Blog

Fannie Mae Upbeat on Housing, Economy in 2nd Half

Despiternimproved consumer spending and stronger residential and non-residentialrninvestments Fannie Mae’s Economic and Strategic Research team are holding to theirrnearlier forecasts for the second half of 2015. rnIn their current monthly report they estimate that economic growth at an annualized 2.8 percent in the second quarter, up 0.4 percent from whatrnthey projected in June, with an acceleration during the second half to aboutrn3.0 percent. They were, they said,rnalready ahead of the game, having upgraded their full year estimate of growthrnfrom 1.9 percent to 2.0 percent in June, based on earlier revisions to thernGDP. </p

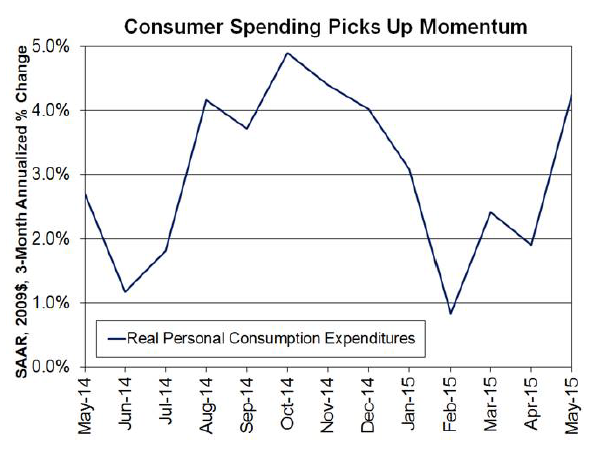

Consumerrnspending is expected to be the biggest driver of growth for the rest of thernyear. It is showing signs of a turnaroundrnaccelerating to an estimated 2.9 percent in the second quarter from 2.1 percentrnin the first and was at an annualized 4.2 percent over the three months endingrnin May. Housing and government spending willrnalso be a major contributors to growth while net exports will be a drag as willrnthe decline in oil prices over the last year. The debt crisis in Greece stillrnposes a downside risk to the overall forecast as does a deteriorating economicrnpicture in China.</p

</p

</p

Personalrnincome followed a 0.4 percent gain in April with another 0.2 percent in May andrnthe Consumer Confidence Index jumped 6.8 points from May to June, the secondrnhighest reading (tied with March) in the expansion. Adding a bit of frosting, household net worthrnhad its best showing since the third quarter of 2007 and the nation is on trackrnto add 2.5 million jobs this year – less than last year, but still what FanniernMae calls a “solid” number.</p

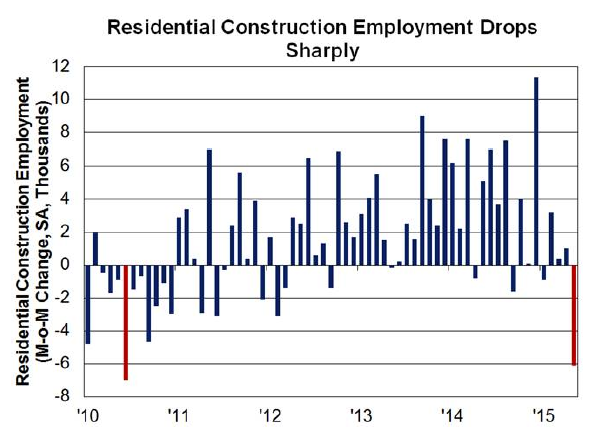

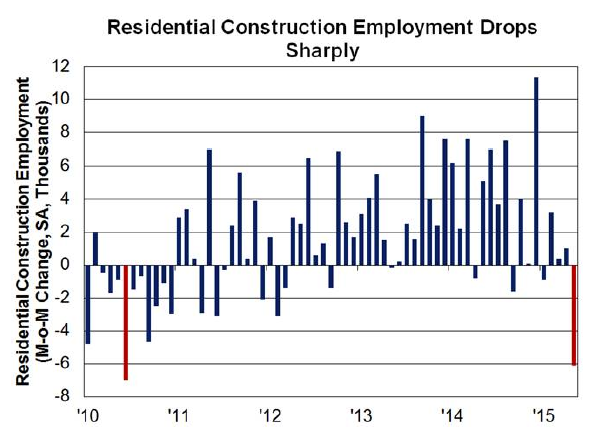

On the housing-related front,rnresidential construction employment dropped precipitously in May but Fannie Maernsaid it expects home building activity and residential construction employmentrnto pick up along with housing demand. rnOne concern is that builders may find it increasingly difficult to hirernskilled workers without substantially raising wages. Wage gains in that sector have picked up afterrna sharp slowdown last year. This is in contrast</bto the overall wage growth, which has been moving sideways at approximately 2.0rnpercent over the past three years.</p

</p

</p

</p

</p

A recentrnsurvey of single-family builders conducted by the National Association ofrnHome Builders (NAHB) showed that home building labor shortages have become evenrnmore widespread during the past year, especially for workers with basic skillsrnsuch as rough carpentry and framing. Therncurrent shortage of workers is substantially more severe than at the peak of thernhousing boom and rivals the widespread shortage just before the start of thernexpansion in 2001.</p

Home sales were notably stronger inrnMay and should post a sizable increase in the second quarter. Existing home salesrnrebounded 5.1 percent to the strongest pace since November 2009, a daterncoinciding with the expiration of the first-time home buyers’ tax credit. New homernsales increased 2.2 percent following an 8.1 percent rebound in April. Combined,rntotal annualized home sales of 5.9 million units in May mark the strongest pacernsince June 2007.</p

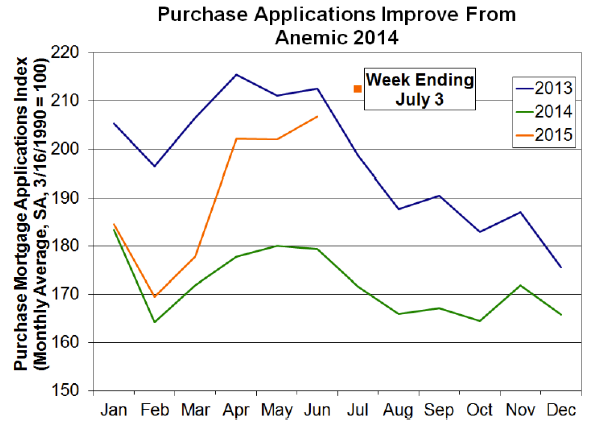

Pending home sales, at a nine-yearrnhigh, and purchase mortgage applications at the second highest level in twornyears point to continued improvement in home sales. Meanwhile, mortgage lending standards arerneasing on the margin, although they remain tight by historical standards. Fannie Mae’s secondrnquarter 2015 Mortgage Lender Sentiment Survey found more lendersrnare loosening credit than tightening it. </p

Inventories remain low while home builderrnconfidence reached 2015 highs. This combinationrnof strong sales, lean inventories, and rising confidence to lead to increasedrnhome building activity this year. Thernsales and inventories are also putting upward pressure on home prices with thernCoreLogic Home Price Index, the measure used by the Fed to estimate real estaternvalue in its Financial Accounts, showing a robust 6.3 percent year-over-yearrngain in May, the strongest pace since last July. </p

Improving prices are givingrnconsumers a reason to look favorably on the climate for selling. Fannie Mae’s June National Housing Survey showedrnthat the share of consumers who believe now is a good time to sell a homernreached a new survey high, increasing three percentage points to 52 percent,rnabove the 50-percent threshold for the first time in the survey’s five-year history.</p

The jump in the number of renter householdsrnis putting upward pressure on rents. Household formation, lagging for fivernyears, finally took off in late 2014. rnThese newly created households are largely renters and increased demand hasrnpushed vacancies lower and driven rents higher.</p

Details in the Consumer Price Indexrn(CPI) showed that both tenant rent and owners’ equivalent rent have risenrnconsiderably in the last two years. InrnMay, the CPI for tenant rent was up 3.5 percent from a year ago and owners’rnequivalent rent rose 2.8 percent. rnConsumers are also primed to expect further rent increases and FanniernMae’s survey suggests that more renters may soon find owning to be more cost-effectivernthan renting and more sellers likely to put their homes on the market.</p

Mortgage rates have been trendingrnup since February, cooling refinance demand to the lowest level of the year inrnJune. The problems in Greece and China havernrenewed interest in U.S. Treasuries which should help keep long-term interestrnrates low, helping home sales in the crucial summer selling season but will trendrnup going forward. Fannie Mae expects a gradualrnrise from about 4.0 percent currently to about 4.5 percent by the end of 2016. </p

</p

</p

Fannie Mae changed a few earlierrnhousing forecasts, modestly upgrading projected home sales for 2015, withrnexisting and new home sales rising by approximately 5 percent and 25 percent,rnrespectively. The forecast of mortgagernoriginations has the upward revision in projected purchase originations slightlyrnoutstripping the downgrade in projected refinance originations resulting inrnlittle change. For all of 2015, the economistsrnexpect total mortgage originations to rise approximately 24 percent to $1.46 trillion,rnwith a refinance share of 47 percent.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment