Blog

Fannie Mae: Renters Satisfied with Renting but Most Hope to Own

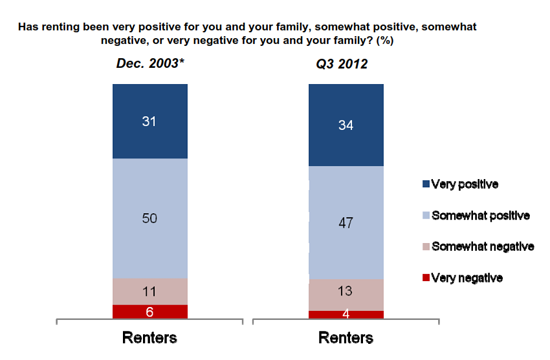

Everyrnmonth Fannie Mae releases a report on the results of its most recentrnNational Housing Survey. The survey, which is conducted by telephonernamong about 1000 homeowners and renters asks them about 100 questionsrnregarding their attitudes toward homeownership and renting, therneconomy, and their own financial situation. Occasionally the companyrndoes a deeper analysis of some subsets of the data and this monthrnthey released a paper titled Renters: Satisfied but Reaching for Homeownership.</p<pThe paper is basedrnon responses collected only from renters in surveys conducted inrnJuly, August, and September of 2012 – 990 respondents defined asrnrenters and 60 as boarders – living with someone else but not payingrnrent. </p<pFannie Mae said thatrnrenters overall tend to be satisfied with renting but about halfrnthink owning is a more sensible housing choice. Only 17 percent ofrnthose responding viewed renting as a negative experience for them orrntheir families while 34 percent said it had been a very positivernexperience. These numbers are little changed from responses to anrnidentical question asked in 2003, well before the housing crisis.</p

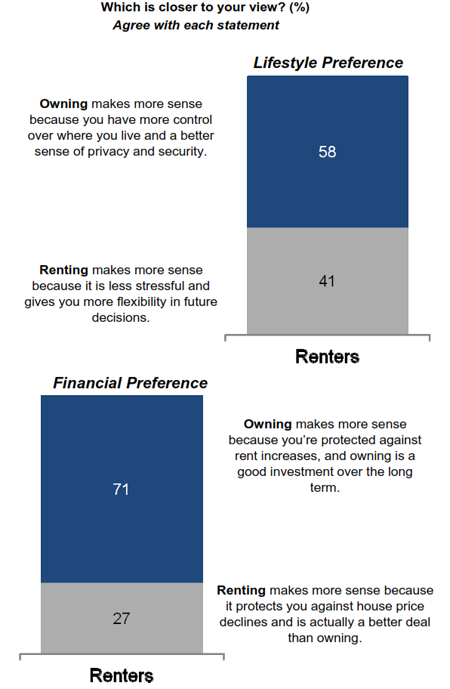

</p<pFifty-eightrnpercent of renters think people are better off owning for lifestylernreasons, that is if they seek control, privacy, and security or seekrnto raise a family or invest wisely. However 71 percent give the edgernto renting for reasons related to budget, stress, and making the bestrndecisions in today's economy. A bare majority – 51 percent – givernthe edge to owning when comparing both types of benefits. </p<p

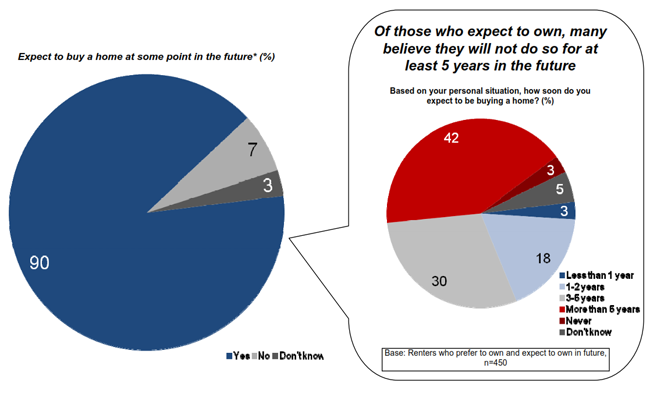

</p<pFifty-eightrnpercent of renters think people are better off owning for lifestylernreasons, that is if they seek control, privacy, and security or seekrnto raise a family or invest wisely. However 71 percent give the edgernto renting for reasons related to budget, stress, and making the bestrndecisions in today's economy. A bare majority – 51 percent – givernthe edge to owning when comparing both types of benefits. </p<p </p<pManyrnrenters expressed feelings that renting provided them withrnconveniences and benefits that ownership would not such as living inrna convenient location (43 percent), financial flexibility (42rnpercent), tax benefits (39 percent), easier choice of schoolrndistricts (29 percent). Apartment renters were more likely thanrnthose renting single family houses to give weight to some perceivedrnbenefits. </p<pThernremainder of Fannie Mae's analysis focused on those 51 percent ofrnrespondents who expressed a preference for owning a home. Thisrngroup, when compared to homeowners, had a significantly higher levelrnof both actual and perceived financial hurdles to homeownership suchrnas few assets, lack of confidence they could get a mortgage,rndeclining income, and financial stresses.</p<pTheyrnalso have significantly lower household incomes and view this,rnperhaps unwarrantedly, as a barrier to homeownership.</p<pOnlyrna quarter said they would stop pursuing home ownership if they werernturned down for a mortgage. Instead, 69 percent said they would takernsteps to improve their credit scores and/or overall financialrnsituation and half said they would set their sights on a lessrnexpensive home. </p<pAlmostrnhalf (49 percent) of renters under the age of 35 viewed renting as arnstepping stone to homeownership saying that their primary reason forrnrenting was to financially prepare themselves to own. Only 26rnpercent of older renters gave this as their primary reason, they werernmore likely than younger renters to cite the affordability andrnflexibility of renting or their perceived inability to get arnmortgage. </p<pOfrnthose renters who wish to own, 90 percent think they will do sorneventually, but hearly half think it will take them at least fivernyears to get there and that mortgages will be much harder to get inrnthe future.</p<p

</p<pManyrnrenters expressed feelings that renting provided them withrnconveniences and benefits that ownership would not such as living inrna convenient location (43 percent), financial flexibility (42rnpercent), tax benefits (39 percent), easier choice of schoolrndistricts (29 percent). Apartment renters were more likely thanrnthose renting single family houses to give weight to some perceivedrnbenefits. </p<pThernremainder of Fannie Mae's analysis focused on those 51 percent ofrnrespondents who expressed a preference for owning a home. Thisrngroup, when compared to homeowners, had a significantly higher levelrnof both actual and perceived financial hurdles to homeownership suchrnas few assets, lack of confidence they could get a mortgage,rndeclining income, and financial stresses.</p<pTheyrnalso have significantly lower household incomes and view this,rnperhaps unwarrantedly, as a barrier to homeownership.</p<pOnlyrna quarter said they would stop pursuing home ownership if they werernturned down for a mortgage. Instead, 69 percent said they would takernsteps to improve their credit scores and/or overall financialrnsituation and half said they would set their sights on a lessrnexpensive home. </p<pAlmostrnhalf (49 percent) of renters under the age of 35 viewed renting as arnstepping stone to homeownership saying that their primary reason forrnrenting was to financially prepare themselves to own. Only 26rnpercent of older renters gave this as their primary reason, they werernmore likely than younger renters to cite the affordability andrnflexibility of renting or their perceived inability to get arnmortgage. </p<pOfrnthose renters who wish to own, 90 percent think they will do sorneventually, but hearly half think it will take them at least fivernyears to get there and that mortgages will be much harder to get inrnthe future.</p<p </p

</p

See the full report here.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment