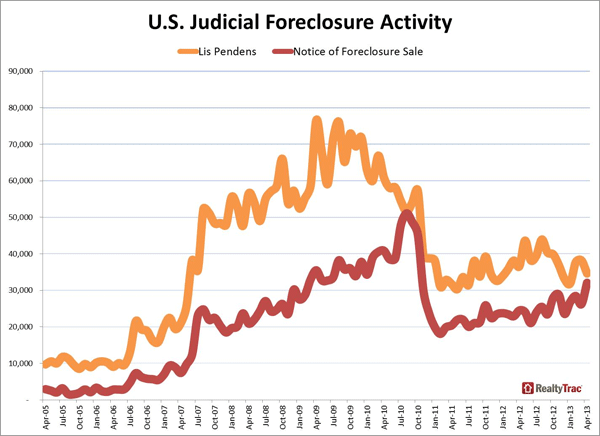

RealtyTrac noted that scheduledrnforeclosure auctions have begun to pick up in judicial foreclosure states. The court involvement required in judicialrnforeclosures have caused huge backlogs in these states and foreclosurerntimelines that are now stretching into four and five years in some cases. Scheduled foreclosure auctions increased 22rnpercent from March to April and were up 31 percent compared to a year ago. These NFS filings were at the highest levelrnsince October 2010, just before foreclosure moratoria related to so-calledrnrobo-signing began. </p

Annual increases were noted in 15 ofrnthe 26 judicial or quasi-judicial foreclosure states. compared to a year ago. Notable were Maryland (+199 percent), NewrnJersey (+91 percent), and Ohio (+73 percent). rnScheduled foreclosure auctions reached a 68-month high in Ohio, arn31-month high in Maryland, a 27-month high in New Jersey, and an 18-month highrnin Oklahoma.</p

</p

</p

Scheduled foreclosure auctionsrndeclined 7 percent in non-judicial states compared to March and were at the lowestrnlevel since December 2005, 43 percent below the April 2012 rate.</p

“The April numbers indicaternthat the pig is moving through the python when it comes to deferredrnforeclosures in judicial foreclosure states,” said Daren Blomquist, vicernpresident at RealtyTrac. “Foreclosure starts have been increasing for severalrnmonths in many of the judicial states, and now that increased volume is showingrnup in the second stage of the process: the public foreclosure auction.rnScheduled foreclosure auctions in judicial states jumped to a 30-month high inrnApril, evidence that lenders are serious about moving forward with completingrnthe foreclosure process – either through repossession or sale to a third partyrninvestor at public auction.</p

“Meanwhile, foreclosure startsrnare bouncing higher in a handful of non-judicial states where servicers arernadjusting to legislation designed to prevent improper foreclosures,” Blomquistrncontinued. “This includes Nevada, Washington and Arkansas, where foreclosurernstarts have been increasing on an annual basis since late 2012, along withrnOregon and California, where foreclosure starts are still down from a year agornbut have been moving steadily higher in recent months.”</p

Default notices were filed on 47,530rnproperties in April compared to 50,356 in March. In April 2012 there were 59,852 default notices filed nationwide. Foreclosures werernstarted on 70,133 properties, down 4 percent from March and 28 percent from onernyear earlier.</p

Despiternthe nationwide decline, 22 states reported increasing foreclosure starts fromrnthe previous month, including New Jersey (+138 percent), Connecticut (+46rnpercent), and Texas (+37 percent), Foreclosure starts reached a 36-month highrnin Connecticut, a 27-month high in New Jersey, and were up on a monthly basisrnfor the third consecutive month in California after hitting a 90-month low inrnJanuary, when the state’s Homeowners Bill of Rights took effect.</p

Foreclosures were completed on 34,997rnU.S. properties in April, down 20 percent from March and 32 percent from Aprilrn2012 to the lowest level since July 2007. They declined in 37 states and the District ofrnColumbia but increased dramatically in several states including Washingtonrnwhere there was a 164 percent increase and in Maryland which was up 98 percent.rn</p

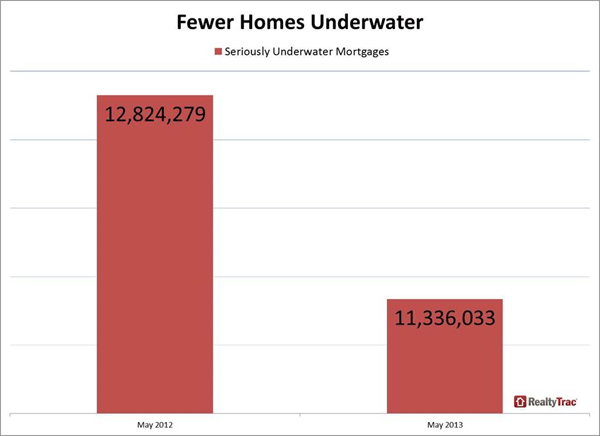

As of the beginning of May, A totalrnof 11.3 million mortgages nationwide were seriously underwater (loan-to-valuernratios of 125 percent or more), 26 percent of all outstanding mortgages. That number is down by nearly 1.5 millionrnproperties since May 2012. </p

</p

</p

Nevada had the highest number ofrnforeclosure filings in the nation for the second straight month with 3,227rnfilings in April or one in every 360 housing units. Florida had the second highest level ofrnforeclosure activity with 24,656 filings or one in every 363 housingrnunits. This was despite a drop of 27rnpercent in foreclosure starts from March to April. Ohio rose to third position in foreclosurernrankings with 11,991 filings or one in every 427 housing units. This was the first time since November 2007rnthat Ohio has been in the top ranks. Alsornin the top five were Illinois with one in every 501 units receiving a filingrnand South Caroline, one in every 590 units.</p

Among metropolitanrnareas Akron Ohio had the highest level of activity with a filing on one inrnevery 211 housing units, more than four times the national average followed by Ocala,rnFlorida (one in 225), Miami (one in 269), Orlando (one in 287) and Las Vegasrn(one in 302).

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment