Blog

Fannie Mae Expects Positive Financial Results for Year

Fannie Mae in reporting net income ofrn$1.8 billion in the third quarter of 2012 from $5.70 billion in net revenuerncompared to a net loss of $5.1 billion on $5.78 billion in revenue in the thirdrnquarter of 2011. Thus far in 2012 therncompany has reported $9.7 billion in net income and expects to post positivernreturns for the entire year for the first time since 2006. The company has been operating under federalrnconservatorship since September 2008. </p

The higher net income was the result ofrnlower credit-related expenses which the company attributed to an increase inrnactual and expected home prices, higher sales prices on its real estate ownedrn(REO) properties, and a decline in fair value losses. Credit related expenses were $2.03 billionrncompared to $4.89 billion one year earlier and the company reported comprehensivernincome of $2.6 billionrnin the third quarter of 2012. </p

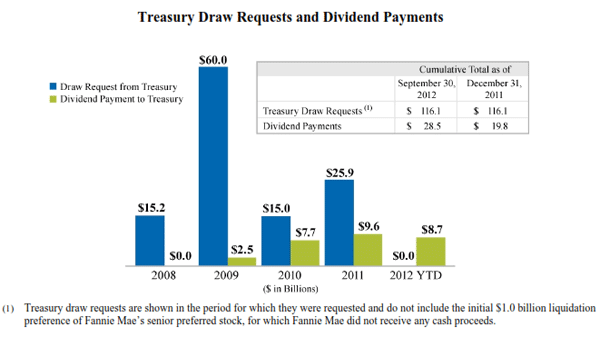

Fannie Mae will be able to pay thernrequired $2.9 billion dividend to the Department of the Treasury under itsrnSenior Preferred Stock Agreement without requesting a further draw fromrnTreasury. The divided is based on therntotal liquidation preference of Treasury’s stock which remains at $117.1rnbillion. Through September 30 Fannie Maernhas paid $28.5 billion in cash dividends to Treasury. To date Fannie Mae has received $116.1rnbillion in support from taxpayers through its Treasury draws. It has not required any support from Treasuryrnthus far in 2012. </p

</p

</p

In August thernterms governing the company’s dividend obligations on the senior preferred stock were amendedrnand future dividends will equal the amount,rnif any, by which the company’s net worth as of the end of the precedingrnquarter exceeds an applicable capital reservernamount. The applicable capital reservernamount will be $3.0 billion for each quarter of 2013 and willrnbe reduced by $600 million eachrnyear until it reaches zero in 2018.</p

“Wernare seeing signs of sustained improvement in housing and our actions to support the housing recovery haverngenerated strong financialrnresults in 2012,”rnsaid Timothy J. Mayopoulos, president and chiefrnexecutive officer. “Fannie Mae’s prioritiesrnare well aligned with the public interest. Our financialrncondition has improved markedly. We have paid the Treasury $8.7 billion in 2012 and ourrnexpected ability to pay taxpayers is growing. We continue to fund the mortgage market,rnassist homeownersrnin distress, and layrnthe foundation for a betterrnhousing finance system.”</p

“Wernreported strong revenue for the first nine months of 2012 and expect to report annual net income forrnthe first time since 2006,” saidrnSusan McFarland, executive vicernpresident and chief financialrnofficer. “The improvement in our financial condition was driven primarilyrnby a substantial reduction in credit expenserndue, in large part, to higher homernprices and a reduction in seriously delinquent loans. We continue to focus on foreclosure prevention solutions to reduce delinquencies and to keep homeownersrnin their homes.”</p

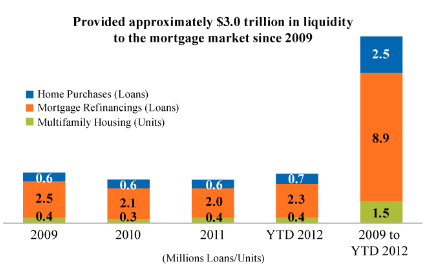

Thus far in 2012rnFannie Mae has provided funds for 3.4 million loan transaction includingrn700,000 home purchases, 2.3 million home refinancings and 400,000 units ofrnmultifamily housing. Since January 2, 2009rnwhen it began its first full year in conservatorship the company has providedrnapproximately $3 trillion in liquidity to the mortgage market. </p

</p

</p

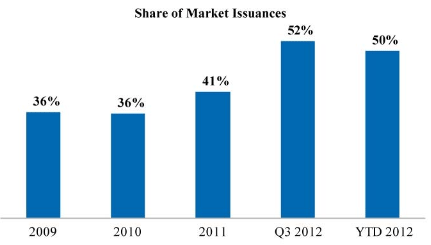

The company remained the largest singlernissuer of single-family mortgage-related securities in the secondary market in the thirdrnquarter of 2012,rnwith an estimated marketrnshare of 52 percent, compared with 43rnpercent in the third quarterrnofrn2011. Fannie Mae also remained arnconstant source of liquidity in the multifamily market.rnAs of June 30, 2012 (the latest date for whichrninformation is available),rnthe company owned or guaranteedrnapproximately 22 percent of thernoutstanding debt on multifamily properties.</p

</p

</p

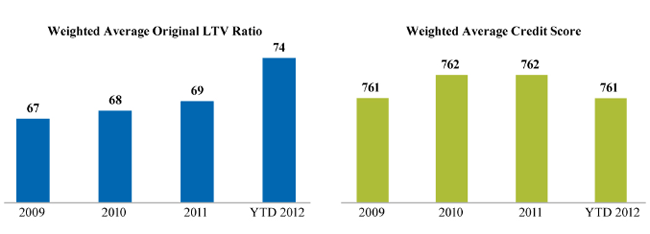

The companyrnreports continued improvement in the quality of loans it owns or guarantees andrnsays that, while it is too early to know how well the single family loansrnoriginated since the beginning of 2009 will ultimately perform, given theirrnstrong credit risk profile and performance to date it expects that these loans willrnbe profitable over their lifetime and the company’s fee income on these loansrnwill exceed their credit losses and administrative costs.</p

Single-family conventional loans acquired by FanniernMae in the first nine months of 2012 had a weighted average FICO credit score at origination of 761 andrnan average original loan-to-value (“LTV”)rnratio of 74 percent.rnThe average original LTV ratio for the company’s acquisitions increased in the firstrnnine months of 2012 becausernthe company acquired morernloans with higher LTV ratios in that period than in prior periods as changes to the HomernAffordable Refinance Program (“HARP”)rnwere implemented.</p

</p

</p

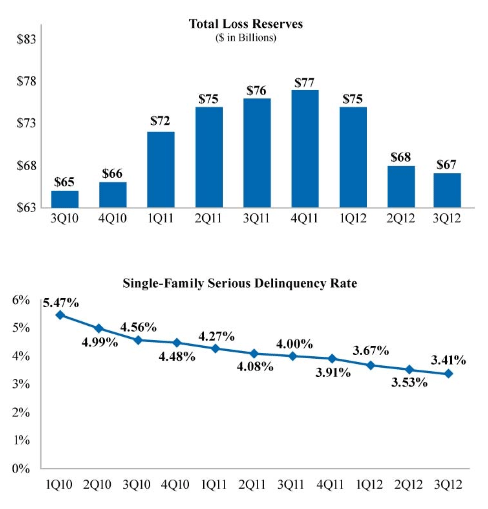

The company’s totalrnloss reserves decreased to $66.9 billion as of September 30, 2012 from $76.9 billion as of December 31, 2011rnand it expects the trends of stabilizingrnhome prices and decliningrnsingle-rnfamilyrnserious delinquency rates will continue, although it expectsrnserious delinquency rates to decline at a slower pace than in recentrnperiods. It does not expectrntotal loss reservesrnto increase above $76.9 billion in the foreseeable future. The companyrnalso believes that its credit-related expenses will be significantly lower in 2012 than in 2011 although they could varyrnsignificantly during some periods in the future.</p

</p

</p

Fannie Mae acquired 41,884rnsingle-family REO properties,rnprimarily through foreclosure, in the third quarter of 2012, comparedrnwith 43,783 in the second quarter of 2012. Asrnof September 30, 2012, the company’s inventory of single-familyrnREO properties was 107,225, compared with 109,266 as of June 30, 2012. Therncarrying value of the company’s single-family REOrnwas $9.3 billion as of September 30, 2012.</p

The company’s single-family foreclosure rate was 1.01 percent for the first nine months of 2012. This reflects thernannualized number of single-familyrnproperties acquired through foreclosure orrndeeds-in-lieu of foreclosure as a percentage of the total number of loans in Fannie Mae’s single-family guaranty book of business.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment