Blog

Fannie Mae Economists see 2013 as a 'Transition to Normal'

The economistsrnat Fannie Mae released their first economic forecast of 2013 and introduced theirrntheme for the New Year, “Transition to Normal.” This theme, they said, has profoundrnimplications for a number of longer-term challenges facing the country andrnreflects the rebound of housing along with the fiscal policy decisions made andrnyet to be made. “It isrnunclear where thisrntransition willrnlead and what type ofrneconomic growth pathrnawaits. Some havernquestioned whether the country has entered a prolonged period of below-potential GDP growth, whichrnthey label “the new normal.” Others ask when housing will returnrnto normal.” The forecast says. </p

The economists project that the firstrninterest rate hike by the Federal Reserve will not occur until the second halfrnof 2015, so long-term interest rates should increase very gradually over thernnext few years with the yield on the 10-year Treasury note rising from itsrncurrent 1.86 percent to 2 percent at the end of 2013 and 2.3 percent at the endrnof 2014. Mortgage rates should follow arnsimilar pattern, ending 2013 and 2014 at around 3.8 percent and 4.2 percent, respectively.</p

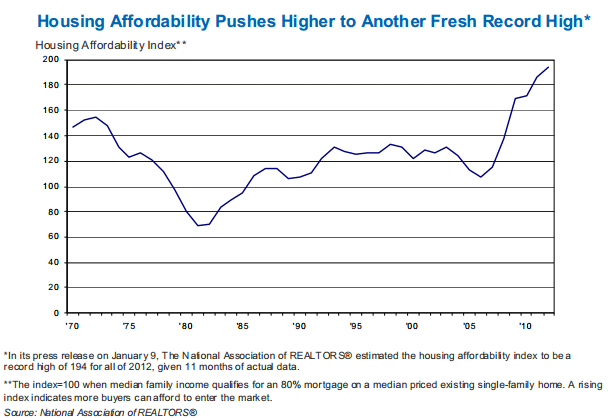

The Federal Reserve Board’s Senior Loan Officer Opinion Survey indicates that while the majority of lendersrnhave loosened mortgage lending standards slightly from the toughrnones adopted inrn2007 they have changed little since 2010. This partially explains the moderate increase in home sales despite recordrnhigh housingrnaffordability.</p

Rising guaranty fees and FHA insurance premiums will increase the costrnof obtaining mortgages going forward; however the effect of the newly released QualifiedrnMortgage rule mortgage originations is still an unknown. </p

Policies encouraging refinancing are likely to wane after this year. There are still significant numbers ofrnhomeowners who could benefit from refinancing and they should keep the level ofrnactivity high for the rest of this year. rnThe Home Affordable Refinance Program is set to expire at the end of 2013rnand the Federal Reserve will likely give further guidance on its plans to endrnquantitative easing which will start to put upward pressure on interest rates. ‘Thus, we expect 2012 to be seen as the high watermark for refinances and 2013rnas the first of severalrntransition years as the housing financernmarketrntransitions back to a more normalrnbalance betweenrnpurchase and refinance activity,” thernforecast says.</p

Housing indicators show that thernrecovery in that sector is on a faster upward track. Improvement in employment and low mortgagesrnrates are beginning to drive prices away from their low point in the firstrnquarter of last year and housing’s contribution to economic growth is expectedrnto increase in this and the following years. rn</p

New and existingrnhome sales have trended higher and the inventory ofrnboth new and existing homes for sale have dipped well below their long-term averages, indicating a balanced home sales market. Declining inventories amid rising demand has created opportunity for homernbuilding activity: both housing starts and permitsrnare on the upswing for both single-family andrnmulti-family construction. </p

Household formation,rnone of the main components of housing demand,rncontinues to rebound, helping to reduce the homeowner and rental vacancy rates. Lenders have increased efforts to implement short sales and other foreclosure alternatives, helping to support betterrnhome price trends.rnSerious delinquency rates, though stillrnhigh by historic standards, have gradually declined from theirrnpeaks in most areas.rnHome prices havernreflected a more balanced housing market and declining shadow inventory, with annual gains accelerating substantially in the second half ofrn2012. Improving marketrnconditions have accompanied a corresponding risernin homebuilder confidence. Overall,rnbuilding activity,rnhome sales, and home pricesrnas well as homebuilderrnconfidence, have risenrnto multi-year highs.</p

Fannie Maernexpects housing starts to risernby approximately 23 percent in 2013 torn950,000 units,rnabout the same increase as in 2012. While still well below the peak of more than 2 million units in 2005, it will be morernthan 60 percent above the record low in 2010. </p

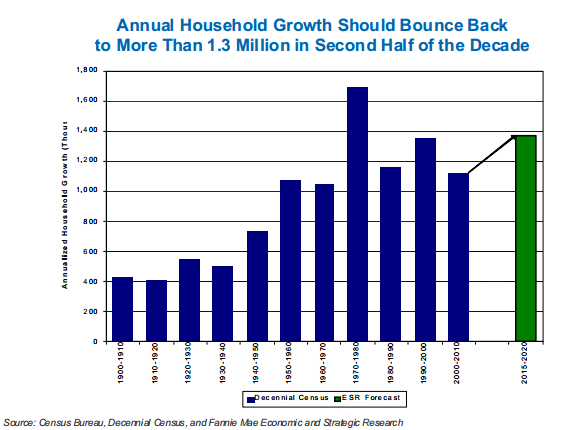

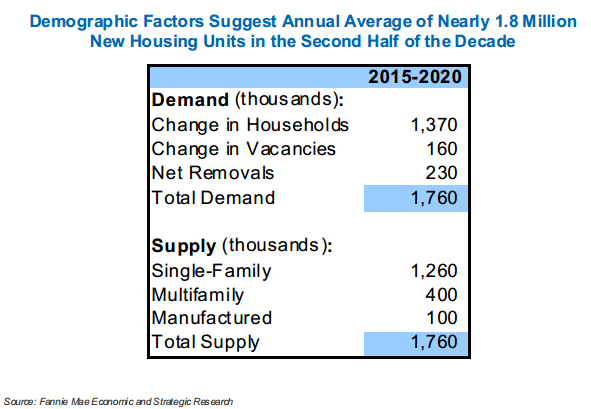

Fannie Mae’srnprojections of headshiprnrates-the rates that population in various age cohortsrnwillrnform into households-rncoupled with new Census Bureau data, leads to an estimate of a 1.37 millionrnannual growth in households in thernsecond half of the decade. </p

</p

</p

During the same period,rnthere should be an annual increase inrnvacancy units of 160,000.rnThis component of housingrndemand includes demand for second homes and vacantrnhomes for sale and for rent required to facilitate the liquid operation of a healthy housingrnmarket. Vacancy rates have trended close to theirrnlong-term averages.</p

The third and final component of housing demand is netrnremovals, which include houses lost tornintentional demolition and disasters,rnand the net conversion of structures between residential and non-residential use. Fannie Mae “conservatively”rnestimates 230,000 net removals per year or 0.2 percent of the housing stock. Summing up all the units of housing required for new households, vacant units, and net removals, Fannie Mae expects a “normal” or sustainable housing supply ofrn1.76 million unitsrnof single-family, multifamily, andrnmanufactured homes.</p

</p

</p

The forecastrnindicates continued rising homebuildingrnactivity, with housing starts reaching sustainable levels in 2016, marking a 10-year processrnof transition from therndownturn back tornnormal activity. rnExisting home salesrnshould to trend up steadily, reaching nearly 6rnmillion units inrn2016. That pacernof sales implies a 4.3 percentrnincrease in the housing stock,rnwhich appears to be thernnormal rate of turnover,rnbased on historic trends.</p

Given the expectations of continued improvement in housing starts, home sales, and home prices in 2013, the economists project that purchase mortgagernoriginations will rise to $642 billion from a forecast of $518 billion in 2012 while refinance originations shouldrndecline to $961 billion from a projected $1.4rntrillion in 2012,rna refinance sharernof 60 percent compared to 73 percent inrn2012. Outstanding mortgage debt willrndecline an additional 0.8 percent in 2013, following an estimated 2.2 percent decline in 2012.</p

The American Taxpayer Relief Act of 2012 which was signed into law onrnJanuary 3 contained two provisions which should have a positive impact onrnhousing. One is the extension of the Mortgage Forgiveness DebtrnRelief Act ofrn2007 which excludes debt forgiven by a lender following a short sale or foreclosurernfrom taxation. The second provisionrnextends the deductibility of mortgagerninsurance premiums for taxpayers.rn

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment