Blog

Dodd-Frank – a Five Year Summary

The debate over whether the Dodd-Frank Wall Street Reformrnand Consumer Protection Act was desperately needed or a pox upon the land survivesrneven as its fifth birthday passed in late July and is likely to become morernheated as the 2016 election nears. Thernstructure and even the existence of its most controversial outcome, creation ofrnthe Consumer Financial Protection Bureau (CFPB), is constantly threatened byrnboth legislationrnand court action.</p

CoreLogic’s current edition of MarketPulse, its on-line magazine, attempts to take a measured andrnobjective look at the Dodd-Frank Act “The Lingering and Lasting Effects”. Policy research and strategy analyst StuartrnQuinn says of the act, “The half-decade (of the Act) has further amplified itsrndivisiveness, with legislators from both sides of the House hitting thernspeaking circuits to either magnify the blemishes or, tout the progress.”</p

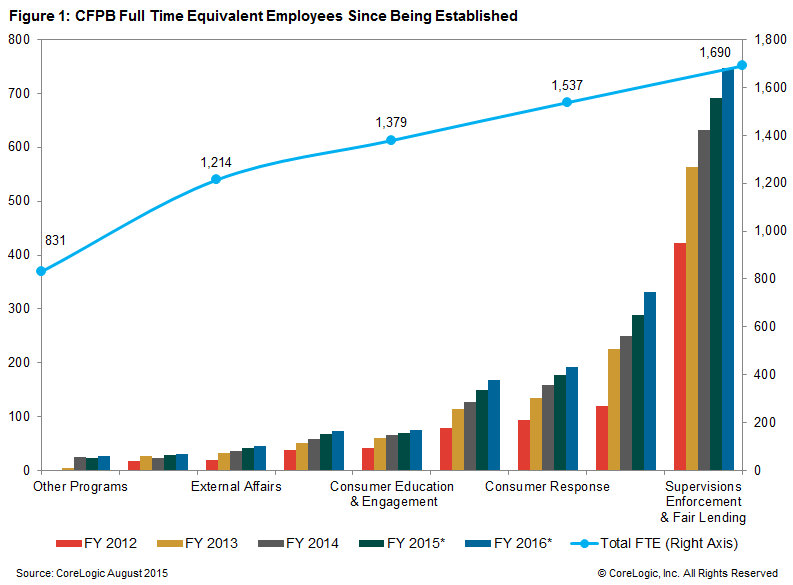

In addition to the CFPB, other agencies established byrnDodd-Frank include the first Federal Insurance Office, the Office of FinancialrnResearch at Treasury, Office of Housing Counselors at the Department of Housingrnand Urban Development (HUD) and the Office of Credit Ratings. CFPB operated for two years without arnconfirmed director but grew quickly, transferring both employees and functionsrnfrom the Federal Reserve and several federal agencies but remains, Quinn says,rnrather lean by federal standards with a current roster of 1,537 employees. The staff tilts heavily toward enforcementrnwith a 10 to 1 ratio of Supervision, Enforcement and Fair Lending staff tornConsumer Education and Engagement employees.</p

</p

</p

Dodd-Frank also established a Civil Penalty Fund designed torncompensate consumers who suffer from a violation of a federal consumerrnprotection law. To date the fund hasrncollected approximately $207 million from more than 45 different entities orrnpersons found to have broken these laws.</p

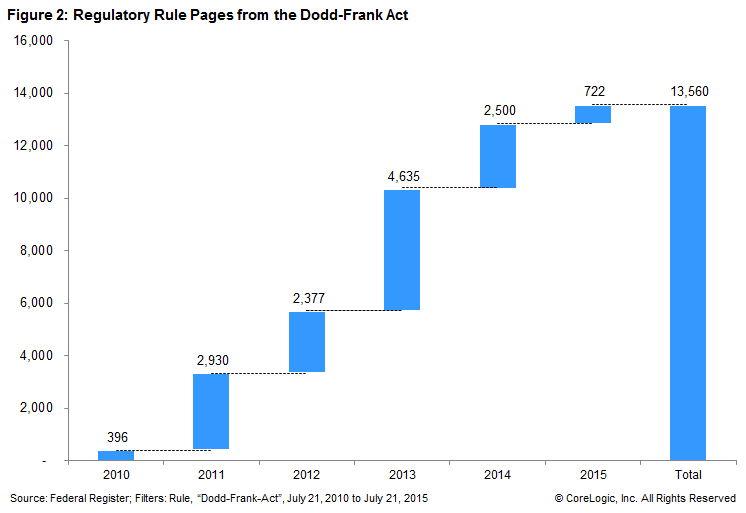

According to the Federal Register over 13,000 pages ofrnpublished rules have come out of Dodd Frank, 2,000 of which had come from CFPBrnby 2013. Other agencies publishing largernvolumes of rules are the Commodities Future Trading Commission (801) and thernSecurities and Exchange Commission (646). rnThe most notable of the rules completed by CFPB by the end of 2013rninclude Qualified Mortgage/Ability to Repay (QM/ATR), Mortgage Servicing Rules,rnand the Integrated Mortgage Disclosures (TRID). </p

</p

</p

Quinn notes that there was significant concern within thernhousing finance industry about QM/ATP and its impact on futurernoriginations. However the exemptionrnestablished for loans eligible for purchase by the government sponsoredrnenterprises (GSEs) Fannie Mae and Freddie Mac along with other exceptions forrnsmaller institutions and rural lenders muted at least near-term originationrnconcerns. </p

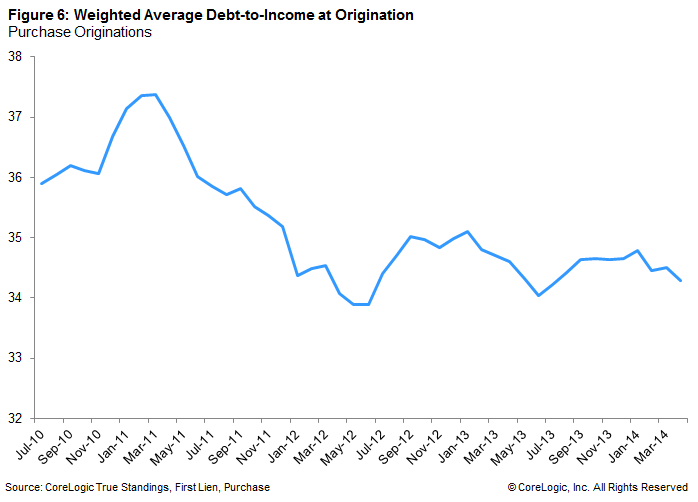

He says Dodd-Frank rules for housing finance seemed to havernmerely solidified what were already trends in originations. He cites low/no documentation loans which hadrnpeaked at 42 percent at the end of 2005 and by the time Dodd-Frank became lawrnfive years later their number had tumbled to a 4 percent share of purchasernmortgages. Adjustable-rate mortgages,rnnot banned by the act but treated differently than fixed-rate loans under QMrnrules, had also largely disappeared comprising only 7 percent of purchasernoriginations. The one origination trendrnwhich Quinn said did pivot was the average debt-to-income (DTI) ratio which, inrnthe month Dodd-Frank was signed peaked at 37 percent.</p

</p

</p

In April 2011 the Federal Reserve proposed a QM/ATR rulernindicating that DTI would be one factor although no specific threshold wasrngiven. Since then Quinn says thernweighted average back-end DTI of purchase originations has dropped to 33rnpercent, 10 percentage points below the 43 percent DTI threshold established inrnthe final QM/ATR rule that went into effect in January of last year.</p

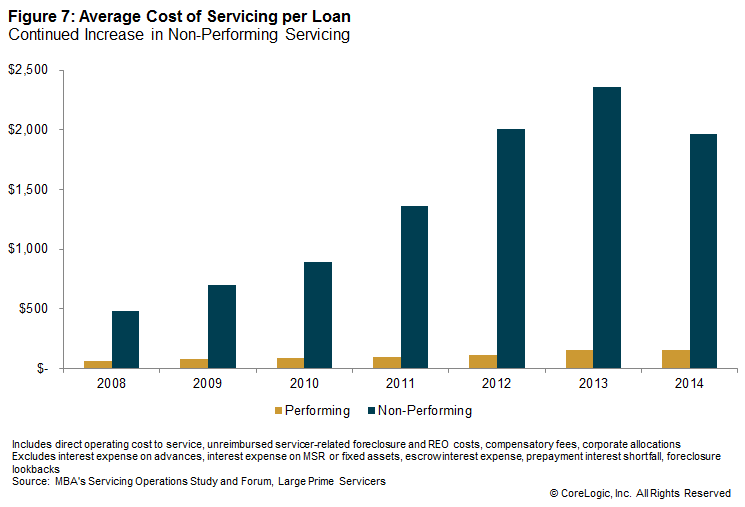

The final mortgage servicing rules promulgated by CFPB hadrnsimilar provisions to those in previous consent orders and/or the 49-staternservicing settlement. Since then the<bcost of servicing, especially of non-performing loans, has continued its upwardrntrajectory and foreclosure timelines in some jurisdictions remain extremelyrnlong even as the volume of distressed loans has decreased. </p

Quinn says the question, five years after Dodd Frank remainsrnwhether true national servicing standards have been attained or if theyrnrealistically can be and whether an appropriate compensation structure coveringrnboth performing and non-performing loans has been reached. There is also Congressional action possiblernregarding treatment of mortgage servicing rights under new Basel III standards.</p

</p

</p

Five years out a number of rules authorized or mandated byrnDodd-Frank either have not yet been finalized or become effective including TRIDrnand the Home Mortgage Disclosure Act. rnOther broader reforms including legislation on too-big-to-fail,rnexecutive compensation, and the Volker Rule remain outstanding or underrndebate. Quinn says even as mortgagernreforms are being implemented some results are difficult to measure because ofrnthe absence of a true private label securitization market, inaction on GSErnreform, GSE credit policy changes, and “the pristine quality of originations inrnthe post-Dodd-Frank era.”</p

He concludes, “The dialogue in Washington revolving aroundrnthe Dodd-Frank Act continues to bubble. rnHow many more rules will the CFPB finalize and what effect will thesernregulations have on the financial services industry? The next five years will be just asrninteresting to analyze when it comes time to celebrate the 10-year anniversaryrnof the Dodd-Frank Act.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment