Blog

Dudley: Housing Recovery "Disappointing" Despite Fed's Extraordinary Easing Measures

Bill Dudley, president and CEO of thernFederal Reserve Bank of New York and vice chair of the Federal Open MarketrnCommittee (FOMC) told a conference audience Friday that despite some extraordinaryrnmeasures taken by FOMC the recovery has been disappointing. Dudley spoke to a conference co-sponsored byrnthe Federal Reserve and the Rockefeller Institute of Government titled “DistressedrnResidential Real Estate: Dimensions,rnImpacts, and Remedies. </p

Dudley said that while measures taken byrnthe Fed have certainly helped to make the economy stronger than it otherwisernwould have been, over the three year period from mid-2009 to mid 2012 the realrnoutput of the economy has grown at a compound annual rate of just over 2rnpercent. Thus employment gains have beenrnmodest and unemployment remains unacceptably high.</p

He pointed to several headwindsrnrestraining economic growth, one that the housing market has failed to respondrnfully to the significant easing of monetary policy. While it is true that some housing indicatorsrnhave improved lately such as increasing housing starts and home sales andrnstabilizing home prices, the absolute level of starts and sales remain quiternlow, especially when viewed on a per capita basis. </p

There is also a considerable variationrnin market conditions across the country and the worst performing areas are stillrnexperiencing high volumes of distressed sales and annual price declines ofrnaround 5 percent. This means that, whilernhousing’s contribution to growth has finally turned positive, it has much lessrnimpact that in previous recoveries.</p

Dudley said there are several factorsrnbehind the sluggishness of the market. rnMortgage credit availability, while improving, is still limited,rnespecially for borrowers with less than perfect credit. Many more borrowers are underwater and mayrnnot be able to refinance or sell and there are still huge inventories ofrnproperties that have either been foreclosed or are moving toward it.</p

He said that the New York Fed is deeplyrncommitted to helping to resolve the housing crises and continues to monitor thernmarket and analyze its impact on the economy while the bank works withrncommunity groups that aid distressed homeowners and the Fed’s lawyers work prornbono with homeowners facing foreclosure. rnFed researchers and market analysts have developed proposals to mitigaterncurrent problems and improve the future structure of housing finance. </p

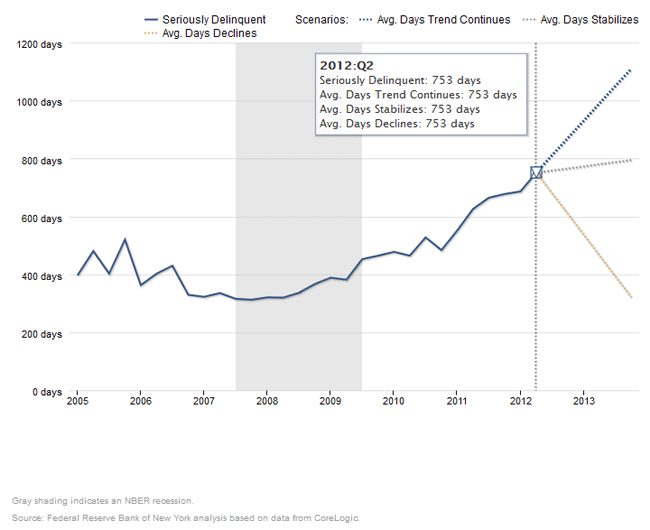

The Fed released data about foreclosurerninventories and owned real estate (REO) at the conference, presented through arnseries of national, state, and regional interactive maps. The national maps present three scenarios forrnforeclosure inventories, showing the difference in the increase or decrease inrnowned real estate (REO) if the current trend in the number days a propertyrnremains seriously delinquent and in foreclosure continues its pattern ofrnincreases. In that instance therninventories of REO in most states would decline but would increasernsignificantly in a few states, especially New York and New Jersey.

Inrnthe second scenario, assuming that the average number of days stabilizes, thernREO in most Western states would decline while states in the Northeast wouldrnhave sizable increases.</p

Ifrnthe third scenario should happen, i.e. the average number of days a loan remainsrndelinquent declines, then REO would increase nearly everywhere and especiallyrnin New York and New Jersey. Only in Californiarnand Arizona would the situation improve. </p

Maps</areleased by the Federal Reserve present information on the State and Regionalrnlevels.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment