Blog

Fannie Housing Survey Logs Major Milestone

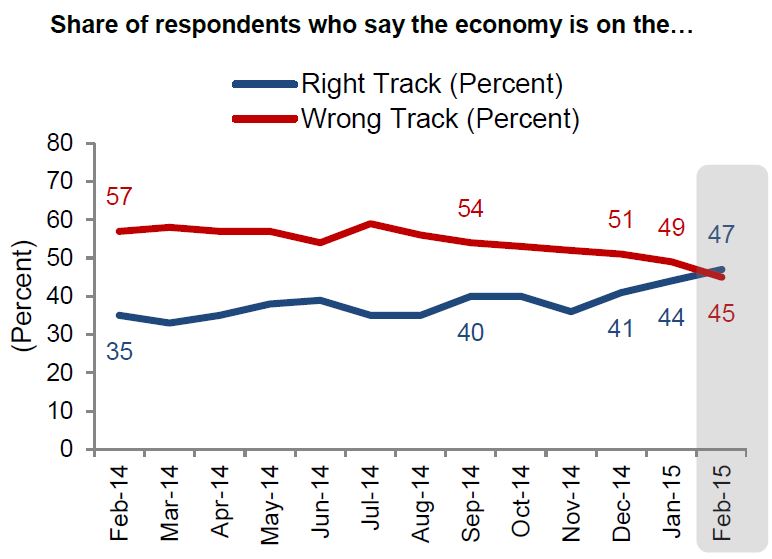

The percentage of consumers believing the economy is on the right track finally crossed paths with those who say the economy is on the wrong track in thernFebruary edition of Fannie Mae’s National Housing Survey. The sharernof respondents who believe the economy is headed in the right directionrnincreased 3 percentage points to a survey high of 47 percent while the share who believe it isrnheaded in the wrong direction decreased 4 points to 45 percent, an all-timernsurvey low. </p

</p

</p

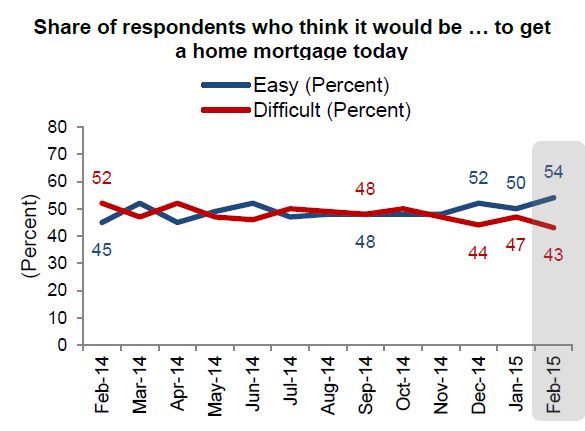

Doug Duncan, senior vice president andrnchief economist at Fannie Mae said, “Continuing improvements in consumerrnattitudes in this month’s National Housing Survey lend support to ourrnexpectation that 2015 will be a year of the economy dragging housingrnupward,” said. “The share of consumers who think the economy is onrnthe right track rose to a record high since the inception of the survey nearlyrnfive years ago and for the first time exceeded the share who believe it’s onrnthe wrong track. Consumer confidence seems to be getting a boost fromrnemployment growth. This is reflected in their views on the ease of getting arnmortgage today, which also reached a survey high in February. We continue tornsee strength in attitudes about the current home buying and selling environmentrnand consistently high shares of consumers saying they expect to buy a home onrntheir next move. At the same time, we still need to see further growth inrnconsumer optimism toward personal finances and income for more robustrnimprovement in housing market attitudes.”</p

Those who say it is a good time to buyrna home remained at 67 percent although those who view it as a good time to sellrnfell from 44 to 40 percent. Forty-sixrnpercent of respondents expect further price increases with the average 12-monthrnincrease estimated at 2.5 percent. Lastrnmonth 49 percent were looking for an increase although the expectation then wasrnalso for 2.5 percent annual appreciation. Those expecting a drop in prices fell from 8rnpercent to 6.</p

The share of respondents who believe itrnwould be easy to get a home mortgage today increased to a record-high 54rnpercent. Forty-three percent, a surveyrnlow, think it would be difficult to get a mortgage. Those consumers who expect to pay more for arnmortgage increased by 3 points to 48 percent while 40 percent expect interestrnrates to decrease over the next 12 months compared to 41 percent in January.</p

</p

</p

Rising rates and difficulties getting arnmortgage aside, consumers remain bullish on home ownership. Sixty-five percent say they plan to buy thernnext property in which they reside compared to only 29 percent who say theyrnwill rent.</p

Slightly more than half (52 percent)rnsaid that rental prices will increase over the next 12 months, unchanged fromrnJanuary, but the average increase expected jumped from 3.6 to 4.0 percent.</p

While their optimism about the economyrnas a whole is up, respondent attitudes toward personal finances fell inrnFebruary. Forty-six percent anticipatedrnan improvement in their personal financial situations over the next year, downrnfrom 48 percent, but there was also a slight decrease in the already smallrnshare who expect it to worsen. The slackrnwas taken up by a 3 point increase (to 42 percent) in those who expect nornchange. Twenty-four percent reportrnsignificantly higher household income than a year earlier, down 5 percentagernpoints, while 31 percent report significantly higher household expenses, downrnfrom 35 percent in the previous survey.</p

Fannie Mae’s National Housing Surveyrnpolls 1,000 Americans via live telephone interview each month. The respondents, composed of both homeownersrnand renters, are asked more than 100 questions to assess their attitudes towardrnowning and renting a home, home and rental price changes, homeownershiprndistress, the economy, household finances, and overall consumer confidence. Thernsurvey began in June 2010.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment