Blog

Fannie Mae: Housing Faring Better than Economy

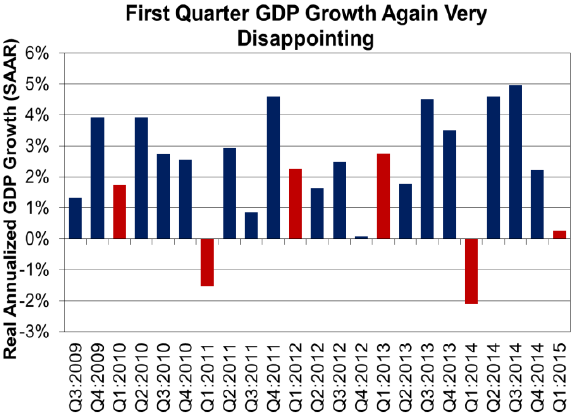

FanniernMae’s economists used their May economic and strategic summary to downgradernexpectations for 2015 growth but at the same time painted a slightly brighter</bpicture for housing. Based on the poor growthrnof GDP in the first quarter, only 0.2 percent, they downgraded expectations forrnthe year by 0.5 percentage point to 2.3 percent growth. The portion of the report dealing withrnhousing was obviously written both before Tuesday's encouraging news about residentialrnconstruction or Thursday's disappointing existing home sales report.</p

</p

</p

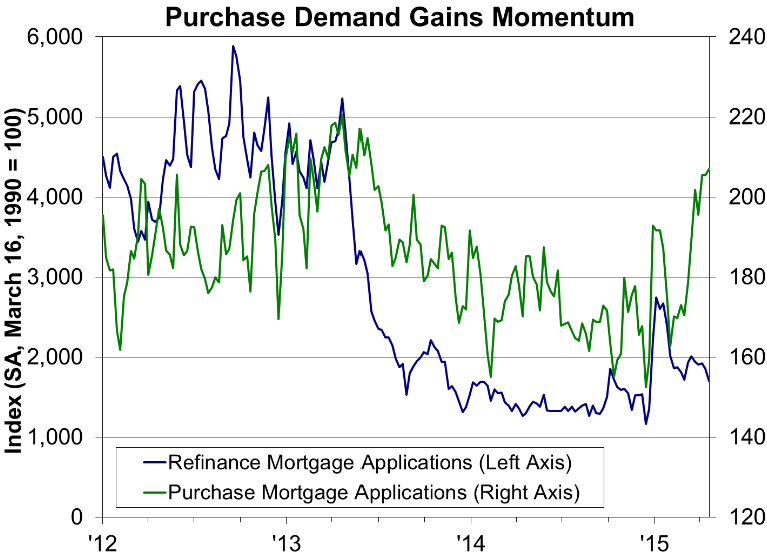

Thatrnsaid, Fannie Mae’s economic team led by Senior Vice President and ChiefrnEconomist Doug Duncan called home sales for the quarter “mixed” with Marchrnexisting home sales at their highest level in two years, preceding the “TaperrnTantrum” over Fed Chair Ben Bernanke’s comments about the Federal Reserve taperingrnbond purchases that choked off recovering sales. Even though March sales were up, the firstrnquarter fell short of fourth quarter 2014 numbers. New home sales retreated in March but thernfirst quarter overall was the best for that sector since 2008 and pending homernsales and purchase mortgage applications both portend a strong spring buyingrnseason.</p

</p

</p

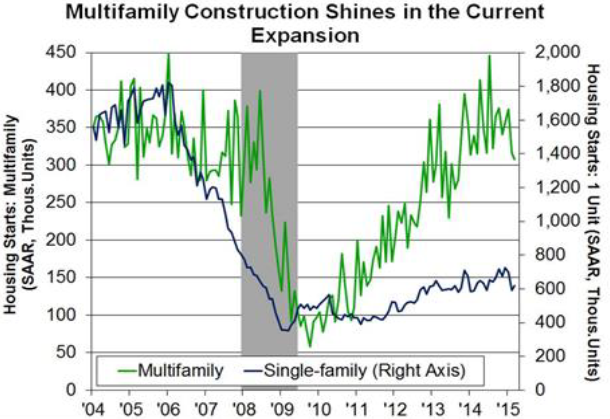

Thernsoft spot singled out in the report is single-family homebuilding whichrncontracted sharply in February and rebounded only slightly in March (but was uprnsignificantly in April with starts jumping more than 20 percent and permits uprnby nearly 11 percent). After nearly sixrnyears of recovery Fannie Mae says spending on private single-familyrnconstruction remains stuck near 1998 levels. Poor performance for homebuildingrnand existing home sales led to a relatively flat contribution of residential investmentrnto GDP in the first quarter. However, builder confidence picked up in April andrnnew home inventories are tight which, along with decreased distressed sales hasrnhelped boost prices. The tightrninventories and increased prices are projected to lead to increased residentialrnconstruction in coming months.</p

Increasesrnin home values have helped to improve both equity and single-family mortgagernloan performance. The Mortgage Bankers Association’s National DelinquencyrnSurvey showed both delinquency and foreclosure rates continuing to improve andrnsome measures approaching pre-recession levels. rnEarly stage delinquency edged down to the lowest level since 1972,rnreflecting tightening labor market conditions and the overall current qualityrnof mortgage debt outstanding.</p

RecentrnFederal Housing Administration and Federal Housing Finance Agency policyrnchanges have helped ease lending standards and this was reflected in thernFederal Reserve’s Senior Loan Officer Opinion Survey in which a large majorityrnof banks indicated loosening lending standards for GSE and government mortgages.rn Likewise the first quarter LenderrnSentiment Survey from Fannie Mae showed that the majority of lenders surveyedrnbelieved that the GSEs’ 97 percent LTV products and the reduction in FHA’s mortgagerninsurance premiums will benefit consumers and lenders. Roughly two out of three lenders surveyedrnexpect that these changes will somewhat increase mortgage originations.</p

Realrndisposable income growth picked up during the first quarter, and Fannie Maernexpects ongoing improvement to help boost household formation and lift housingrnactivity. Household formation rose byrn1.7 million in the fourth quarter compared to a year earlier and another 1.5rnmillion in the first quarter of 2015, still homeownership declined 1.1rnpercentage points over the past year to the lowest reading since the earlyrn1990s, as new households turned to renting. </p

</p

</p

Constructionrnactivity responded to the strong demand for rental properties and multifamilyrnstarts rebounded sharply after the recession ended, rising to prerecessionrnlevels during last summer but pulling back this year. This drop should berntemporary as rents continue to rise and help to support the sector. </p

</p

</p

Despiternthe popularity of renting Fannie Mae says the recent faster pace of householdrnformation is encouraging. If income growth continues to improve many householdsrnshould, at some point, switch from renting to owning, especially considering thatrnmortgage rates remain historically low and underwriting standards are becomingrnmore favorable for first-time homebuyers.</p

Despiternsome disappointment during the first quarter Fannie Mae says housing activityrnso far is in line with its forecast of a moderate but broad-based improvementrnin 2015 and while its forecast of total home sales is little changed it is morernupbeat about mortgage originations. Bothrnrefinancing and purchase originations appear stronger than expected and therncompany has upgraded mortgage originations by 14 percent for earlierrnforecasts. Originations should totalrn$1.46 trillion this year, up 23 percent from 2014. The refinance share is projected at 46rnpercent an increase of 3 percentage points over 2014.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment