Blog

Down Payments: Percentages Trend Lower as Amounts Rise

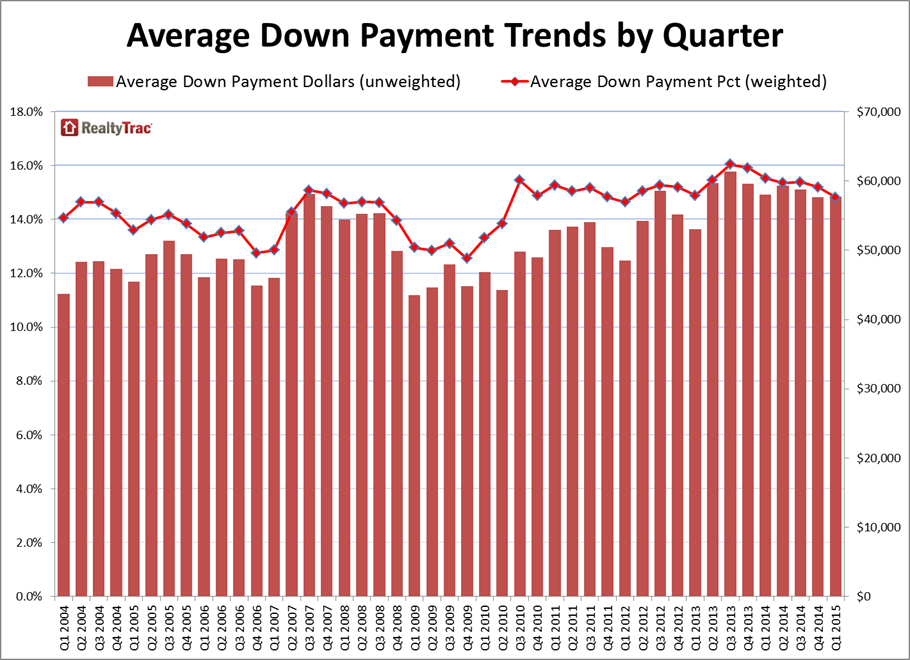

Are those sought-after first-time homebuyers finally re-emerging? RealtyTrac said on Thursday that they may bernthe reason that the average percentage of down payments used to purchase single-familyrnhomes, condos, and townhomes in the first quarter of 2015 was at the lowestrnlevel in three years. </p

On average homebuyers put down 14.8 percent of their home’srnpurchase price compared to 15.2 percent in the fourth quarter of 2014 and 15.5rnpercent a year earlier. This was thernlowest average percentage for a down payment since the first quarter of 2012.</p

“Downrnpayment trends in the first quarter indicate that first time homebuyers arernfinally starting to come out of the woodwork, albeit it gradually,” said DarenrnBlomquist, vice president at RealtyTrac. “New low down payment loan programsrnrecently introduced by Fannie Mae and Freddie Mac, along with the lowerrninsurance premiums for FHA loans that took effect at the end of January arernhelping, given that first time homebuyers typically aren’t able to pony up largerndown payments. Also helping tilt the balances toward first time homebuyers inrnthe first quarter is less competition from the large institutional investorsrnthat have been buying up starter home inventory as rentals.”</p

</p

</p

Even at an average rate substantially below the traditionalrn20 percent buyers are making a substantial out-of-pocket investment. The average dollar amount put down wasrn$57,710 compared to $57,618 in the previous quarter and a slightly higher 57,992rnin the first quarter of 2014.</p

The average down payment on an FHA loan was 2.9 percent ofrnthe purchase price or $7,609 while conventional loan down payments averagedrn18.4 percent or $72,590.</p

High loan-to-value (LTV) ratio loans – 97 percent or higher orrnwith a down payment of 3 percent or less – made up 27 percent of purchasernoriginations in the first quarter. Thisrnwas a one percentage point increase over both the previous quarter and thernfirst quarter of 2014 and was the highest share since the second quarter ofrn2013. Eighty-three percent of FHArnpurchase loans originated in the first quarter were high LTV and 11 percent ofrnconventional purchase loans.</p

RealtyTrac pointed to several trends through thernquarter. First, FHA loans represented arnlarger share in each month of the quarter, rising from 21 percent in January torn25 percent in March. Second, whilernoverall low down payment loans increased as a share of originations through thernquarter the low down payment share of conventional loans moved in the oppositerndirection, from 11 percent inrnJanuary and February to 10 percent in March while the share of FHA loans thatrnwere low down payment loans increased throughout the quarter, from 83 percentrnin both January and February to 84 percent in March</p

Among the nation’s 20 largest countiesrnwith down payment data available those with the lowest average down paymentrnpercentage were Wayne County (Detroit), 12.0 percent; Philadelphia County,rn(12.6 percent), Clark County (Las Vegas), 13.3 percent, Riverside County,rnCalifornia, 13.7 percent; and Maricopa County (Phoenix), 14.2 percent. The highest average down payments were inrnthree counties in the metropolitan New York area, Santa Clara and OrangernCounties in California. Markets with thernhighest percentage of low down payment loans in the first quarter includedrncounties in Atlanta; Washington, D.C.; El Centro, California; Worcester,rnMassachusetts; and Charlotte and Greensboro in North Carolina while the lowestrnshare of low down payments were in New York County, the Bay Area, and KingsrnCounty (Brooklyn).

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment